Daily Comment (June 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities futures are off to a strong start as investors digest the latest ADP jobs data. In sports news, the US Women’s National Team (USWNT) delivered a convincing victory over South Korea in their pre-Olympics preparation. Today’s Comment will focus on why a slowdown in job openings may be good news for the market, why the regional banking system remains a point of concern, and why the UK Prime Minister debate wasn’t a clear win for either candidate. As usual, our report concludes with a roundup of international and domestic data releases.

Labor Cooling: Job openings have fallen in recent months in a sign that rising interest rates may finally be impacting the US economy.

- US job openings have plunged to a three-year low, according to the Bureau of Labor Statistics. April data shows that 8.06 million jobs are available, down from 8.35 million in the previous month, which pushed the job openings rate down to 4.8% from 5.0%. This marks the third straight month of decline and fuels speculation of an economic slowdown. The Atlanta Fed’s GDPNow forecast predicts second-quarter growth of just 1.8%, down from last week’s estimate of a 2.7% rise. This weak reading was seen as bullish for risk assets as it raised the possibility of the Federal Reserve cutting rates to prevent a recession.

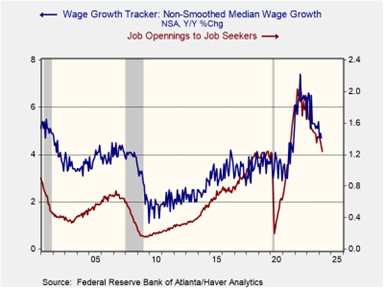

- The recent jobs data offers a glimmer of hope for a soft landing. The ratio of job openings to unemployed workers is steadily declining and is now approaching pre-pandemic levels. This suggests employers are adjusting to wage pressures by scaling back on hiring, as opposed to reducing their workforce. This aligns with past comments from Fed Governor Christopher Waller. A few years ago, he suggested companies might freeze hiring rather than resorting to layoffs during an economic slowdown. This trend strengthens the case for potential rate cuts by the Fed in the latter half of the year.

- A Goldilocks scenario seems likely for the economy, with growth potentially slowing enough to tame inflation without tipping into recession. Friday’s jobs report is a crucial test for this forecast. The expected gain of 190,000 jobs would be considered modest. A significantly weaker number could fuel expectations of a rate cut, possibly as early as September. If our forecast holds true, this could lead to a rise in stock prices, with small-cap and mid-cap stocks potentially outperforming their larger counterparts as investors embrace riskier assets. Additionally, US government bonds should also rally as investors look to get ahead of the Fed.

Bank Troubles: Even though some indicators suggest financial conditions are still relatively stable, regulators remain concerned about potential trouble for banks.

- The Federal Deposit Insurance Corporation (FDIC) identified an increase in bank vulnerability, with 63 banks now considered at risk. This marks a rise from 52 in the fourth quarter of 2023. The US banking system faces a growing burden of unrealized losses totaling $517 billion. This represents an 8.2% increase from the previous quarter. Residential mortgage-backed securities are the primary culprit, accounting for 95% of the recent rise in losses. Additionally, there is an upward trend in the volume of past due and nonaccruals (PDNA), with most of the increase coming from the largest banks.

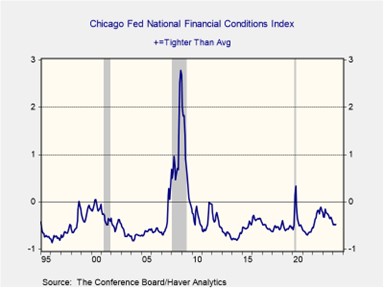

- Despite signs of vulnerability in some banks, broader financial conditions remain easy. The Chicago Fed National Financial Conditions Index reflects this disconnect, with 101 out of 105 indicators signaling looser-than-average conditions. As a result, hawkish voices within the Fed are rising. Last week, Dallas Fed President Lorie Logan, a non-voting FOMC member, emphasized the need to keep rate hikes on the table in order to prevent reigniting inflation through premature easing. She finds support from Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, and Fed Governor Michelle Bowman, who have also signaled openness to further tightening.

- A recent increase in banks identified as potential problems by the FDIC raises concerns. However, with only 1.2% of the system flagged, the overall health of the banking industry remains strong. This will be a key factor for policymakers as they navigate next week’s rate decision. While recent economic data is unlikely to completely derail rate cuts, rising inflation concerns may prompt the Fed to scale back its plans. Instead of the previously anticipated three cuts, the Fed might opt for a more measured approach with just two reductions. Additionally, policymakers may choose to monitor the effects of slowing the balance sheet reduction before resorting to more aggressive measures to safeguard the banking system.

UK Showdown: Prime Minister Rishi Sunak clashed with his Labour counterpart Keir Starmer as he attempted to boost support for his re-election campaign.

- The debate opened with a fiery exchange, as Sunak launched a direct attack by accusing Starmer of proposing a £2,000 tax increase (roughly $2,550). Starmer countered, insisting the figure was grossly inflated and based on flawed assumptions about his policies. However, despite his pushback, Starmer struggled to deflect concerns about potential tax hikes, leaving him on the defensive throughout most of the verbal sparring. That said, Sunak struggled to defend his party’s 14-year record in power, likely damaging his overall likeability rating.

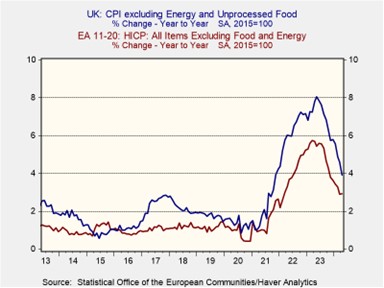

- Although polls showed that Sunak was the victor of the debate, his party is still heavily favored to lose the election that is set to take place on July 4. Two of the most pressing concerns for the British are the rising cost of living and immigration. While inflation has come down from its peak, prices in the UK are still rising faster than in the eurozone. Additionally, many voters are concerned that immigration is placing a strain on housing affordability and public services. Although the country has implemented stricter immigration policies, there is still a push for lawmakers to go further.

- Despite exiting the European Union more than four years ago, the UK continues to search for a clear national identity. If polls hold true, the country could be on its fourth prime minister in that timeframe. This persistent leadership change is likely to complicate efforts to predict the future course of policy, as the UK grapples with ongoing challenges. One key issue in the coming months will be the country’s ability to manage its debt in order to achieve economic stability. A successful approach could attract investment, but failure could lead to investor hesitancy.