Daily Comment (July 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are indicating a subdued open as investors digest earnings. In sports news, Team USA’s basketball team defeated Germany in its final Olympic tune-up. Today’s Comment begins with our analysis of why the Magnificent 7 companies might be declining in popularity, followed by an explanation of why bond liquidity is becoming a big problem. We will then discuss how a potential economic slowdown in the EU could shift the central bank’s focus from inflation. As usual, our report concludes with a summary of international and domestic data releases.

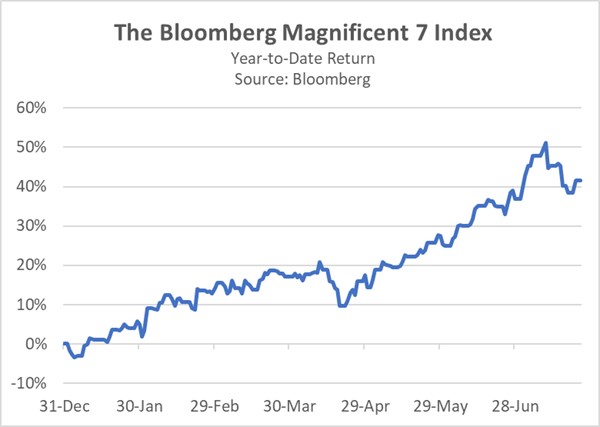

Big Tech Fades: Two Magnificent 7 companies have underwhelmed investors this earnings season as the market demands concrete evidence of profitability.

- Google’s parent company, Alphabet, topped second-quarter earnings expectations on Tuesday, but failed to reassure investors about the impending returns on its AI investment. The company’s AI spending surged to $2.2 billion, doubling the previous year and pushing back the timeline for substantial profits to 2025 or 2026. Adding to investor woes, Tesla reported disappointing earnings and pushed back the launch of its highly anticipated robotaxi by two months. These setbacks, coupled with slowing demand for electric vehicles, signal broader challenges for the company.

- The recent decline of the Magnificent 7 was anticipated. Two months ago, we highlighted that several of the companies were attempting to bolster investor confidence through dividends and buybacks to help justify their stocks’ lofty valuations. While these actions temporarily lifted sentiment, they did little to alter the fundamental reality: AI remains in its early stages. Nvidia, a key beneficiary of the AI frenzy, has been under our close watch. Given the company’s history of exceeding earnings expectations, a miss could lead the recent decline in the Magnificent 7 Total Return Index to deepen.

- The Magnificent 7 initially captivated investors with their scale and AI focus, propelling their stock prices to extraordinary heights over the past two years. This rally coincided with a sharp rise in interest rates on government bonds, making investors wary of smaller, riskier companies due to tighter financial conditions. However, much of these tech giants’ future growth appears priced in, limiting their upside potential. While it’s too early to declare a long-term trend, the outperformance of small and mid-cap stocks suggests a potential shift in investor sentiment may be underway.

Treasury Auction: The expectations of lower interest rates have helped fuel demand for US government debt, even as liquidity remains an issue.

- Tuesday’s $69 billion auction of two-year Treasury notes yielded a strong result, with a yield of 4.434%, more than 2 basis points lower than the previous record-matching auction. Surprisingly, the overwhelming majority of the issuance was absorbed by just two bidders, leaving a mere 9% for primary dealers — a historic low for these buyers who are typically responsible for picking up excess supply. This robust investor demand likely reflects a desire to lock in yields ahead of the anticipated Federal Reserve rate cut in September.

- One of the most pressing questions facing the US government is how to address its ballooning deficit. While the Treasury market has historically proven to be a reliable outlet for government debt, concerns are growing about its capacity to absorb future issuances. A liquidity index that tracks US government securities is showing signs of deterioration. In fact, it suggests that liquidity conditions are now worse than both the COVID crash in 2020 and the European Debt Crisis in 2011. This erosion appears to be on track to continue as long as the government struggles to deal with its growing fiscal imbalances.

- We have long suspected a coordinated policy approach between the Federal Reserve and Treasury to manage the nation’s growing debt burden. While we are skeptical of market projections for aggressive rate cuts in the near term, we acknowledge the potential for heightened Fed intervention in the Treasury market. If economic conditions deteriorate and inflation persists, the central bank may need to play a more active role to avert a crisis, which could include a sooner-than-expected end to quantitative tightening and a possible return to quantitative easing.

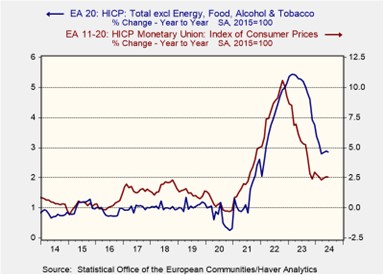

Europe’s Growth Problem: A slowdown in economic activity could complicate efforts by the ECB to balance growth and inflation concerns.

- The S&P Global Purchasing Manager Index (PMI) for the EU fell from 45.8 to 45.6 in July. A reading below 50 is a signal of contraction. The reading was below estimates of an increase to 46.1. The problem was really pronounced in the two largest countries within the bloc. Germany’s manufacturing PMI fell from 43.5 to 42.6, while France’s manufacturing PMI fell from 45.4 to 44.1. Although service activity was stronger throughout the regions, (particularly in France, which has benefited from the Olympics) there does seem to be a loss of momentum.

- The slowdown in economic activity could shift the European Central Bank’s (ECB) focus from solely targeting inflation toward supporting growth. Despite acknowledging progress in curbing inflation toward its 2% goal, the ECB has maintained a cautious approach to interest rate cuts. Following a 25-basis-point reduction in June, the bank opted to hold rates steady in July, pending further evidence of sustained disinflationary trends. In June, overall inflation in the eurozone held steady at 2.9%, while core inflation was roughly unchanged at 2.6%.

- Despite economic growth concerns, the ECB is likely to delay further rate cut commitments until the Federal Reserve’s monetary policy becomes clearer. Widening interest rate differentials have been a primary driver of recent currency fluctuations. This poses a challenge for the eurozone as it seeks to contain inflation, given the region’s heavy reliance on dollar-priced imports. As a result, while future price cuts cannot be ruled out, we think a potential hawkish shift by Fed members could alter the path of future ECB policy.

In other news: Democratic candidate Kamala Harris has announced that she has locked up enough delegates to secure the nomination as president. The move sets up a showdown between her and former President Donald Trump. Home prices hit a new high in a sign that shelter prices may continue to be a problem for inflation. The US has become increasingly concerned about Russia and China’s activities in the Arctic. This concern likely reflects the growing tensions between the West and these two nations.