Daily Comment (March 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently awaiting the Fed’s rate decision later today. In sports news, Putin and Trump have expressed an openness to organizing hockey games between teams from their respective countries. Today’s Comment will cover our expectations for the latest Fed meeting, recent developments in the Ukraine-Russia ceasefire talks, and other market-related news. As usual, the report will include a summary of international and domestic data releases.

Fed Speaks: The Federal Open Market Committee (FOMC) is expected to conclude its two-day meeting by keeping interest rates unchanged. However, the market will closely monitor the press conference for insights into the Fed’s outlook on inflation and its expectation for the economy.

- Despite the January core CPI report signaling accelerating price pressures, Fed officials are likely to welcome the progress that has been made on inflation. In January, the year-over-year change in core PCE increased by 2.6%, marking its slowest pace in over six months. Meanwhile, core CPI has seen its slowest two-month start to the year since 2020.

- Meanwhile, recent economic data has sparked concerns about the health of the economy. The Atlanta Fed’s GDPNow forecast suggests the possibility of economic contraction, though this reading has been heavily influenced by a surge in imports, particularly gold. The inclusion of gold, classified as an investment rather than a consumable good, has drawn scrutiny for potentially skewing the data. The Atlanta Fed plans to adjust for this issue with its update on March 26.

- Tariffs are expected to be a key topic of discussion among Fed officials as they explore ways to mitigate the potential negative economic impact of trade restrictions. So far, most Fed officials have signaled a “wait-and-see” approach to the administration’s trade policies. However, recent data suggests that tariffs may already be influencing import prices.

- The prices that US importers are paying for Chinese goods have risen at their fastest pace since 2021, signaling that Chinese firms are unwilling to absorb the cost of tariffs. The sharp increase in import prices appears to reinforce the view that Beijing has pressured its firms to resist easing the tariff burden for their US buyers, underscoring its stance that it will not bear the cost of these tariffs.

- We expect the Fed to lean dovish, in line with its current policy stance. While officials may not signal a willingness to cut rates in May, they could be prepared to do so in June, assuming inflation data continues to show progress toward the 2% target. Additionally, we believe the central bank is likely to address and downplay concerns about the economy entering a recession.

Ceasefire on Ice: Talks between Vladimir Putin and Donald Trump ended without securing a deal for a comprehensive ceasefire. Despite this setback, cautious optimism remains that both leaders will eventually reach a mutually acceptable agreement.

- The failure to reach a ceasefire agreement appears to stem from Putin’s insistence that military aid to Ukraine, particularly from the US, be halted during the pause in hostilities. This demand has been deemed unacceptable by the US, as it would effectively allow Russian forces to regroup and rearm during the lull, while leaving Ukraine severely constrained and vulnerable.

- However, Putin did offer one concession by agreeing to halt attacks on Ukraine’s energy infrastructure. Despite this gesture, other critical areas remain vulnerable to assault. Shortly after the agreement, Russia launched a drone strike targeting other forms of Ukrainian infrastructure, a move that drew sharp criticism and condemnation from EU officials.

- Additionally, the US has been actively seeking support from the EU and the UK, as their involvement is crucial for any peace deal. This is largely due to the need for their approval to lift sanctions as Russia desires — a process that is likely to face significant hurdles. Complicating matters further, both the EU and the UK are currently considering plans to sell seized Russian assets, a move aimed at supporting Ukraine’s recovery but one that could exacerbate tensions with Moscow.

- We remain cautiously optimistic that a peace deal can eventually be reached between the two sides. However, Russia’s lack of urgency in ongoing negotiations suggests a perceived strategic advantage over Ukraine. A potential agreement will likely prioritize European equity interests, reflecting regional stability concerns. Despite this, the path to peace remains challenging, with both sides navigating complex demands. Entrenched positions continue to complicate the negotiation process.

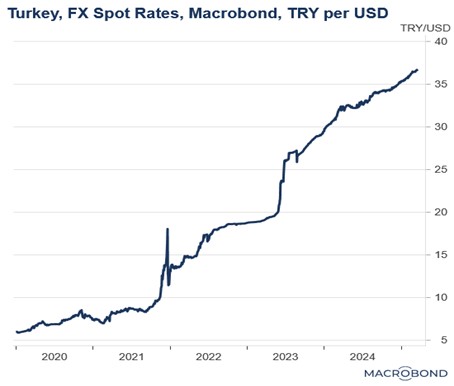

Erdoğan Crackdown: The Turkish president has been accused of targeting political rivals in an effort to stifle any serious challenge ahead of elections scheduled to take place by 2028. This move has unsettled markets, with investors raising concerns about the erosion of the country’s rule of law.

- Turkish police have detained Istanbul’s mayor, Ekrem İmamoğlu, widely regarded as a formidable political rival to President Erdoğan. The arrest, which was linked to alleged terrorism-related charges, coincided with reports that the opposition Republican People’s Party (CHP) was preparing to name him as its presidential candidate. İmamoğlu, who gained significant popularity after securing major victories in Istanbul’s mayoral elections, has become a symbol of opposition strength.

- His detention has ignited widespread criticism, with many condemning the move as politically motivated and warning of its implications for democracy and judicial independence in Turkey. The news triggered a sharp sell-off in Turkish assets, sending the lira (TRY) plunging by 10% to new record lows, while equities dropped 6%, prompting a temporary trading halt. Additionally, the country’s bond yields surged as investor confidence eroded following the report.

- Erdoğan’s intensifying crackdown on political rivals aligns with his party’s refusal to consider early elections, despite mounting public discontent. A recent poll highlights the deepening frustration among Turks, with 61% predicting a further deterioration in the country’s economic situation over the next six months and 58% calling for new elections. Turkey’s economy has been plagued by soaring inflation and rising unemployment, placing significant strain on households and exacerbating widespread dissatisfaction.

- While political instability in Turkey is a growing concern, there is currently little indication that widespread outrage, either domestically or from the West, will escalate into a larger movement. For now, we view these developments as relatively contained, though the situation could intensify if the government’s crackdown on opposition parties sparks violent protests or further unrest. As such, Turkey remains a country to monitor closely, but for the time being, there is no immediate cause for significant alarm.

Meloni in the Middle: Italian PM Giorgia Meloni urged Brussels to avoid escalating a trade war with the US, emphasizing that such conflict benefits no one. This aligns with her cautious approach to transatlantic relations amid existing tensions.

- Her warning comes as the EU prepares to impose 50% tariffs on US goods, including whiskey, motorcycles, and jeans, set to take effect on April 1. In response, President Trump has threatened to levy 200% tariffs on European wines, escalating tensions in an already fraught trade dispute.

- Additionally, Meloni has cautioned the EU against attempting to ramp up defense spending as a means of reducing reliance on the US. She argued that it would be unrealistic for the EU to fully shoulder its defense responsibilities without American support, emphasizing the continued importance of transatlantic cooperation in maintaining global security.

- Meloni is set to meet with EU leaders in Brussels on Thursday, where they will discuss strategies to address US tariffs and calls for increased defense spending. Her remarks highlight a growing reluctance among some EU leaders to engage in a prolonged tit-for-tat with the US, underscoring a preference for diplomatic solutions over escalating tensions.