Daily Comment (June 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Investors are looking past the recent Federal Open Market Committee meeting after a bullish PPI report boosted rate cut hopes. On the sports front, the US Men’s National Soccer Team secured a draw against Brazil in their Copa América warmup. Today’s Comment will analyze the FOMC meeting, explore why the CPI report offers hope of a policy shift for the Fed, and delve into the significance of the French elections. We’ll also provide our usual roundup of domestic and international news.

Fed Raises Doubts: The latest FOMC move suggests that it is unlikely to feel confident enough to cut rates before the election.

- The central bank held its benchmark interest rate steady at a target range of 5.25% to 5.50%. However, it lowered its projected number of rate cuts for the year from three to one. This shift surprised market participants, as recent declines shown in the CPI and PCE reports suggested progress toward the central bank’s inflation target. A recent surge in the nonfarm payroll data, though, appears to have influenced this hawkish stance. During the press conference, the Federal Reserve Chair reassured markets that the Fed remains prepared to act if job growth weakens unexpectedly in the coming months.

- Job data has become paramount in the Fed’s monetary policy decisions. Fed officials have recently signaled that a significant weakening of the labor market could prompt them to ease policy. However, recent data suggests that the labor market remains tight. Since the last Fed meeting, the unemployment rate has edged up slightly, from 3.8% to 4.0%, while nonfarm payroll jobs averaged a strong 200,000. Elevated wage pressures also remain a concern. Hourly earnings remain stubbornly above 4% annually, exceeding the level policymakers view as a sustainable long-term path, which is closer to 2.5%.

- The hawkish pivot may be related to concerns about political favoritism. Recent setbacks in inflation, as evidenced by the CPI reports during the first quarter, coupled with a relatively tight labor market, have led many commentators to question the need for any rate cuts at all. This criticism may have influenced the FOMC’s decision to revise its terminal fed funds rate upward, particularly as the election nears. However, the central bank remains open to a dovish shift if labor market conditions deteriorate. Should the unemployment rate remain above the year-end projection of 4.0% (which is the current rate), it could prompt Fed officials to reassess the number of rate cuts planned for the year.

Calling the Fed’s Bluff? Despite concerns from some Fed officials, inflation is rising at its slowest pace since monetary tightening began in 2022.

- Inflation eased to a three-year low in May, according to the Bureau of Labor Statistics. Consumer prices rose just 3.4% year-over-year, down from 3.6% in April. Core inflation, a more stable measure excluding food and energy, also slowed slightly to 3.3% from 3.4%. This moderation was driven by monthly price drops in airline fares, auto insurance, and new cars. Further supporting this trend, housing costs, the index’s largest component, held steady for the fourth consecutive month. This cooler-than-expected report suggests that despite Fed concerns, policy rates are still helping relieve inflationary pressures.

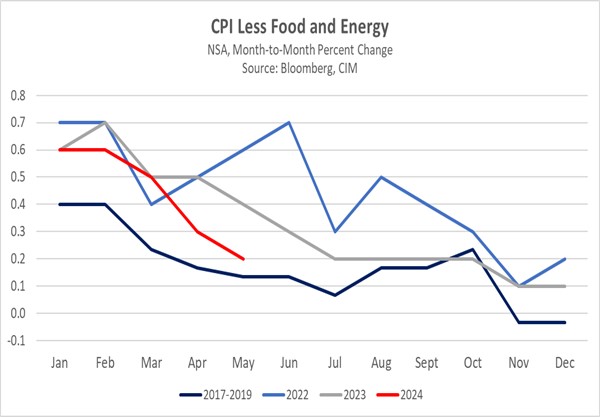

- The 10-year Treasury yield plunged 9 basis points on the day, as the market cheered the CPI results and shrugged off the FOMC meeting. The market’s reaction suggests that bond investors may be discounting the Fed’s projection of a single rate cut this year, instead believing policymakers submitted their estimates prior to the release of the latest CPI figures. Data from the first five months of the year shows that non-seasonalized inflation, which is never revised, is rising at a much slower pace than in 2022 and 2023. The latest report provided even more optimism that inflation may be falling closer to its four-year average recorded before the pandemic.

- Fed officials have consistently emphasized the need for greater confidence in falling inflation before considering rate cuts this year. The next three months, which typically see lower core CPI readings, will be a critical test for the central bank. If inflation remains below 2023 levels during this period, it would be seen as evidence of easing price pressures. The bond market’s reaction reflects optimism that this will happen. However, the scenario is not without risks. A disappointing CPI report could trigger a sharp rise in bond yields in the coming months and a rethink as to whether policy rates are restrictive enough to bring down inflation.

Macron’s Gamble: The French president is hoping that the market can help spook voters into reconsidering their support for far-right parties.

- The latest opinion polls indicate that the far-right conservative party is poised to make significant gains in the upcoming election on June 30. Projections suggest that the National Rally (RN) is expected to secure between 235 and 265 seats in the 577-member National Assembly. Although this would constitute a substantial increase, they are likely to fall short of achieving an outright majority. While there have been discussions about RN aligning with the center-right Republicans, significant internal opposition within both parties hinders such a partnership. Meanwhile, far-left parties are also working on forming a united front.

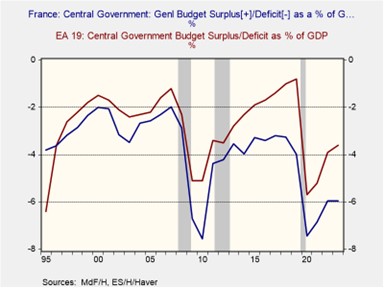

- The upcoming election is likely to thrust the country’s ballooning deficit into the spotlight. Post-pandemic efforts to control the national debt have been unsuccessful. In 2023, the debt-to-GDP ratio remained at 6%, significantly exceeding the 3% threshold mandated by EU fiscal rules. Bond yields surged after the snap election announcement. Investors fear a potential RN victory could lead to higher government borrowing rather than debt reduction. Marine Le Pen, the party’s leader, has unnerved investors with her proposed sales tax cuts and push to lower the retirement age. As a result, the spread between French and German 10-year bonds widened.

- Although RN gained momentum from the recent European parliamentary elections, its success in the upcoming elections remains uncertain. Its surge over the weekend was driven primarily by frustrated voters who were more motivated to participate in an election widely regarded as inconsequential. Voter turnout for the parliamentary election was only 50%, compared to 80% in the general election. Nonetheless, a potential defeat for RN could increase pressure on Emmanuel Macron to step down, as it would be seen as a sign that the country has lost faith in his leadership. Although a leadership change in France is not our base-case scenario, it is something we will be paying close attention to.

In Other News: In a sign that conflict in Europe will likely continue, the G-7 struck a deal to offer additional funding to Ukraine for its war efforts. South Africa inches closer to a coalition government as the African National Congress Party negotiates a power-sharing deal with the pro-business Democratic Alliance.