Daily Comment (June 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest on the simmering China-Philippines tensions in the South China Sea. We next review several other international and US developments with the potential to affect the financial markets today, including a new down-leg in the value of the Japanese yen, a bad inflation report in Australia, and, on a more positive note, signs of continued strong demand for junk-rated debt in the US.

China-Philippines: In an interview with the Financial Times, the Philippine Ambassador to the US warned that the China-Philippines dispute over the South China Sea’s Second Thomas Shoal has now reached an incendiary phase in which it could suddenly expand into a major conflict, much as the assassination of Austrian Archduke Franz Ferdinand sparked World War I. However, according to Ambassador Jose Manuel Romualdez, this conflict would be more dangerous because it could draw in countries with nuclear weapons.

- As a reminder, our new Mid-Year Geopolitical Outlook identifies the China-Philippines territorial dispute in the South China Sea as the world’s most dangerous geopolitical risk in the second half of 2024.

- While Beijing has deployed its coast guard and marine militia to quarantine a Philippine military outpost on the Second Thomas Shoal, using aggressive tactics to thwart resupply missions, Manila has also used provocative tactics to fight back, including by cutting Chinese fishing nets in the area and secretly delivering construction materials to shore up the outpost.

- What isn’t clear is the extent to which Washington and Manila are coordinating. One concern we have is that Philippine President Ferdinand Marcos, Jr., may be trying to force the US into backing his country’s sovereignty claim more forcefully.

- Since the US and the Philippines have a mutual defense treaty, which the Biden administration has repeatedly pledged to honor, Marcos may be trying to goad China into a violent action that would force the US military to make a show of force in the area. Ambassador Romualdez’s interview may also be aimed at prompting the US into action. Of course, the risk is that bringing US and Chinese military forces into closer proximity in the area could push them into conflict, even if accidentally.

- With our extraordinary focus on geopolitical risks here at Confluence, we are actively considering how we can adjust our investment strategies to hedge against such risks or take advantage of any resulting opportunities.

China-United States: In a new sign that the US is military is preparing for a potential conflict with China, the Marine Corps earlier this month recertified the airstrip on the Western Pacific island of Peleliu. In a major battle during World War II, the US sent 50,000 Marines and Army soldiers to pry the island and its airstrip from 10,000 Japanese defenders, resulting in tens of thousands of casualties. As discussed in our new Mid-Year Geopolitical Outlook, the US is now strengthening its presence across the Indo-Pacific region in an attempt to deter further Chinese aggression.

Japan: The value of the yen (JPY) today fell to 160.36 per dollar ($0.0062), reaching its weakest level since 1986. The currency has now lost some 12.2% of its value so far this year, as investors continue to be disappointed by the Bank of Japan’s slow pace of interest-rate hikes while the Federal Reserve and other major central banks keep their rates high. The new yen weakness will likely raise expectations that the Japanese government will again intervene in the currency markets to slow the currency’s slide.

Australia: The May consumer price index was up 4.0% from the same month one year earlier, well above both the expected increase of 3.8% and the April rise of 3.6%. A measure of core inflation rose to 4.4%. Coming just one week before a cut in income taxes and government payments to individuals to help offset the rise in the cost of living, the data has boosted expectations that the Reserve Bank of Australia will be forced to hike interest rates again. In turn, that prospect is weighing heavily on Australian stock and bond prices so far today.

North Atlantic Treaty Organization: In other security news, NATO’s member states today officially approved outgoing Dutch Prime Minister Mark Rutte as the alliance’s next secretary general. Rutte is seen as a strong trans-Atlanticist who can manage NATO relations with both the US and Russia. However, he has been criticized for the Netherlands’ failure to reach the NATO target of spending at least 2% of gross domestic product on defense throughout his time as prime minister. Rutte will take over the leadership of NATO on October 1.

Eurozone: The European Commission and European Central Bank today jointly announced that Bulgaria and Romania have failed to meet the economic criteria to join the eurozone, as widely expected. The countries’ key shortcomings included excessively high consumer price inflation and concerns that their institutions were too saddled with corruption and money laundering. The decision means that the eurozone will continue to encompass 20 countries; the last of which to join was Croatia at the beginning of 2023.

Kenya: The mass protests against the government’s new tax hikes, which we described in yesterday’s Comment, have now turned deadly, as police opened fire yesterday on protestors who had broken into parliament. According to local rights groups and activists, at least five protesters and first responders were killed and scores were injured in the incident. The violence threatens both the political and economic stability of a major African country.

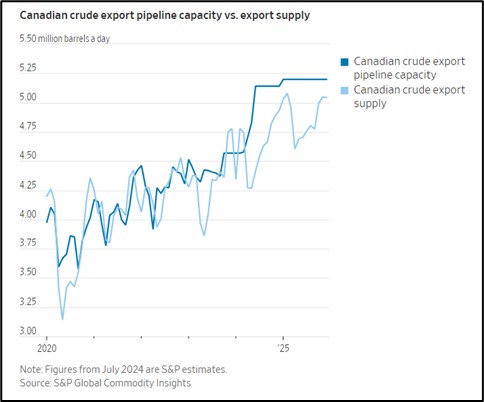

Canada: The Wall Street Journal today carries an interesting article on Canadian oil sand companies and their recent outperformance. After years in which the firms were held back by high costs and limited export-pipeline capacity, they have now largely completed their expensive facility build-outs and are discovering improved operating practices to cut production costs. The May 1 opening of a new export pipeline to Canada’s west coast has also removed export bottlenecks. The resulting higher profits have pushed the firms’ stock prices sharply upward.

US Financial Conditions: New research from Goldman Sachs shows firms with low credit ratings have repriced some $391 billion in leveraged loans into lower-interest debt so far this year, a new record for the period. According to Goldman, the benefit from the repricing has been equivalent to a 0.50% cut in the Federal Reserve’s benchmark fed funds rate.

- The ability of the firms to roll their debt over into lower-interest loans stems from high investor demand for investment products that package the loans into securities.

- As illustrated by the rollover activity, burgeoning private credit funds, and the current low spreads for junk bond funds, high investor demand for yield is probably one reason today’s high interest rates haven’t sparked a broad financial crisis or thrown the economy into recession.