Daily Comment (March 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are reacting to the news that a government shutdown was averted. In sports, Steph Curry made history by hitting his 4,000th 3-pointer in the Warriors’ victory over the Kings. Today’s Comment will explore the market’s recent correction, how a PPI subcomponent could shed light on the trade war’s effects, and other key market-moving developments. As always, we’ll also provide a summary of international and domestic data releases.

S&P 500 Correction: The market plunged 10.1% from its all-time high on Thursday, driven by mounting fears of a government shutdown and escalating trade war tensions. The sharp sell-off underscores just how sensitive investors have become to any signs of uncertainty.

- On Thursday, President Trump escalated trade tensions with the EU by threatening to impose tariffs of up to 200% on European wine, retaliating against proposed EU tariffs on American goods. This move sent a strong signal of escalating trade uncertainty, revealing a further decline in relations and the increasingly erratic nature of the dispute.

- Meanwhile, House Speaker Chuck Schumer (D-NY) fueled further uncertainty by initially declaring that his party would not support the legislation needed to avert a government shutdown. Although he later walked back this threat and expressed support for the bill, his initial reluctance underscored growing concerns that deepening partisanship is making effective governance increasingly difficult.

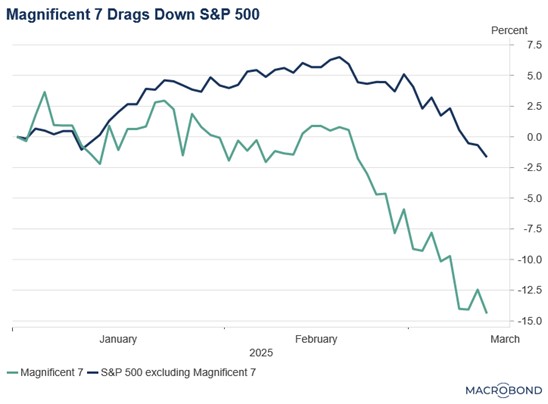

- Heightened uncertainty has prompted investors to reduce their exposure to risk assets, particularly the mega cap tech stocks. The divergence in year-to-date performance — a 1.6% decline for the S&P 500 excluding the Magnificent 7 versus a 14.4% drop for those stocks — indicates a significant rotation. This shift reflects potential investor fatigue with the persistent tech-led market leadership of the preceding two years.

- Trade tensions are creating a “wait and see” market. A prolonged conflict risks a significant market sell-off due to increased volatility. However, a rapid resolution could fuel a market surge, with mega cap tech leading the way, given their exposure to trade sentiment and growth. In the interim, commodities could provide a potential buffer against market uncertainty.

Producer Prices Ease: Following a report of easing consumer inflation in February, producer prices also showed a slowdown in supplier price pressures. However, the ongoing trade war raises concerns that this relief may be temporary.

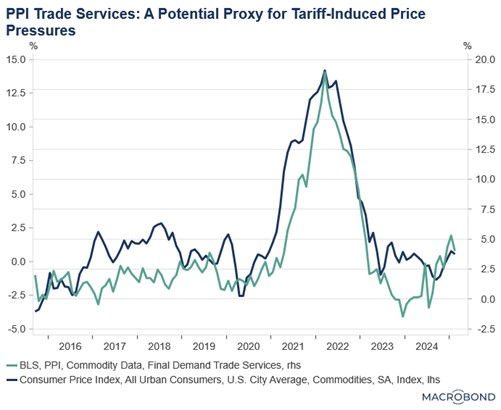

- The overall Producer Price Index (PPI) showed a year-over-year slowdown, easing from 3.7% to 3.2%, while core PPI, which excludes food and energy, also moderated, falling from 3.8% to 3.4%. This deceleration was largely attributed to a decline in trade services, which tracks changes in profit margins between wholesale and retail businesses. The report indicates that businesses may be hesitant to pass on higher costs to consumers.

- Trade services are expected to remain a critical indicator to monitor as the trade war persists. Changes in margins between retailers and wholesalers reflect the pass-through effects of price increases, making this metric particularly sensitive to the impact of tariffs. As a result, it could provide valuable insights into how businesses are navigating the challenges posed by ongoing trade tensions.

- This indicator proved particularly useful in assessing the impact of supply chain disruptions and surging demand on businesses during the pandemic. As the gap between retail and wholesale margins widened, inflationary pressures intensified. Conversely, as these margin differentials began to narrow, price pressures started to ease for consumers.

- In short, as long as trade services remain relatively subdued, the inflationary impact of tariffs is likely to be contained. As highlighted in previous reports, while many argue that taxes on imported goods are inherently inflationary, we believe the effects may vary significantly depending on the type of good. In fact, we contend that earnings compression — where businesses absorb higher costs rather than passing them on to consumers — could also emerge as a realistic outcome of the trade war.

Benefits on the Chopping block? President Trump is open to allowing Republican lawmakers to explore cuts to certain social spending programs as part of efforts to secure funding for his priorities, including tax cuts, border security, and defense spending.

- The president is reportedly permitting Senate Republicans to identify instances of “waste and fraud” within Medicaid as part of an effort to curb spending and reduce costs. This development follows reports that Elon Musk’s cost-cutting taskforce, DOGE, has been examining inconsistencies in entitlement disbursements as part of its broader initiative to address the deficit. Both efforts highlight a growing focus on fiscal responsibility, though such measures are likely to draw scrutiny and debate.

- The heightened focus on spending comes as Republicans seek to finance an ambitious tax bill, with several conservative lawmakers insisting they will not support any legislation that exacerbates the fiscal deficit. Recently, Senator Rand Paul (R-KY) has been vocal about his concerns, vowing to oppose the stopgap bill due to its potential impact on spending. Similarly, Kentucky Representative Thomas Massie voted against the legislation in the House, citing the same reservations.

- The ongoing debate over how to fund the proposed tax cuts indicates that conservatives remain determined to pass the legislation. Efforts to target waste and inefficiency may offer some financial flexibility, but so far, these measures have not yielded substantial savings. While we anticipate that the tax bill will likely be passed before the end of the year, we remain skeptical about its ability to be deficit-neutral.

Ceasefire Close? The Russian president appeared to downplay the possibility of agreeing to a temporary ceasefire with Ukraine, instead expressing a preference for pursuing a long-term resolution. That said, there does seem to be progress.

- Putin has indicated openness to the proposed arrangement but emphasized that further discussions are necessary before he would agree to the plan. A central point of contention revolves around the allocation of territory between Ukraine and Russia, which remains a highly sensitive and unresolved issue. Additionally, negotiations would need to address the critical question of control over a large power plant, a matter of strategic and symbolic importance for both sides.

- Despite the lack of clarity, President Trump seems optimistic that a deal will be done between the two sides as Ukraine has already agreed to the terms of the truce. While there is no timeline as to when an agreement will be reached, it is clear that Russian and US officials are in contact to get something done over the next few months.