Daily Comment (June 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a new medium-term forecast of global oil supply and demand from the International Energy Agency. We next review several other international and US developments with the potential to affect the financial markets today, including a risky decision by the European Union to impose steep antidumping tariffs on Chinese electric vehicles and a proposed new US rule that would keep medical bills out of credit reports.

Global Oil Market: The IEA, in its closely watched medium-term outlook, has forecast that the world’s capacity to produce oil will far exceed demand by the end of this decade. The forecast is based on expectations of further fast supply growth in the US and elsewhere in the Americas, coupled with waning oil demand as green energy becomes more prevalent. The implication is that the supply/demand mismatch will drive down oil prices.

- The IEA now expects global oil production capacity to rise to 113.8 million barrels per day by 2029, but it expects demand to peak in that year at about 105.4 million bpd.

- Of course, the IEA forecasts are highly dependent on a continued transition to non-fossil fuels. Recent political trends and weaker-than-expected demand for electric vehicles suggests that the transition going forward may not be as significant as the IEA expects.

Global Shipping Market: Global shipping and logistics firms suffered big declines in their stock prices yesterday, reflecting the possibility of a ceasefire in the Israel-Hamas conflict. After the UN Security Council approved a US-proposed ceasefire plan late Monday and both Israel and Hamas showed signs that they are inching toward accepting the deal, hopes are rising that the Houthi rebels in Yemen would stop their sympathy attacks on shipping in the Red Sea.

- Of course, the complex interplay of various actors surrounding the Israel-Hamas conflict means it could still expand to a wider, regional war. For example, Iran-backed Hezbollah militants in southern Lebanon fired a barrage of missiles today into northern Israel to retaliate for an Israeli strike that killed one of the group’s commanders.

- In any case, if the US peace deal is eventually put into place and allows the Red Sea to reopen, ships would no longer have to be re-routed around Africa, global capacity would be freed up, and freight rates would be driven lower.

- While lower freight rates would undermine shippers’ profits, they could also help bring down consumer price inflation around the world.

European Union-China: Risking a trade war, the European Union today said its antidumping probe into Chinese electric vehicles found that they are heavily subsidized and present “a threat of clearly foreseeable and imminent injury to EU industry.” In response, the EU said it will impose antidumping tariffs on Chinese EVs, on top of the current 10% tariff. The move will bring total EU tariffs on Chinese EVs from 20% to almost 50%, depending on the brand and how much the producer cooperated with the EU probe. The new tariff will apply starting on July 4.

- The EU’s move aims to protect the region’s large auto and auto parts sector, which employs a large share of the EU workforce. Nevertheless, the new tariffs are opposed by European automakers, who fear Chinese retaliation against their exports to China. Those automakers themselves also make a lot of the Chinese EVs and import them to the EU under their own brands.

- The EU’s move brings it into closer alignment with the tougher US approach to China’s geopolitical and economic challenge. That raises the prospect that China might indeed retaliate against the EU, imposing its own tariffs and other trade barriers against European goods and services.

- In sum, the EU’s new tariffs and any Chinese retaliation fits in with our often-stated view that the world is fracturing into relatively separate geopolitical and economic blocs. A few key results are likely to be higher and more volatile inflation and interest rates going forward.

China: The global fear of Chinese dumping these days stems largely from a new surge of investment in Chinese factories, leading to excess capacity, falling domestic prices, and firms exporting at fire-sale prices. Illustrating that the problem isn’t just in EVs, the chair of the Asian Photovoltaic Industry Association says China’s solar panel industry is dealing with a severe glut and falling prices, to the point where it is in an “ice age.” The official called on the Chinese government to intervene to bring supply back into balance with demand.

- Separately, China’s May consumer price index was up just 0.3% from the same month one year earlier, as anticipated. May factory-gate prices were down 1.4% year-over-year.

- The price data is consistent with continued weak domestic demand and broad excess capacity in the factory sector.

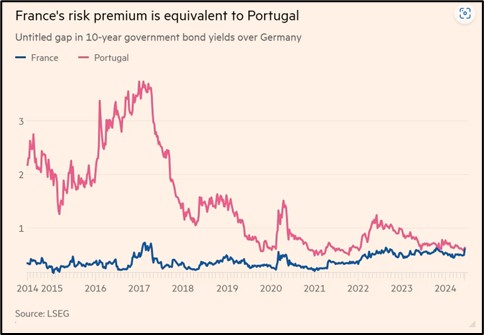

France: Ahead of the country’s snap parliamentary election on June 30, Finance Minister Bruno Le Maire has warned that a victory by the far-right National Rally could spark a debt crisis like the UK suffered during the short-lived government of Liz Truss. Le Maire’s warning smacks of scaremongering to discredit his political rivals, but market action does reflect investor concern that the surging NR’s populist program could lead to a blow-out in France’s budget deficit and debt levels. Some French debt is now trading at yields above Portugal’s.

Canada: Yesterday, the government and the Public Service Alliance representing about 9,000 of the country’s border agents reached a tentative deal on a new labor contract, averting a threatened “work to rule” strike that could have substantially disrupted US-Canadian trade starting on Friday.

US Monetary Policy: The Federal Reserve wraps up its latest policy meeting today, with its decision due at 2:00 PM ET. With price pressures still high, the policymakers are expected to keep their benchmark fed funds interest rate unchanged at 5.25% to 5.50%. They will also release their updated economic projections, including their “dot plot” of expected rate changes going forward.

- Based on interest-rate futures pricing, investors currently look for the Fed’s first rate cut to be in the autumn. The biggest uncertainty is whether the policymakers will implement further cuts later in the year.

- Because of today’s sticky inflation, we continue to believe the policymakers could keep rates “higher for longer” than investors currently believe.

US Regulatory Policy: The Consumer Financial Protection Bureau yesterday proposed a rule barring medical bills from credit reports. According to the CFPB, the rule would keep debt collectors from harassing consumers for inaccurate or false medical bills. The bureau also said its internal research shows medical bills on credit reports have “little or no value” in predicting whether consumers would repay their other debts. The CFPB said removing medical bills from a report would raise the relevant credit score by about 20 points.