Daily Comment (July 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures are off to a great start ahead of Federal Reserve Chair Powell’s second day of testimony. In sports news, Spain has successfully knocked out France in the Euro semifinal. Today’s Comment discusses how Powell has opened the door for a policy shift, the reasons emerging markets are likely to continue building up their gold reserves, and why Brazilian President Lula may be forced to make uncomfortable decisions to protect the country’s currency. As usual, the report includes a roundup of international and domestic news.

Powell Talks to Congress: The Fed Chair mostly stuck to the script during his testimony, but he gave subtle hints that the central bank might be considering goals beyond its inflation mandate.

- Fed Chair Jerome Powell expressed growing concern about the labor market for the first time on Tuesday. During his testimony, he mentioned that recent employment data prompted him to reconsider his views on the economy, as unemployment rose to 4.1% in June, slightly above the median year-end estimate outlined in the Fed’s summary of economic projections. While he acknowledged that further measures are necessary to achieve the Fed’s 2% inflation target, he cautioned that an excessive focus on inflation could negatively impact the economy.

- While Powell did not specify a timeline, the market still anticipates a rate cut from the central bank in September. The latest CME Fedwatch tool shows that investors believe there is a 75% chance the central bank will lower interest rates before the election. This is a sharp increase from over a month ago, when the indicator suggested a less than 50% chance. The boost in confidence appears to be a response to a string of weaker-than-expected economic data over the last couple of months. In addition to a rising unemployment rate, retail sales and personal consumption have also been disappointing.

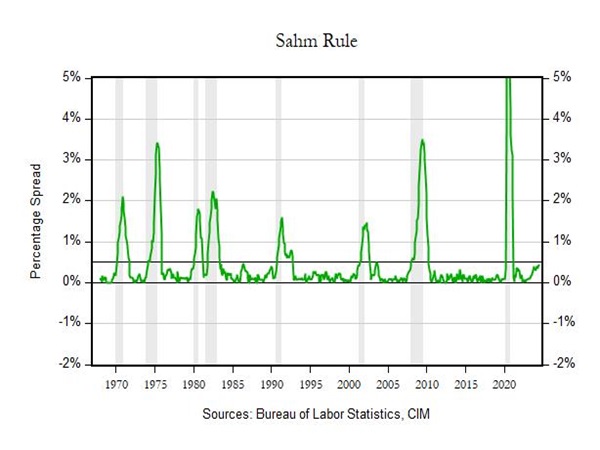

- Powell’s testimony before Congress reinforces our earlier view from May that the Fed is preparing for a rate cut based on labor market conditions rather than inflation. Since we made that call, the unemployment rate has risen for the fourth consecutive month and is now approaching the Sahm Rule threshold, an indicator of recession. The Sahm Rule is triggered when the three-month moving average of the unemployment rate climbs 0.5% above the lowest rate of the past 12 months. If the unemployment rate reaches 4.2% within the next two months, it may be sufficient to prompt a rate cut.

Bullion on the Rise: More emerging market countries are showing a preference for holding gold as they look to diversify their reserve holdings.

- Nigerian lawmakers are drafting legislation that would empower the Central Bank of Nigeria to hold a larger share of its reserves in gold. The bill prioritizes domestically produced gold for acquisition and proposes raising the minimum gold reserves from 4% to at least 30% of total external reserves. The decision to ramp up the holdings comes as the country struggles to contain its inflation and repay its debts, since a rising US dollar has made imports more expensive and interest payments more burdensome.

- Emerging markets are increasingly diversifying their foreign reserves, reflecting concerns about the West’s use of the dollar as a financial weapon after Russia’s invasion of Ukraine. This trend is likely to continue as these countries aim to increase their gold holdings, which currently represent only 6% of their reserves, roughly half the level in developed markets. Notably, India repatriated 100 tons of gold from the UK just before its recent elections, and China had been actively accumulating gold for 18 months, adding 300 tons before pausing purchases in May.

- While Nigeria’s actions alone might not significantly impact global markets, emerging markets as a whole have the potential to do so. Their increasing holdings of reserve currencies reflect a broader trend likely to be followed by other central banks in these economies. However, the People’s Bank of China (PBoC) will likely be the most watched central bank during this transition as it seeks to reduce its reliance on the US dollar. As a result, we expect gold prices could be on the verge of an upward trend over the next few years.

Lula and the Currency: Brazilian President Luiz Inácio Lula da Silva’s plan to deliver renewed economic prosperity is under threat as the Brazil real continues to plummet against the dollar.

- On Tuesday, Gabriel Galipolo, the overseer of currency intervention in Brazil, stated that he does not plan to prop up the currency without the full support of the central bank board. His comments come as the currency has fallen 10% since the start of the year, making it the second-worst-performing currency in Latin America behind only the Argentine peso. While he has the power to use over 2.5% of the country’s international reserves to protect the currency, his reluctance appears to be driven by concerns that the market could undermine his efforts.

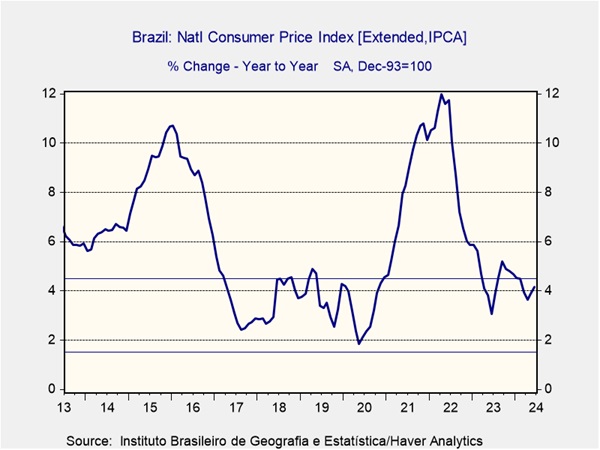

- The currency’s weakness stems from concerns about the country’s fiscal and monetary future. Earlier this year, Brazil relaxed its fiscal target for 2025, aiming for a balanced primary budget, which excludes interest payments, instead of the previous year’s goal of achieving a surplus. Additionally, there are concerns that Lula will replace the current central bank head, Roberto Campos Neto, with the aforementioned Galipolo. Although inflation remains within the 1.5% tolerance range of the 3% target, there are fears that Galipolo might cut rates prematurely to help boost growth.

- The attractiveness of Brazilian assets hinges on Lula’s ability to convince investors of his commitment to central bank independence and fiscal responsibility. His past criticism of the central bank has undermined its credibility as an independent institution. Additionally, a higher-than-expected increase in public spending has fueled concerns about his adherence to budget goals. In the short term, this trend is unlikely to change. However, a shift toward central bank independence and fiscal discipline could make Brazil a more attractive investment destination.

In Other News: Colorado Senator Michael Bennet has officially requested President Joe Biden to end his bid for re-election. This shows that Biden is still facing intense pressure to pass the torch. BP raised its outlook on demand for oil and gas as it sees a moderation in the clean energy transition. This could lead to higher energy prices.