Daily Comment (June 14, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] Risk markets remain soft this morning in the wake of the German 10-year yield dipping under zero.

It is historic enough that we now have the German yield curve below zero going out 10 years. A total of 75% of German bonds now carry a negative yield and 50% yield below -40 bps. The -40 bps level is important because the ECB can’t legally buy bonds with a yield below that level. Thus the continued decline in German yields is making QE in Europe increasingly difficult, forcing the ECB to purchase riskier credits. Perhaps just as important is that U.S. 10-year T-note yields have dipped under 1.60% this morning, reaching a low yield of 1.57%.

The other big news is Brexit. The Sun newspaper, with the highest circulation in the U.K., has come out in favor of leaving the EU. Although the actual impact of this news is probably less than it would have been a decade ago, it does add to evidence of a surge toward leaving the EU.

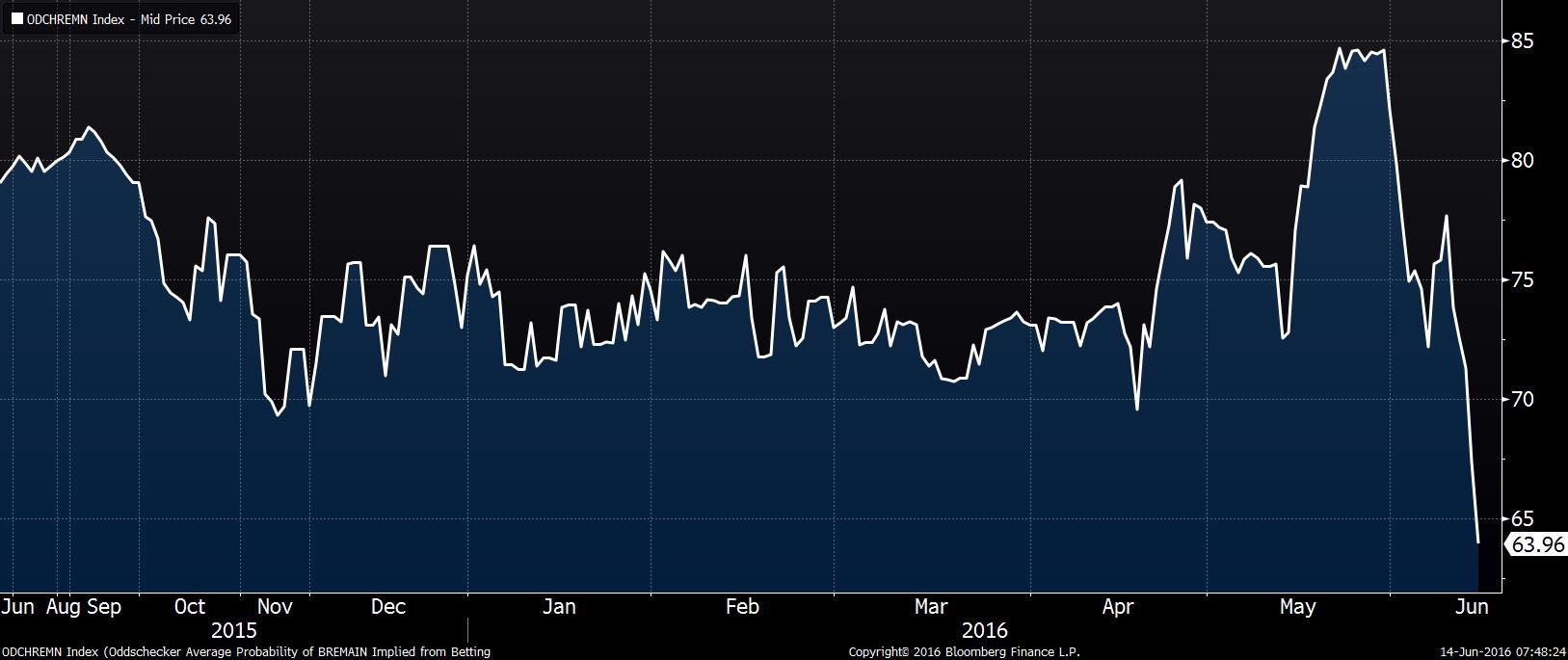

This chart shows a Bloomberg calculation of the average of betting sites on the question of staying in the EU. At the beginning of the month, odds makers’ betting pools showed a clear bias toward Bremain as the betting flows suggested the U.K. would not vote to leave the EU. Although the odds still favor that position, there has been a definitive shift since early June. Next week’s WGR will examine the Brexit issue from the context of the viability of the EU project.

Finally, the FT is reporting that, since last August, China has spent $470 bn supporting the CNY. The onshore rate has been inching down recently despite persistent central bank support. Recent comments suggest China will not allow a free float of the CNY; usually, that means depreciation, but due to fears of capital flight, the most likely outcome is a gradual slide in the exchange rate. On a related note, the MSCI is nearing a decision to allow onshore (A shares) equities into its emerging market basket. Based on the lack of openness in the Chinese financial markets, it is hard to justify adding additional Chinese exposure to the emerging indices. On the other hand, given China’s size, it will be difficult to keep the onshore shares out indefinitely. We suspect they will get added in a measured fashion starting later this year.