Daily Comment (March 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

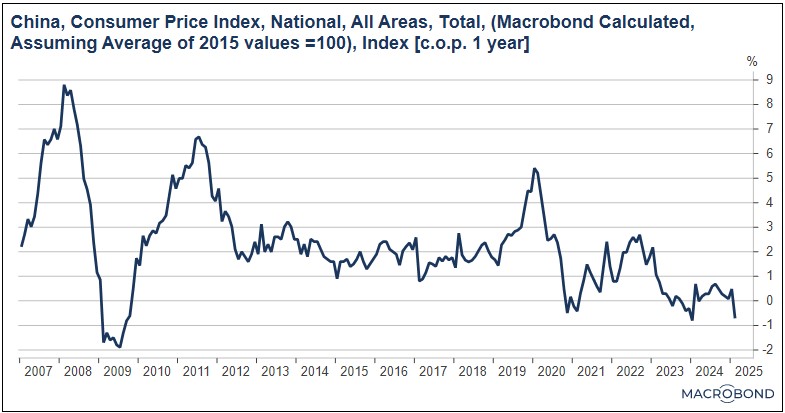

Our Comment today opens with a new example of the possible repercussions from today’s reordering of the geopolitical landscape — a call by Poland’s prime minister for his country to consider building its own nuclear weapons. We next review several other foreign and US developments with the potential to affect the financial markets today, including an outright annual decline in China’s consumer price index and a statement by President Trump that he may be willing to spark a recession to restructure the US economy.

Poland: In a speech to parliament on Friday, Prime Minister Tusk said that Poland must respond to the US’s changing foreign policy by dramatically increasing the size of its armed forces and “boldly” considering the development of its own nuclear weapons. The statement illustrates an important potential risk as the Trump administration pushes US allies to take more responsibility for their own defense: Rather than simply spending more on their militaries, key countries could develop destabilizing capabilities.

- The administration continues to show signs that it may not live up to the commitments made in the US’s various mutual defense treaties, including the one underlying the North Atlantic Treaty Organization. That brings to mind the old proverb that the purpose of NATO was to “Keep the Americans in, the Germans down, and the Russians out.” If the US pulls back from NATO, keeping the Germans (and Poles) down will be much harder.

- By raising questions about its commitments, the US action is already spurring stronger defense spending by its allies, especially in Europe. As we have long predicted, that has been giving a significant boost to European defense stocks over the last year or so.

- However, if the allies believe they will be left to fend for themselves, there is no set limit to the capabilities they will want to develop. While the UK and France are currently the only NATO allies with nuclear arsenals, Germany, and now Poland, may build them as well. Other countries could also consider them, even if building or buying nukes may require them to break nuclear nonproliferation treaties.

- Without the ballast of the US to restrain them, these historical enemies at some point could fall into disputes and sharp disagreements, raising the risk of nuclear confrontation between them. Just as destabilizing, the Russians would also be alarmed if European countries on their doorstep began building independent nuclear arsenals.

- For investors, an important implication is that the demand for uranium will likely get a further boost, even beyond the bump it is expected to get from the increased use of nuclear power plants to generate electricity. As we’ve written in the past, China’s massive expansion in its nuclear arsenal is probably already supporting uranium prices. A potentially broader nuclear arms race should support uranium prices even further.

Germany: In a survey by the Financial Times, eurozone economists, on average, said Germany should be able to issue 1.9 trillion EUR ($2.1 trillion) in new debt over the next decade to fund increased defense spending and infrastructure investment. According to the economists, that’s the amount of new debt that Berlin could take on for those priorities without hurting its economic growth. As a result, German debt would rise to 86% of gross domestic product from 63% now. The figures suggest that Germany has plenty of fiscal space for stimulative spending and faster growth.

Syria: In other security-related news, a wave of sectarian killings arose in Syria’s coastal region over the last several days. The violence apparently started when insurgents supporting the deposed dictator Bashar al-Assad ambushed forces of the new government on Friday. Since then, government forces and their allies seem to be attacking perceived enemies, including the Alawite sect that had supported Assad. The violence raises the risk that Syria could devolve into broader sectarian violence rather than calming down under the new government.

China: The February consumer price index was down 0.7% from the same month one year earlier, coming in even weaker than expected and posting its first outright decline in 13 months. The government attributed the decline to an earlier-than-usual start to the Lunar New Year holiday, but even if that’s true, the lack of any inflation in China illustrates how weak price pressures have become as the country confronts a range of economic headwinds.

China-Canada: Beijing announced on Saturday that it will impose tariffs of up to 100% on canola, pork and other food products. According to the Chinese government, the tariffs are to retaliate for Canada’s decision last August to impose steep tariffs on Chinese electric vehicles, steel, and aluminum. However, the new duties are being widely seen as a warning to Ottawa not to cooperate with the US as it puts up tariffs and other trade barriers against Chinese imports.

Canada: Former central banker Mark Carney yesterday won the election to become the new leader of the center-left Liberal Party. Some 85.9% of party voters selected Carney, giving him a landslide win over former Finance Minister Chrystia Freeland. In coming days, Carney will be named prime minister, replacing Justin Trudeau, after which he will likely call national elections. Carney has signaled that his priorities will be to resist President Trump’s effort to annex Canada and shore up the Canadian economy’s resilience against US tariffs.

Mexico: President Sheinbaum yesterday held a giant fiesta in the capitol’s main square to celebrate a second month’s suspension of US tariffs proposed by President Trump. The fiesta, which included thousands of workers bussed in from all parts of the country, was originally planned for Sheinbaum to outline her retaliatory tariffs against the US. With the further suspension of many US tariffs last week, the party was repurposed into a show of national unity and Sheinbaum’s determination to resist US economic pressure.

US Economy: In an interview that aired yesterday, President Trump refused to rule out the chance that his tariffs and other economic policies could lead to a recession this year. He instead repeated his previous statements that due to the big changes he is trying to bring about, the economy will have to go through a “transition” period. Trump’s response suggests that investors shouldn’t necessarily expect Trump to pull his punches when or if the economic data starts to show softening growth, rising unemployment, or faltering asset prices.

- As of this writing, the administration plans to impose 25% tariffs on all imported steel and aluminum starting on Wednesday. The administration also plans to add “reciprocal” tariffs against any country that charges higher tariffs against the US than the US does against it, starting April 2.

- The president’s interview statements appear to be the key reason for a downdraft in US equity markets so far this morning. As of this writing, S&P 500 futures are trading down about 1.0%.

US Oil Industry: Following on Trump’s statement about a rough economic transition, the Financial Times today carries an interview with his energy secretary, Chris Wright, in which Wright says that Trump’s policies to boost US shale oil output will produce low prices, a wave of bankruptcies, and industry disruption. However, he insisted that the result will be a US oil industry that is more efficient and can produce at lower cost. Wright’s statement underscores the administration’s willingness to impose short-term economic costs for long-term benefits.

US Lumber Market: As Canadian export taxes and US import tariffs drive a widening price divergence between Canadian spruce, fir, and pine versus US southern yellow pine, CME Group has announced it will begin offering futures on the US lumber starting March 31. The new futures for southern yellow pine will trade under the ticker SYP. Please be careful that you don’t confuse it with SPY, the popular exchange-traded fund tracking the S&P 500 stock index!