Daily Comment (July 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new color on the dangerous China-Philippines standoff in the South China Sea. We next review several other international and US developments with the potential to affect the financial markets today, including an impending shift in investment strategy by a major Japanese pension fund and several notes on US politics and economic policy.

China-Philippines: Amid the worsening tensions between China and the Philippines over disputed territory in the South China Sea, we are increasingly struck by the strong domestic political winds that appear to be pushing on Philippine President Ferdinand Marcos Jr. Popular opinion appears to be pushing Marcos to be more assertive against Beijing. Still, the president’s sister, Imee Marcos, in recent days has warned that her brother’s growing closeness to the US and strong moves against China could prompt Beijing to attack.

- Imee Marcos is a senator in the Philippine legislature. She is known to be close to Sara Duterte, the daughter of former President Rodrigo Duterte, whose foreign policy was initially much more deferential to China and uncooperative with the US.

- Rodrigo Duterte and Ferdinand Marcos Jr. eventually became allies in the country’s 2022 elections. When Marcos won the presidency, Sara Duterte was named as his vice president. Since then, former President Rodrigo Duterte has continued to express a view that the country must be stronger in protecting its sovereignty against China.

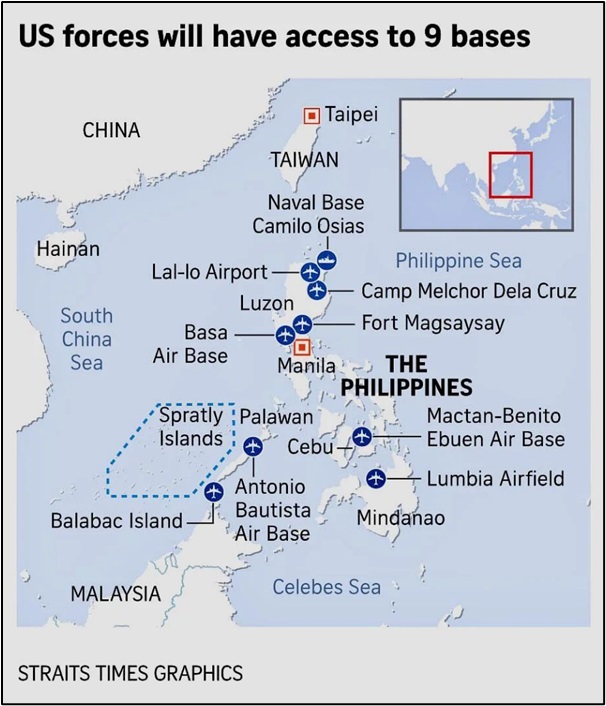

- However, it now appears Imee Marcos and Sara Duterte may be trying to undermine President Marcos’s stronger alliance with the US and efforts to bolster Philippine sovereignty, which has included a new defense cooperation agreement with the US in which Washington gained expanded access to Philippine military bases.

- Last week, Philippine Armed Forces Chief Gen. Romeo Brawner claimed the US offered to aid his country in its dispute with China, implying US willingness to help resupply the Philippine marines posted on a disputed shoal in the South China Sea. However, Brawner insisted Manila turned down the offer. Given the Biden administration’s extreme caution, Brawner could well be blowing smoke. Still, if his claim is true, it implies President Marcos may be sensitive to charges that he is getting too close to the US.

- Even if Imee and Sara have helped retard President Marcos’s embrace of the US so far, it isn’t clear that they can soften the broader public’s strong support for a more aggressive stance toward Beijing. That would keep alive the risk of a Philippine miscalculation that could draw the US into a direct conflict with China.

Hungary-Ukraine-Russia-China: Just a week into Hungary’s six-month stint chairing the Council of the European Union, Prime Minister Orban has ruffled feathers in Brussels with trips to Kyiv, Moscow, and Beijing, ostensibly seeking to facilitate peace talks between Russia and Ukraine. As noted in our Bi-Weekly Geopolitical Report from July 1, the chair of the Council has no authority to represent the EU in international affairs. Therefore, Orban’s theatrics appear aimed at bolstering his own image, embarrassing the EU, or both.

Japan: As the massive Government Pension Investment Fund starts prepping for its regular five-year strategy review in 2025, analysts say the recently improved performance of domestic assets implies a substantial shift back into Japanese stocks and bonds. Since the fund has more than $1.5 trillion in assets, any such shift could push prices for those assets upward, while taking some air out of the US and other foreign stocks or bonds to be sold. Analysts think the likely shift could also buoy the weak yen.

United Kingdom: In her first speech since the Labour Party took power, Chancellor Rachel Reeves said she had already seen data suggesting the UK is now in its worst fiscal position since World War II. She also announced that she has directed the Treasury to launch a review of the UK budget position, a move many observers fear could be a prelude to tax hikes when the new budget is introduced in the autumn.

United States-China: At the Hudson Institute yesterday, Republican Speaker of the House Johnson vowed his chamber would soon pass a series of new bills empowering the government to take even stronger economic measures against China. For example, Johnson said the House would vote on bills imposing new curbs on US investment in China and imposing tariffs on low-value imports that currently enter the US duty-free. Johnson’s vow is consistent with our view that US-China relations will likely continue to spiral in the near term.

US Fiscal and Trade Policy: Following up on Johnson’s remarks, the Republican Party yesterday released its platform for the November elections. The document clearly indicates the party would continue to pursue former President Trump’s “America First” foreign policy, protectionist trade policies, tax cuts, and deregulation. For example, the platform says the Republicans would:

- Impose base-line tariffs on foreign goods, using the income raised to cut taxes;

- Punish foreign countries that practice unfair trade;

- Revoke China’s “Most Favored Nation” trade status;

- Revive the US auto industry by cutting regulations; and

- Ban imports of Chinese vehicles.

US Politics: As many in the Democratic Party keep trying to convince President Biden to end his re-election bid because of his age, a new poll shows Biden’s national support down to 42% versus 43% for former President Trump. In a head-to-head matchup, the poll also puts Vice President Harris’s support at 42% versus 41% for Trump. Even though former Secretary of State Hillary Clinton isn’t being seriously considered, the poll puts her support at 43% versus 41% for Trump, while a hypothetical Harris-Clinton ticket would have the advantage at 43% versus 40%.

US Monetary Policy: Federal Reserve Chair Powell today begins his semiannual testimony to Congress. At 10:00 ET today, he addresses the Senate Banking Committee, and at the same time tomorrow, he’ll address the House Financial Services Committee. Powell is expected to say that while progress has been made in bringing down consumer price inflation, policymakers want to be more certain that price pressures are under control before they start cutting interest rates.

US Artificial Intelligence Frenzy: Corning, the maker of glass screens for televisions and smartphones, saw its stock price jump approximately 12% yesterday after boosting its guidance for second quarter revenues and profits. A key reason for the upward shift was good uptake of the company’s new optical connectivity products for generative artificial intelligence. The jump in the stock price suggests investors remain excited about AI and are still looking for new ways to participate in the frenzy.