Daily Comment (June 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion about the growing hawkishness of central banks in advanced economies. Next, we give our thoughts on the disappointing economic data coming out of Europe. Finally, we’ll explain how the rivalry between the U.S. and China is leading countries to change their trade relationships.

Keeping Up the Fight: Markets are learning to accept that rates will be higher for longer.

- On Thursday, the Bank of England stunned investors with a larger-than-expected 50 basis point rate hike. It is the BOE’s 13th rate hike since it began tightening its monetary policy in late 2021, and it is unlikely to be the last. Under fire due to concerns over the economic impact, BOE Governor Andrew Bailey warned that if the central bank does not get tough now, inflation could possibly get worse. Bailey’s remarks reflect a hawkish trend among central banks in the developed world, as they grapple with the challenge of taming inflation without tipping their economies into recession.

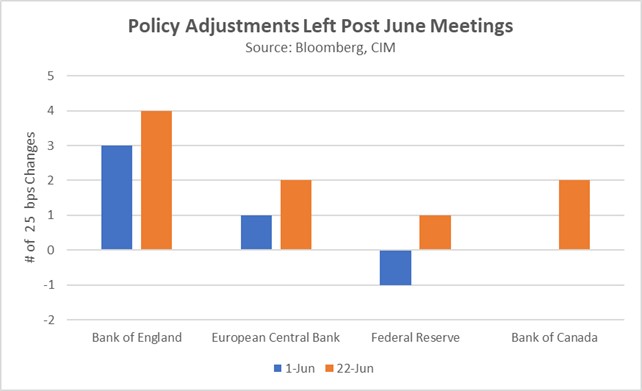

- Equities dipped on Thursday as investors grew more convinced that central banks are serious about fighting inflation. The Euro Stoxx 50 and FTSE 100 finished the day down 0.5% and 0.8%, respectively. Meanwhile, the S&P 500 Equal Weight Index fell 0.4%, reflecting weakening sentiment among investors. The poor performance in stocks is related to market fears that interest rate hikes will hinder global GDP growth. Overnight index swaps show that traders have revised their expectations up for year-end hikes. As the chart below shows, major central banks are expected to end the year with policy rates of 25 bps or higher than their current levels.

- Rising interest rates will encourage firms to be more profitable and provide investors with more value. This is because investors are increasingly prioritizing profitability over growth, as stocks now have a viable alternative in government bonds. However, growth companies are not completely out of the race. As the recent craze over AI has demonstrated, investors are still willing to buy stocks with a lot of upside potential. In the meantime, stocks should start to look more attractive over the next few months and should provide investors with opportunities in the medium- and long-term.

Recession Fears Abound: Property prices are under pressure, and economic activity is slowing in Europe.

- Higher interest rates are starting to weigh on real estate markets around the world. In Germany, the year-over-year change in housing prices fell 6.8% in the first quarter. The United States is also facing high levels of distress in commercial real estate properties, while the United Kingdom is trying to prevent a potential mortgage crisis. These problems are a reflection of the negative impact that the current monetary policy is having on the world economy, and they may be a potential sign that financial conditions are becoming too tight.

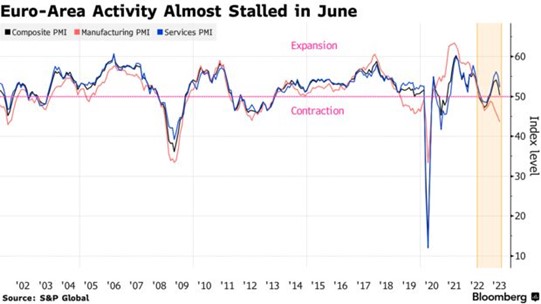

- The purchasing managers’ index (PMI) from the eurozone is on the brink of contraction. The flash reading for the June composite PMI for the euro area slowed from 52.8 to 50.3, just above the 50-point threshold that separates growth from contraction. The slowdown was driven by a steep decline in manufacturing activity. Industrial output has been struggling as demand for goods has started to weaken. The drop in manufacturing activity will contribute to the decline in the economic output and may worsen if the country’s energy supply is strained this winter.

- European central bankers are facing a difficult balancing act. They are concerned about inflation, which is well above the central bank’s 2% target. However, they also worry that raising interest rates could further damage the eurozone economy. Fears that it may cause harm to consumers have led policymakers to push banks to increase the pay savers for their deposits. The potential income effect due to higher deposit rates could encourage the central bank to tighten for longer; however, it is not clear whether banks will listen.

Choosing Friends: The growing rivalry between the United States and China is pushing Asian and European allies to diversify their trade relationships and strengthen their security ties

- This is evident in South Korea, which has imported more goods from the United States than it has from China for the first time in almost two decades, and reflects the country’s need to protect itself from a growingly hostile China. Beijing has pressured South Korea to reduce its reliance on the U.S. and Japan, but the country is resisting these efforts. In addition to improving trade ties with the U.S., South Korea has also looked to deepen defense ties with Japan.

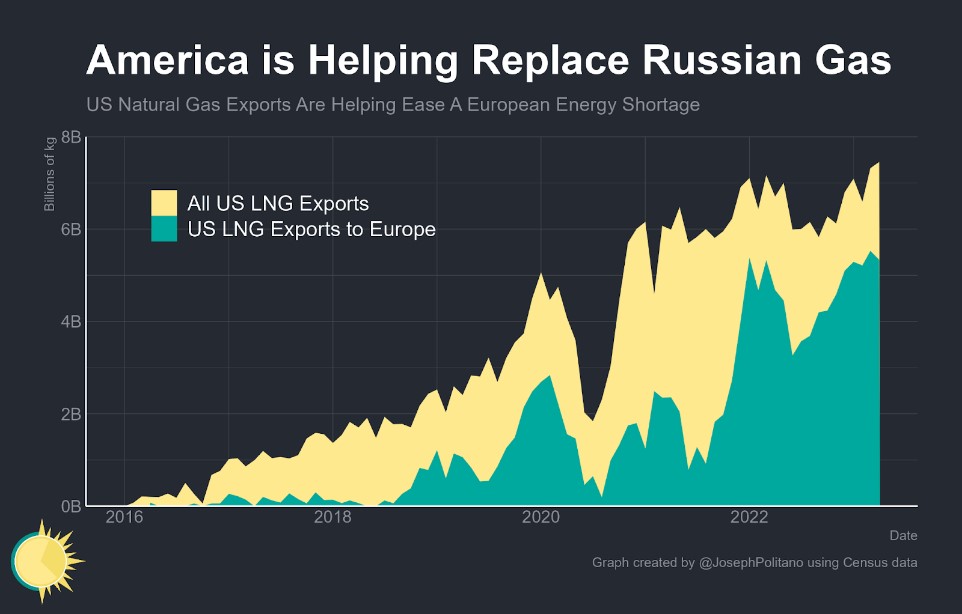

- As Germany weans itself off Russian gas, it has signed a deal with the United States for liquefied natural gas (LNG). This is a significant shift in Germany’s energy policy and shows how the country is looking to distance itself from Moscow following its invasion of Ukraine. The deal is also an example of the United States’ emergence as an energy-exporting power. It has been a net exporter of natural gas since 2016 and is expected to export more oil than it imports later this year. The U.S.’s growing influence in the energy space will likely play a role in its ability to keep its trade partners on its side as it looks to compete with China.

- We expect that China and the United States will use a carrot-and-stick approach to win over countries. The carrot will likely come in the form of increased market access and foreign direct investment for friendly countries. In contrast, the stick may come in the form of sanctions and trade restrictions. Even though many countries will look to resist having to choose a side between the two major powers, most will ultimately have to do so. This may mean that certain countries could face some backlash. At this time, it does not appear that either Washington or Beijing is willing to use its full might against potential detractors, but that could change over the next few years.