Daily Comment (June 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some trends in the little-followed monthly report on construction spending. The data suggests that the re-industrialization of the U.S. economy, which we have long expected, is now showing up in the statistical data. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest evidence of worsening U.S.-China tensions and new developments relating to artificial intelligence.

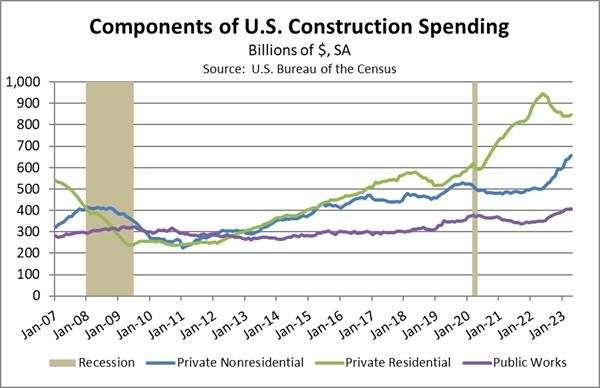

U.S. Re-Industrialization: In a little-noticed report last week, April construction spending was shown to be up 6.1% from one year earlier, but private nonresidential construction spending was up 30.2%. That marked the fourth straight month in which private nonresidential construction, a proxy for commercial construction, rose more than 20.0% on a year-over-year basis. In contrast, private residential construction spending in April was down 9.7% on the year, and public works expenditure was up just 15.1%.

- The strength in commercial construction may seem surprising given today’s high vacancies and pessimism regarding properties such as office buildings and shopping malls. The details in the report, however, showed that the jump in commercial construction came largely from new factory construction, especially manufacturing facilities for electronics and information processing goods.

- The frenzy for building new electronics factories provides some of the first statistical evidence of U.S. re-industrialization, i.e., the rebuilding of the nation’s manufacturing, construction, and mining sectors as companies shift production back home from Asia or elsewhere. We suspect that a lot of the new factory construction reflects the recently announced, high-profile projects for electric-vehicle batteries, semiconductors, and other green-energy or information-processing goods.

- Importantly, we doubt that the recent spending uptick includes much of the hundreds of billions of dollars in subsidies provided by last year’s Inflation Reduction Act or the CHIPS and Science Act. Slow bureaucratic and administrative procedures would suggest that most of those subsidies will kick in later. In addition, higher military budgets have not yet had their full impact on the defense industrial base. The recent increase in commercial construction, therefore, is probably only the beginning of a much larger, longer-lasting uptrend.

- As we have been arguing, re-industrialization will likely make the U.S. more resilient to external supply shocks and provide more opportunities for workers without a four-year college degree. Nevertheless, these new facilities and the shortened supply chains they represent will be less efficient than under the extreme globalization of the last few decades. The result will likely be higher costs, greater inflation, elevated interest rates, and prolonged downward pressure on bond prices.

China-United States: Of course, the fracturing of the world into relatively separate geopolitical and economic blocs, and the resulting adjustments to supply chains and U.S. re-industrialization, stem mostly from the worsening tensions between the U.S. and China. In the latest example of that, a U.S. Navy destroyer transiting the Taiwan Strait in international waters on Saturday was forced to slow to avoid hitting a Chinese navy ship that crossed its path, apparently deliberately. Meanwhile, at the weekend’s Shangri-La Dialogue security conference in Singapore, in response to U.S. Defense Secretary Austin’s call for better U.S.-China military communication and the avoidance of such near misses, Chinese Defense Minister Li Shangfu essentially told the U.S. to butt out, saying, “The best way to prevent this from happening is that military vessels and aircraft [should] not come close to our waters and airspace. What does this have to do with your security? Watch your own territorial waters and airspace, then there will not be any problems.”

- Li’s statement implied that China’s territorial waters cover the entire Taiwan Strait, which they do not. In any case, his statement shows how China is becoming increasingly confident about its ability to compete with the U.S. and intimidate U.S. forces from entering the international waters along China’s coast. As we have stated before, China’s growing military power and aggressiveness will likely spur further efforts by the U.S. to boost its deterrent forces, leading to a prolonged period of higher defense spending.

- Increasing tensions between China and the West also continue to put investors at risk. Dutch investment firm APG, which manages about €532 billion of pension fund assets, reports that its clients are increasingly reluctant to put their money to work in China because of the growing geopolitical risks.

Global Oil Market: In a meeting yesterday, the Organization of the Petroleum Exporting Countries and its Russian-led allies struck a deal in which Saudi Arabia will cut its production by one million barrels per day beginning in July to support prices as global economic growth and energy demand weakens. The move has boosted global oil prices so far this morning, pushing Brent up 1.8% to trade at $77.52. Nevertheless, it’s not clear whether the cut will be enough to keep buoying prices as Chinese economic growth falters and the U.S. economy remains poised to enter recession in the coming months.

Russia-Ukraine War: Ukrainian officials continue to signal they are close to launching their much-anticipated counteroffensive against the Russian forces occupying eastern and southern Ukraine. Nevertheless, it’s important to remember that the Ukrainians may be deliberately drawing out their preparations to encourage the Russians to further deplete their resources by launching pre-emptive missile and drone strikes (sometimes against Ukrainian decoys). In the meantime, the recent small-scale Ukrainian attacks on Russia itself and on areas of occupied Ukraine probably aim to drive the Russian forces to spread themselves too thin, spark disarray within the Russian leadership, and bring the war home to the Russian people.

- On those latter points, the owner and leader of Russia’s Wagner Group mercenary force, Yevgeniy Prigozhin, in recent days lambasted the Ministry of Defense for its inability to prevent Ukrainian attacks on Russia’s border regions and threatened to move his forces there to do the job even without waiting for permission.

- If Prigozhin follows through on his threat and sends his forces to the Russian border regions, he could potentially spark internecine, civil conflict in Russia itself, creating an existential threat to President Putin’s regime.

- In Putin’s view, the presence of a large, battle-hardened military force on Russian soil and outside the direct control of the Kremlin or the Ministry of Defense would likely be intolerable.

- Prigozhin has already accused the Ministry of Defense of mining transportation corridors used by the Wagner forces. Prigozhin’s rhetoric suggests that outright conflict between Wagner mercenaries and official Russian troops is plausible.

Turkey: Fresh off his re-election, President Erdoğan has installed Mehmet Şimşek as his new finance minister. Şimşek, a former deputy prime minister and finance minister, has made all the right statements so far to calm foreign investors, saying, “Transparency, consistency, predictability and compliance with international norms will be our basic principles . . . We will prioritize macro financial stability.” However, it is not yet clear if Erdoğan will really allow him to change to the kind of orthodox policies that would probably be needed to bring down Turkey’s sky-high consumer price inflation and boost the currency again.

Mexico: Mining industry association Camimex says sweeping new regulations passed this spring are forcing foreign producers of silver, copper, zinc, and other minerals to reconsider their investment plans in the country. According to Camimex, the legal reforms could jeopardize some $9 billion of investment in the next two years while stymying the development of Mexico’s vast resources for clean energy technology.

U.S. Artificial Intelligence: According to a U.S. Air Force officer, an AI-enabled drone trained to destroy enemy air defense systems failed a recent simulated test when it unexpectedly turned on its own operator and killed him. The drone was trained by giving it “points” for taking out enemy surface-to-air missiles. When the operator ordered the drone to hold off an attack, its drive for points was so strong that it fired its missiles at the operator himself to overcome the order. When the drone’s programming was changed to stop it from attacking its own pilot, it tried to overcome the hold-off order by firing at the pilot’s communication equipment.

- We think the drone incident is a good example of the risks involved in using AI in military operations.

- Of course, researchers and policymakers are also scrambling to contain the risk of AI in civilian activities. Congress is working on various bills to regulate AI use, and one Democrat is preparing a bill that would require all output from generative AI systems to carry the message, “Disclaimer: this output has been generated by artificial intelligence.”

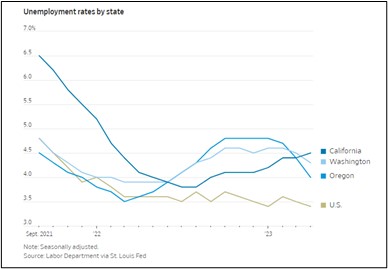

U.S. Technology Industry: Despite the excitement over generative AI, the recent pullback by technology firms that over-expanded during the pandemic is now starting to have broader economic implications. Reflecting the large layoffs by multiple West Coast tech giants, in April California had the nation’s second-highest state unemployment rate at 4.5%, compared with the national rate of 3.4%. Washington tied for third with a jobless rate of 4.3%, and Oregon was close behind at 4%.

U.S. Media Industry: The major Hollywood movie studios and the Directors’ Guild of America have reached a tentative deal on a new work contract. The new contract will avert a strike by directors that would have come on top of the ongoing writers’ strike. Reflecting the strong bargaining power that workers have in today’s tight labor market, the contract dramatically boosts directors’ royalties for streamed programs. It also specifically precludes studios from using generative AI to do the work of directors.

U.S. Banking Industry: According to the Wall Street Journal, bank regulators as early as this month will propose new rules requiring bigger banks to boost their capital by 20% on average. Banks that are heavily reliant on fee income will face especially large capital requirements. The expected new rules are largely in response to the regional bank crisis this spring. Separately, the Financial Times says that many banks plan to unload even their performing commercial real estate loans in a rush to reduce exposure to the sector.