Daily Comment (July 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

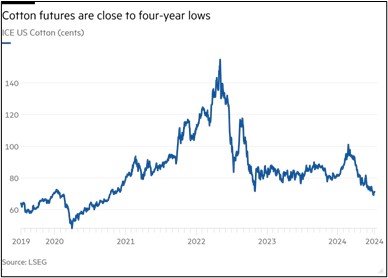

Our Comment today opens with a note on the recent plunge in global cotton prices, which has been driven by surging output in Brazil. We next review several other international and US developments with the potential to affect the financial markets today, including a major new tax reform in Turkey and a few words on US political developments.

Global Commodity Market: Global cotton prices have plunged to about $0.69 per pound so far in July, reaching their lowest levels since October 2020 and less than half their 10-year peak in May 2022. The decline largely reflects surging exports from top-producer Brazil, where low corn prices have pushed farmers to plant cotton instead. The drop in cotton prices will hurt farm incomes in other major cotton-producing countries, but it could also help boost margins for clothing manufacturers.

China: The Communist Party yesterday opened its latest “Third Plenum” meeting, which takes place every five years and often focuses on new economic reforms. Reports in state media say General Secretary Xi will use the meeting to push China’s “self-confidence and self-reliance,” in part by supporting the development of “new productive forces,” such as the increased production and export of advanced technologies like electric vehicles and solar panels.

South Korea: New polling shows 66% of South Koreans now support or strongly support their country developing its own nuclear weapons, up from 60% in a poll from last year. Prime Minister Han Duck-soo recently said the government isn’t in a position to develop nukes “for now,” but Seoul’s conservative mayor, Oh Se-hoon, who is seen as a likely presidential candidate in 2027, last week called for South Korea to go nuclear immediately.

- The developments are consistent with our view that rising geopolitical tensions and foreign doubts about US security commitments could spark a new nuclear arms race around the world.

- Our Bi-Weekly Geopolitical Report from February 12, 2024, provides a detailed discussion of this possibility.

France: As politicians keep jockeying for power after this month’s inconclusive parliamentary elections, the left-wing New Popular Front alliance that came in first is being riven by infighting. Its most radical faction, the far-left France Unbowed, has pulled out of the alliance’s negotiations on a candidate for prime minister after its leader, anti-capitalist firebrand Jean-Luc Mélenchon, was blocked by the Socialists.

- If the leftists within New Popular Front can’t agree on a candidate, it raises the chance that President Macron’s centrists could retain the prime minister’s post.

- That would likely be a relief to investors, as it would probably ensure at least some continuity with Macron’s pro-business policies, but the fractured nature of the new parliament would still leave French politics unstable in the near term.

Turkey: President Erdoğan’s government is reportedly prepping a major tax reform aimed at broadening the tax base, cooling economic growth, and helping reduce consumer price inflation. Among other measures, the reform would introduce a minimum corporate tax rate of 10% and toughen tax audits. The moves would complement last year’s hike in the value-added tax and cuts in fuel subsidies, as well as the central bank’s recent boost to interest rates. Those moves have yet to rein in Turkey’s big post-election surge in prices.

Canada: In a release yesterday, the Bank of Canada’s quarterly business-outlook survey showed many businesses expect softer demand and reduced cost pressures going forward. The survey results have increased expectations that the central bank will cut interest rates again at its policy meeting on July 24, despite recent data showing a re-acceleration in consumer price inflation in May. The renewed expectations for a rate cut have put pressure on the Canadian dollar, which is now trading at about 1.37 per greenback, a depreciation of 0.7% from one week ago.

US Politics: Former President Trump, the presumptive Republican nominee for president in the November elections, chose Senator J. D. Vance of Ohio as his running mate yesterday. Vance, who will turn 40 in August, is expected to shore up Trump’s support among younger white males, especially in the industrial Midwest, who are a critical group supporting Trump-style populism.

- The politically savvy move is likely to further cement expectations that Trump will win in November. It will also probably increase expectations that the Republicans will win added seats in the Senate and the House of Representatives.

- In turn, that will likely add to the revived “Trump trade,” which is reflected in falling bond prices, higher bond yields, increased prices for many equities, and stronger valuations for bitcoin and other cryptocurrencies.

US Monetary Policy: At an event in Washington yesterday, Fed Chair Powell said recent economic data “do add somewhat to confidence” that inflation will return to the Fed’s target after price pressures remained elevated earlier in the year. However, he declined to provide any hint as to when the monetary policymakers will start to cut interest rates. We continue to expect the Fed will start cutting rates at its September policy meeting, potentially following that with one more rate cut later in the year.