Daily Comment (July 7, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with a recap of the minutes from the FOMC meeting in June. Next, we discuss the latest events in Ukraine and other situations related to the war. Afterward, we review various stories from around the world, including developments in the European Energy Crisis, China’s new stimulus, and the possibility of inflation cooling in the U.S.

Fed Meeting Minutes: The Federal Reserve reaffirmed its commitment to fighting inflation in its June meeting. The minutes from the meeting revealed that FOMC members were concerned that the central bank was at risk of losing its credibility. As a result, the members decided that a 50 or 75 bps rate hike would be appropriate for their July meeting. The market had little reaction to the minutes, as recent economic data did not convince investors that the minutes represented the Fed’s current thoughts on the economy. Thus, equities closed slightly higher than open, and the two and 10-year Treasury remained inverted.

Russia-Ukraine: For the first time in 133 days, Russia has not reported any territorial gains in Ukraine. The lack of progress suggests that Moscow may be implementing a pause in its invasion. Although Russian forces are still conducting limited military offensives in Ukraine, it appears that the Kremlin is preparing for more expansive operations in the future. This assessment is supported by the Russian government adopting a new law that will give it direct control over its economy. The measure allows government officials to recall workers from vacation, reschedule their time off without consent, and force them to work weekends, holidays, and nights. This change in law will allow the government to allocate more of the country’s resources toward its war effort as it seeks to take over the entirety of Ukraine. This development provides evidence that this war will probably not end soon.

- The West is continuing to look for ways to curtail the Russian invasion by targeting its energy exports. After sanctions failed to deter countries from purchasing Russian oil, the U.S. and its allies are now looking to implement price caps. The caps on the price of Russian oil will range from $40-$60 a barrel, and are designed to limit Russian export revenues. So far, it isn’t clear when the caps will be imposed; however, there does seem to be some momentum for the measure. The U.S. officials are meeting with G-20 members in Bali to work out the details.

- As the Russian blockade continues to prevent Ukraine from exporting grain to the rest of the world, there is a growing push to transfer these crops via rail. On Thursday, Romania announced that it was able to reopen its railway earlier than expected to help facilitate the shipment of wheat. As a result, Ukraine can transfer its grain to countries whose ports are not blockaded. The improvement in the transportation of wheat will possibly reduce the likelihood of a global food crisis.

- Ukrainian President Volodymyr Zelensky revealed that the weapons it received from the West are helping to slow Russian advances in his country. His statement suggests that Ukraine could look to revamp efforts to retake lost territory after a noticeable lull in the conflict. This will likely mean that the stalemate between the two sides will continue as both have the weapons needed to keep the war going.

Shake-up in Europe: As the war looks to ramp up pressure on Russia, Europe is also dealing with political headaches.

- PM Boris Johnson: Boris Johnson was forced to resign from his post following a slew of resignations and growing calls from within his party to step down. More than 30 people have left his administration, and Johnson fired a key minister after urging his resignation. Although he plans to stay in power until a new party leader is chosen, there is growing pressure for him to step down immediately. Details of a timeline of his departure are expected to be released next week. The possibility of decreasing political uncertainty following Johnson’s resignation led to a brief rally in the pound. Currently, there are several candidates to replace Johnson, but no clear front-runner.

- European Energy Crisis: As commodity prices rise, Europe is taking extreme action to help ensure its energy security. On Thursday, the French government agreed to nationalize nuclear energy company EDF (ECIFY, $1.74). France’s decision to take it over is designed to assure the company’s survival as the country prepares to secure its energy resources moving into the winter. In a similar move, the German government bailed out energy provider Uniper (UNPRF, $10.75) on Tuesday. Recently, energy shocks due to the war in Ukraine have forced governments to make bold moves to protect the stability of energy prices. Although the EU has not altered its commitment to fight climate change, the rise in the amount of coal use and its reclassification of green energy to include natural gas and nuclear suggest it is becoming more flexible in meeting its ambitious climate standards. In the short run, this could bolster commodity prices as it appears Europe has no other alternatives to fossil fuels.

- Draghi in trouble? The Italian parliament is in danger of collapse as disagreement over the Ukraine war has led to fractures within the ruling government. Leader of the Five Star Movement Giuseppe Conte met Prime Minister Mario Draghi to deliver a list of demands to ensure the party’s support of the coalition. The list included measures to protect the Five Star welfare payment program and raise the minimum wage. Although the Five Star Movement confirmed its commitment to supporting the current government, it is not clear how long that will last. The inter-coalition rift started when the Five Star Movement voted against offering Ukraine military support and urged the government to use more of the country’s resources to improve people’s lives at home. Tension within Italy has led to heightened political uncertainty risks and could have ramifications for the euro area in the long run.

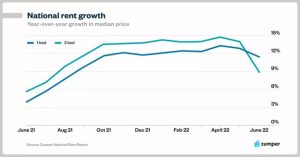

Inflation cooling: As the economy shows signs of slowing, there is evidence that prices may be cooling. The latest data from Zumper suggest that rental prices are starting to slow. Meanwhile, the chipmakers are reporting quicker delivery times of semiconductors suggesting that the shortage of chips may be waning. Lastly, energy prices, one of the largest contributors to inflation, have started to decline. Brent Crude has dipped below $100 a barrel for the first time since April and declining demand could see it fall further later this year. These developments indicate that inflation may have already peaked.

China: Although economists forecast that the Chinese government will report that its economy grew 1.5% in the second quarter, other data sources suggest that the economy shrank. The slowdown in the economy is forcing Beijing to take action to ensure that it meets its target of 5.5% growth by the end of the year. To meet its goal, China is exploring a rare mid-year sale of bonds to help fund a $220 billion stimulus package. The funds will be used to boost infrastructure and stimulate the economy.

- After loosening some of its COVID restrictions and offering stimulus, Beijing may also try to help its economy by improving ties with U.S. politicians and pushing vaccinations. According to the National Counterintelligence Security Service, China plans on recruiting state and local leaders to lobby Washington on its behalf. If true, the report suggests that Beijing may not be in a rush to decouple from the U.S. as it seeks to rebound from its recent economic setback.

- New lockdowns may be imposed in Shanghai after the city reported that the number of new infections doubled on Wednesday to 54. The outcome suggests that supply chains issues may persist in China.