Daily Comment (June 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with the reasons we remain cautious about recent market optimism. We then explain why the Bank of Japan’s move away from yield curve control could hurt bond prices. Finally, we discuss the impact the U.S.-China rivalry has had on countries in Southeast Asia.

Will It Last? Investor sentiment surged on Thursday as the possibility of a soft landing increased, and the U.S. government moved closer to averting a debt default.

- The debt ceiling bill passed through the Senate on Thursday. This crucial legislation ensures that the government can continue to meet its financial obligations. The bill curtails spending until 2024 and extends the legal debt limit until January 2025. Additionally, the Congressional Budget Office estimates that the bill will yield substantial savings of $975 billion in government spending over the next decade. The legislation is now en route to President Joe Biden’s desk, where it is expected to be signed over the weekend. This comprehensive debt-ceiling package will avert potential default but will be a fiscal drag on the economy.

- Additionally, remarks from two prominent Fed officials appear to support a pause in rate hikes in June. During an event for the National Association of Business Economists, Philadelphia Fed President Patrick Harker mentioned that he would like to leave rates unchanged at the next FOMC meeting. At the same time, a post on the regional bank’s website from Saint Louis Fed President James Bullard, a hawk, suggested that rates are now within the sufficiently restrictive zone. Unlike Harker, Bullard is not a voting member this year; however, his remarks suggest that other hawks, such as Fed Governor Chris Waller, may also support a pause at the next meeting.

-

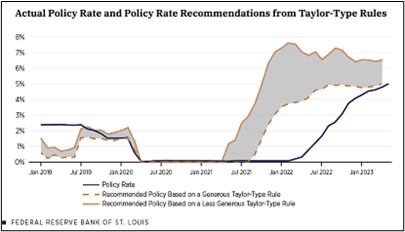

- Bullard uses the chart above, based on the Taylor rule, as a guide to where policy should be. It shows that the current policy rate has surpassed the lower level of the recommended range.

- The sudden optimism in the market is likely temporary as the economy still appears to be headed toward recession. Elevated interest rates could possibly deter consumption and investments. Similarly, a reduction in government spending should also weigh on economic activity. The recent surge in the payroll numbers suggests the labor market may be strong but keep in mind that responses for the Current Employment Survey have been on the decline since the pandemic. Hence, the data may not completely represent employment conditions across the country. As a result, it is still too soon to tell whether a downturn is actually around the corner.

Ueda’s Time: Bank of Japan (BOJ) Governor Kazuo Ueda’s impending move to end the central bank’s ultra-loose monetary policy has investors uncomfortable, as the shift is likely to cause a ripple throughout the financial system

- Earlier this week, the BOJ Governor hinted that he is ready to follow other central banks and raise rates. His remarks have added to speculation that the BOJ is preparing to end its policy accommodation. An April survey showed that around two-thirds of economists expect Ueda to lift rates by July. Meanwhile, market pricing suggests that investors believe the BOJ is unlikely to make any major changes to its policy over the coming months. The differing views have added to market jitters as investors don’t want to be caught off guard again when the central bank does decide to tighten policy.

- The lingering uncertainty surrounding the timing of policy changes has made governments nervous. One of the main concerns is that Japanese investors may decrease their purchases of foreign bonds if the central bank abandons yield curve control (YCC), which caps the yield on 10-year Japanese government bonds at 0.5%. This potential shift in investor behavior has prompted the European Central Bank to warn that BOJ normalization could potentially lead to strains in the international financial system. The BOJ is currently studying the matter, and its review is expected to last at least a year. However, Ueda, a former academic, has made it clear that he believes the era of low interest rates is over.

-

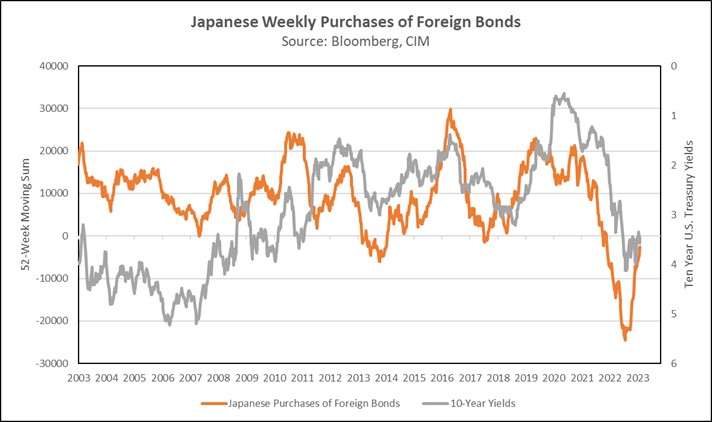

- The chart above compares Japanese purchases to the yields on the 10-year Treasuries. The two variables have been inversely correlated since the Bank of Japan began YCC back in 2016.

- The upward movement in Japanese government bond yields will capture the attention of both domestic and international investors, which could position the Japanese Government bonds as a genuine competitor to the U.S. Treasury, especially for investors looking to diversify their portfolios. This changing dynamic will likely play a significant role in the ongoing secular decline in bond prices, further shaping the landscape of the global financial system. Close monitoring of these developments is crucial for understanding the potential implications for market participants and stakeholders.

Uncertainty in Southeast Asia: The U.S.-China rivalry is expected to loom over the Asia security summit this weekend, as both countries look to steer clear of one another.

- On Friday, defense chiefs from China and the United States met with Singapore leaders to discuss security concerns. Although not much was disclosed regarding talks besides the usual pleasantries, Singapore announced that it agreed to establish a hotline with China for high-level communications. The agreement comes as tensions continue to escalate between the two major powers. Last week, a Chinese fighter jet intercepted a U.S. spy plane. Although there were no casualties, the incident shows the contentious relationship between the U.S. and China. The hotline will likely ensure that U.S. allies have the ability to maintain communications with both sides in the event of a dispute.

- However, the escalating tensions between the two dominant superpowers have significantly unsettled countries in the Asia-Pacific region. Numerous nations have expressed their apprehensions regarding the increasing hostility between these global powers. The former Malaysian foreign minister, for instance, has openly expressed concerns about the potential for a conflict over Taiwan. Similarly, Singapore’s Deputy Prime Minister has characterized the rift between the United States and China as insurmountable. Southeast Asian countries find themselves in a challenging position, as they are reluctant to align themselves with either side. Their primary objective is to maintain access to the vast Chinese markets while ensuring the security offered by the United States. Striking a delicate balance between these two priorities is of paramount importance to these nations as they navigate through this complex geopolitical landscape.

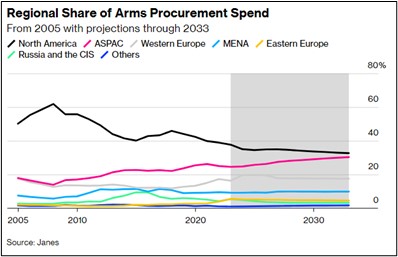

- The intensifying rivalry between the United States and China is anticipated to have adverse consequences for countries across Asia. As depicted in the chart above, governments in the region are projected to witness a significant surge in their military spending. This substantial increase in defense expenditures indicates a growing demand for advanced weaponry, technology, and infrastructure as countries look to prepare for a potential conflict. As a result, we suspect that aerospace and defense companies are poised to benefit from this trend and remain an attractive space for investment.