Daily Comment (July 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equities are relatively muted as investors await earnings reports. In sports news, the USMNT is looking to hire Jürgen Klopp as head coach. Today’s Comment will begin with a discussion of the latest CPI report, then will explore why small caps are showing signs of life, and we will wrap up with a look at the challenges Russia faces in navigating a smooth exit from the war. As always, our report will include a roundup of international and domestic data releases.

Inflation Inflection Point? The cooler-than-expected CPI report fueled market optimism for a potential Fed rate cut in September.

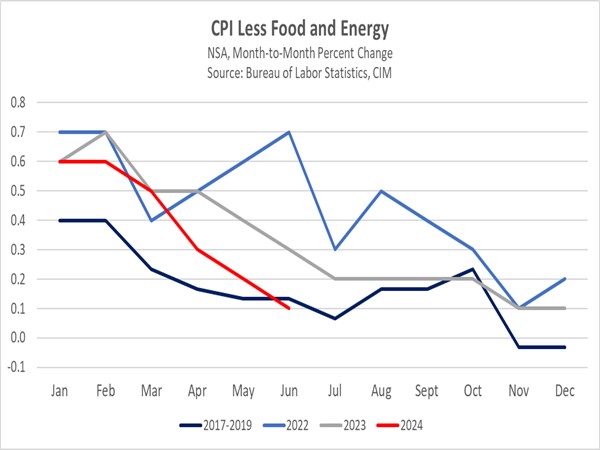

- June marked the first time in nearly four years that inflation has dipped. Consumer prices fell 0.1% month-over-month, according to the Bureau of Labor Statistics. This slowdown brought the annual inflation rate down to 3.0% in June, a decrease from 3.3% in May. While energy prices led the monthly decline, the slowdown was more widespread. Core inflation, which excludes volatile food and energy, held steady at 0.1% for the month. However, annual core inflation slipped to 3.3%, a slight improvement from the previous month’s increase of 3.4%.

- The recent slowdown in price increases is likely to be welcomed by Federal Reserve officials. However, it may not be sufficient to prompt a rate cut at their next meeting. St. Louis Fed President Alberto Musalem commented that while the CPI data is encouraging, more evidence is needed before the central bank decides to lower interest rates. Financial markets seem to agree, pricing in only a 7% chance of a cut this month, but a much higher 94% chance by September. This cautious stance reflects concerns about overreacting to a single month of positive data.

- The coming months are critical for the Fed to build confidence in delivering multiple rate cuts this year. As the chart above shows, inflation has expanded at a slower pace than it has in the previous two years, with the latest reading falling below levels that were normal even prior to the pandemic. We will be paying particular attention to the shelter component. If it holds steady at June’s 0.2% pace or declines further, inflation is likely to continue its downward trend. This could lead to two rate cuts, with a possibility of even three.

Small Cap Has Its Moment: Thursday’s inflation surprise triggered a risk-on mood among investors, fueled by renewed confidence in a soft landing.

- Investors initially sought refuge in the S&P 500 after inflation data emerged. However, the trading day witnessed a significant rotation towards mid- and small-cap stocks. The large-cap index climbed as high as 1.0% midday but ultimately closed down 0.8%. Meanwhile, the S&P MidCap 400 and S&P SmallCap 600 indexes surged, gaining 2.45% and 3.31% respectively. Their strong outperformance relative to large cap was driven by investors looking for bargains as they prepare for the possibility of rate cuts.

- Our latest Bi-Weekly Asset Allocation Report underscores the potential for small-cap stocks to outperform in a scenario where interest rates are cut. This optimistic outlook hinges on two key factors. First, small-cap companies tend to hold a greater share of floating-rate debt, making them more responsive to interest rate reductions that directly translate to improved profitability. Second, the valuation gap between small and large caps has widened to near-historic levels. Historically, such a spread has triggered mean reversion, where undervalued assets experience a surge to close the gap.

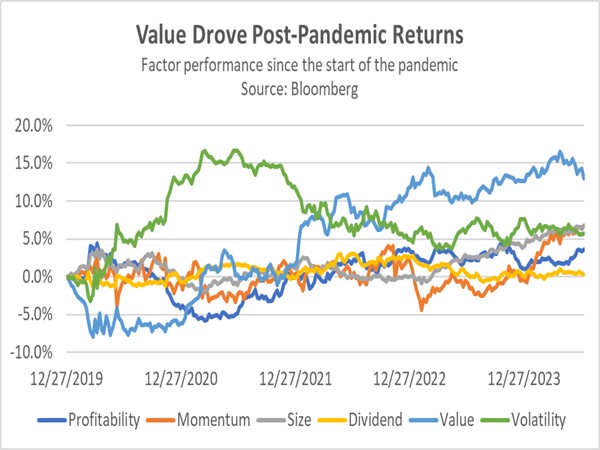

- Momentum undeniably fueled returns in 2024, but value investing holds a proven track record for long-term outperformance. As the chart illustrates, value stocks recovered from an initial pandemic dip to become the strongest driver of returns compared to other factors. This trend should persist as long as the economy is not in recession, inflation approaches the 2% target, and the Fed implements multiple rate cuts over the next three years. While we’re confident in these conditions prevailing, a worsening geopolitical climate could disrupt this scenario.

Moscow’s Poker Face: While NATO continues to demonstrate its commitment to backing Ukraine’s war effort, Moscow may not be in a rush to end the conflict.

- NATO leaders solidified a united front at their summit on Thursday, emphasizing shared concerns over territorial disputes with China and Russia. The deepening Sino-Russian relations particularly alarmed the leaders, who viewed them as a potential challenge to the established international order. Discussions also addressed accusations of China’s covert support for Russia’s actions in Ukraine, despite Beijing’s claims of neutrality. Western leaders further warned China that its actions could force a choice between aligning with them or with Russia.

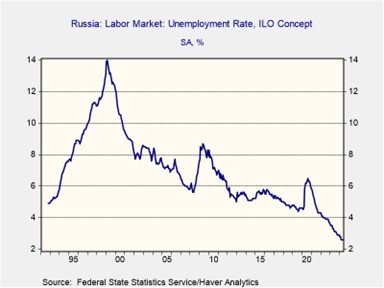

- Despite the West’s commitment to Ukraine, it appears that Moscow is in the fight for the long haul. Russia’s economy is performing well, as the country has mobilized to sustain its war efforts. The unemployment rate is at a 30-year low, and strong domestic consumption has pushed GDP growth, outpacing most countries within the eurozone. However, there does seem to be a problem under the surface. Russia’s historically heavy reliance on exporting commodities to Europe, now restricted by sanctions, could pose a significant long-term economic threat.

- While a desire to conclude the war might exist on both sides, ending the conflict in Ukraine appears immensely challenging. Rebuilding the country into a fully functioning state will be a long and arduous process, potentially taking decades. Even if Russia aimed to claim all or part of Ukraine, it’s unlikely they possess the resources or capacity to handle such a reconstruction alone. China’s own economic challenges also limit its ability to help in the transition. Faced with Western isolation and the immense challenges of rebuilding Ukraine, Russia is likely to adopt a more calculated approach in its search for an exit strategy.

Other news: President Biden failed to win over supporters after making several blunders during his speech at the NATO summit, raising the likelihood that he may be forced to drop out of the race. Also, US intelligence reportedly thwarted a Russian assassination attempt against the CEO of Rheinmetall, a major German arms supplier to Ukraine. This suggests Russia might be willing to escalate the conflict beyond Ukraine’s borders. Meanwhile, Saudi Arabia’s budget constraints have forced it to pause spending on some projects.