Daily Comment (June 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equities are starting the day strong despite another round of disappointing economic data. In sports, Texas A&M dominated Florida, bringing them closer to clinching the College World Series title. Today’s Comment will explore why Nvidia’s momentum may wane, discuss the renewed investor interest in the US dollar, and explain the latest rate decision from the Bank of England. As always, we conclude with a roundup of international and domestic news.

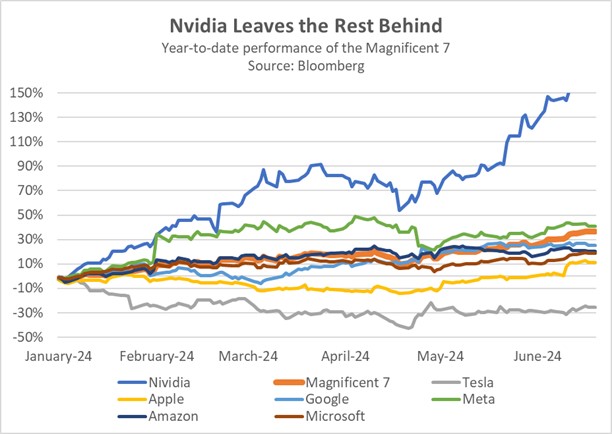

Hype Keeps Growing: Nvidia’s stock price keeps climbing, but there’s growing worry that the current enthusiasm might not be sustainable.

- The US chip designer overtook Microsoft as the world’s most valuable company on Tuesday. This rise is fueled by the ongoing excitement surrounding artificial intelligence (AI), which continues to captivate investors. The company’s recent strong performance is partly due to its decision to split its stock 10-to-1. This move made the shares more affordable for retail investors, increasing their accessibility. Nvidia sits at the forefront of the AI revolution, controlling an estimated 80% of the market for AI-specific chips. This takeover marks a historic shift, with the top spot last held by a non-Microsoft or Apple company being claimed by Cisco in 2000.

- While Nvidia’s stock soars, the momentum has not carried over to other AI-related stocks. Nearly 60% of the companies within the S&P 500 have seen gains this year, while more than half the stocks in Citi’s “AI Winners Basket” have seen a decline. The problem may be related to valuation. The “Magnificent Seven,” a group of prominent tech companies, trade at a significant premium compared to their large-cap peers. Their average price-to-equity ratio is a hefty 36.6, compared to 21.6 for the S&P 500 when those seven stocks are excluded.

- AI’s rising popularity is being met with increasing regulatory hurdles. The US is taking further steps to curb China’s chipmaking capabilities by limiting access to advanced chips. This week, a White House official will meet with counterparts from Japan and the Netherlands to discuss stricter chip export restrictions to China. Domestically, US antitrust watchdog and FTC Chair Lina Khan has announced her intentions to prevent large tech firms, particularly in the AI space, from further expansion. Earlier this year, she blocked the proposed Nvidia-ARM merger, which would have been the largest ever in the semiconductor industry, citing concerns that it would stifle innovation.

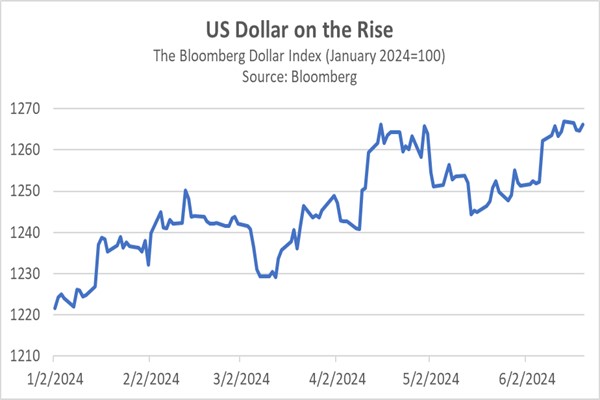

The Dollar Comeback: The Bloomberg Dollar Spot Index is on the verge of setting a new high for the year as investors view the US currency as being safer than its European counterpart.

- The US dollar has risen sharply since May. Investors are seeking the greenback due to rising uncertainty in the eurozone. Earlier this month, the European Central Bank cut its benchmark policy rates by 25 basis points, despite signs that inflation might be about to resurge. Meanwhile, the Federal Reserve surprised markets with a hawkish turn, despite evidence suggesting that inflationary pressures are easing. These contrasting policy moves have widened interest rate differentials, as investors rotate out of European bonds and into US Treasurys, in a sign that they are growing confident in America’s ability to control inflation.

- Political uncertainty has bolstered the US dollar, with French elections set to take place in 10 days. There is widespread concern that populist parties will win a significant number of seats, which is fueled by the rising popularity of the National Rally party and a potential coalition of left-wing populist movements that could gain control of parliament. Although French President Emmanuel Macron’s position is not on the ballot, the election may act as a referendum on his presidency, potentially rendering him a lame duck if his party suffers a serious defeat. A populist victory could see a slowdown or even a reversal of some of his pro-market reforms.

- Although the dollar has some momentum, concerns over US growth could prevent it from a breakout. The latest retail sales data suggests that consumers are starting to become price sensitive, while the labor market has shown signs of cooling. This weakness may lead investors to price in another rate cut for the year, rather than just the one that the Fed outlined in its summary of economic projections. Additionally, a less disruptive than expected election outcome could entice investors back to European markets. Consequently, the dollar may enter a holding pattern in the coming weeks as investors seek greater clarity.

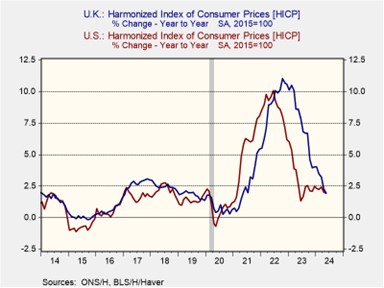

No Action in the UK: The Bank of England held rates steady at its latest meeting despite inflation falling to target in May.

- The BOE kept its key policy rate at a 16-year high of 5.25%. The decision not to move was not unanimous, as two members of the committee voted in favor of a cut. While inflation did return to 2% in May, policymakers signaled concerns that service inflation and wage pressures remained a problem and could hinder the central bank’s target of maintaining price stability, while others showed that elevated components of the reports were likely temporary. That said, the committee seems to be satisfied with the level of inflation progress.

- The BOE’s cautious approach mirrors the Fed’s latest decision from earlier this month. Both central banks expressed concerns about a potential resurgence of inflation in the second half of the year during their explanations for their recent actions. The BOE’s meeting minutes stated that they believe price pressures may rise later in the year as energy prices stop acting as a drag on the inflation index. Meanwhile, Fed Chair Jerome Powell argued that the rollover impact of the core PCE price index could also cause the Fed’s preferred inflation measure to increase due to these temporary effects. However, both central banks maintained that a cut is still likely this year.

- The possibility of rate cuts in late summer or early fall remains on the table for both the BOE and the Fed. The chart above shows that when inflation is adjusted for comparison with other countries (harmonized inflation), UK inflation is roughly in line with US inflation. However, it’s important to note that recent declines are largely due to falling energy prices, which may not reflect the underlying trend in other parts of the economy. Reflecting this concern, the Bank of England may consider a cut in August, while the Federal Reserve will likely wait for data releases, particularly inflation reports from July and August, before deciding on a September rate cut.

In Other News: In a move to counter isolation by the US, Russia signed a mutual defense treaty with North Korea. This highlights Russia’s efforts to forge alliances with countries opposing the West, potentially to bolster its war effort in Ukraine. Meanwhile, Dutch Prime Minister Mark Rutte was selected as the new head of NATO, and his seamless transition will likely help the military alliance maintain unity as it looks to take on threats from Russia and China.