Daily Comment (March 20, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently processing the latest decision from the Federal Reserve. In sports news, Duke University is bound to let college basketball fans down again in the NCAA Men’s Basketball Tournament this year — whether they win or lose. In today’s Comment, we’ll delve into the Fed’s latest rate decision, explore the growing pressures on chipmakers to establish operations in the US, and cover other key market developments. As always, we’ll also provide a comprehensive roundup of the latest international and domestic data releases.

Team Transitory Is Back! While Federal Reserve officials have revised their inflation forecasts upward, they have kept the possibility of rate cuts on the table, maintaining their view that tariffs will only have a limited impact on inflation.

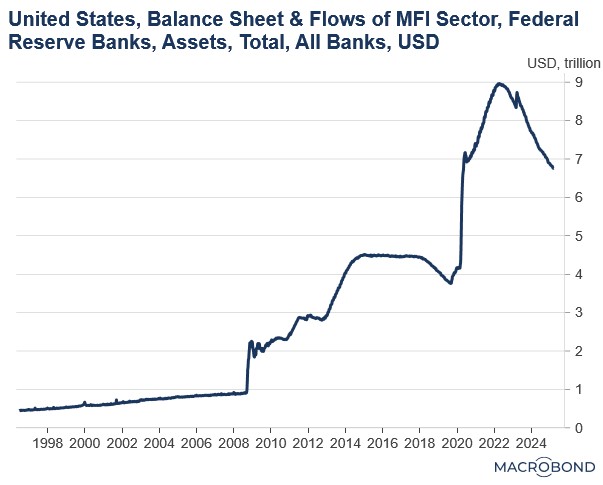

- The FOMC unanimously voted to maintain the federal funds rate target range at 4.00%-4.25%. However, Christopher Waller dissented regarding the Quantitative Tightening (QT) policy (specifically the reduction of the Fed’s balance sheet runoff from $25 billion to $5 billion monthly), preferring to continue with the original pace.

- Fed officials cited increased uncertainty in the economic outlook, which led them to revise their year-end projections. Core PCE inflation was revised upward to 2.8% from 2.5%, the unemployment rate forecast was raised to 4.4% from 4.3%, and the GDP growth projection was lowered to 1.7% from 2.1%.

- During the press conference, Fed Chair Jerome Powell acknowledged that the central bank viewed tariffs as a potential driver of higher inflation throughout the year, which could hinder the Fed’s progress toward its inflation target. When questioned about whether the Fed would raise interest rates in response to tariff-induced inflation, Powell emphasized that if the inflationary pressure is temporary and expected to dissipate on its own, tightening monetary policy would not be an appropriate response.

- Regarding quantitative tightening, Powell stated that the Fed intends to slow the pace of its balance sheet runoff to prolong the reduction process. However, he emphasized that this adjustment in pace does not signal any broader implications for future monetary policy decisions. He reiterated that the central bank would continue to shrink the balance sheet until reserves decline from their current abundant levels to what the Fed considers an ample level.

- The latest Federal Reserve meeting suggests that the central bank is poised to take a cautious, wait-and-see approach to monetary policy. While we still anticipate no more than two rate cuts this year, the likelihood of no cuts at all has risen as the economic impact of tariffs begins to materialize in key data. In response, the Fed may explore alternative measures, such as an earlier-than-expected halt to its balance sheet reduction program, in order to alleviate long-term rates.

Nvidia Invests: The chipmaker announced a multi-billion-dollar plan to build US manufacturing facilities for chips and electronics over the next four years, reflecting a broader shift among tech firms to relocate production domestically amid efforts to strengthen US supply chains.

- The AI semiconductor leader plans to manufacture a significant portion of its systems in the US, partnering with key suppliers such as Taiwan Semiconductor Manufacturing Company (TSMC) and Foxconn. This strategic shift reflects the company’s response to escalating geopolitical risks, particularly growing threats from China. During the announcement, CEO Jensen Huang emphasized that the move would strengthen US supply chain resilience and reduce dependency on foreign manufacturing.

- The shift toward US manufacturing comes amid growing concerns about tech companies’ reliance on production facilities in Taiwan. Rising tensions between China and Taiwan, including Beijing’s increasingly assertive stance toward the self-governing island, have sparked fears of a potential invasion. Such a move could severely disrupt global supply chains, leaving companies dependent on Taiwanese factories exposed to significant risks.

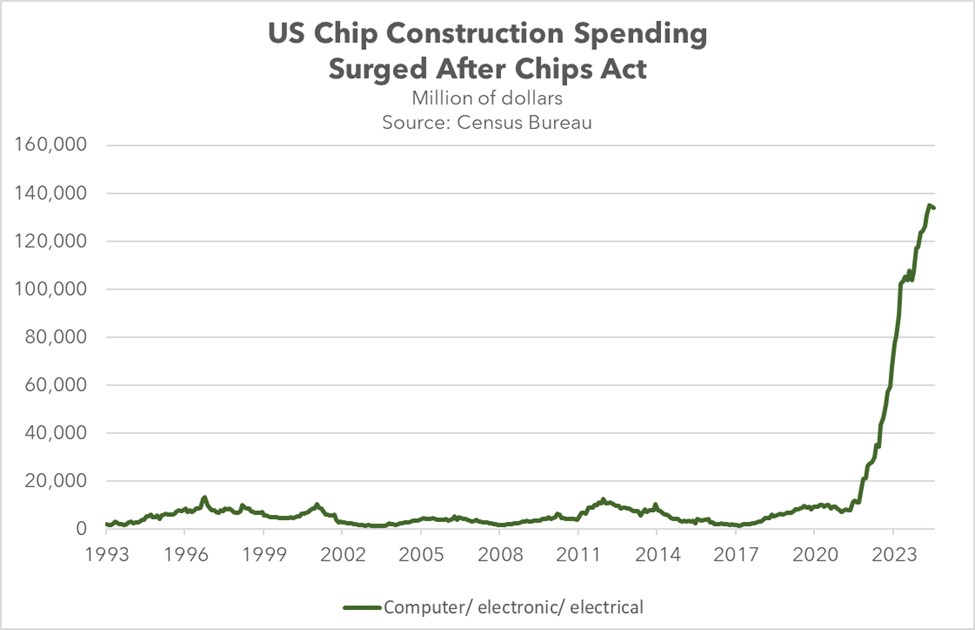

- To mitigate these concerns, construction spending in the US for computer, electronic, and electrical manufacturing has surged since 2022, fueled primarily by the CHIPS Act. The legislation has offered companies tax incentives and subsidies to accelerate the relocation of manufacturing facilities to the US. A significant portion of these investments has been directed toward states like Arizona, New York, and Ohio, where new factories are being built.

- While the current administration has aimed to build on this trend, it seeks to do so more cost-effectively by leveraging tariffs. President Trump argues that the government should not rely on financial incentives to encourage domestic manufacturing. Instead, companies should be motivated to build domestically to avoid tariffs.

- Despite President Trump’s opposition to the CHIPS Act, there has been no significant policy reversal, indicating that the law is likely to remain in place. As a result, tariffs are expected to serve as the “stick” to complement the CHIPS Act’s “carrot,” as the US aims to expand its domestic chipmaking capabilities, reduce reliance on Taiwan, and better compete with China.

Election Date Set? Canadian Prime Minister Mark Carney is expected to announce this week that elections will be held on April 28. The campaign is likely to center on how best to address an increasingly assertive US without jeopardizing the economy or triggering a recession.

- Carney’s decision to call for an election appears to be strategically motivated, as his Liberal Party has surged ahead of the opposition Conservative Party in recent polls. According to the latest data from Mainstreet Research Canada, the Liberals have a 61.4% chance of securing an outright majority in the upcoming election. They are projected to win approximately 179 out of 338 seats, while the Conservative Party is expected to trail behind with 127 seats, placing them in the minority.

- The reason for this shift has been driven by Canadians’ dislike of President Trump following comments that Canada should become a US state. Current polls show that the number of Canadians with very/somewhat positive views of the US has dipped from 52% in June 2024 to 33% as of March of this year. In comparison, people with positive views of China improved from 29% to 30%, within the same time frame.

- A recent poll indicates Mark Carney is seen by many Canadians as best equipped to handle the nation’s challenges, edging out Pierre Poilievre 36% to 34%. Carney’s strong name recognition, despite limited public understanding of his detailed policies, appears to be a key asset. Conversely, Poilievre’s populist rhetoric has led to comparisons with Trump, potentially hindering his appeal.

- Ironically, it is Poilievre who has emerged as the most vocal critic of Trump, pledging to lessen Canada’s economic dependence on trade with the US. In stark contrast, Carney has taken a more pragmatic approach, openly conceding that Canada cannot sustainably engage in or escalate a tit-for-tat trade war with its powerful neighbor. This nuanced stance has seemingly resonated with Trump, who has publicly expressed a preference for working with Carney over Poilievre.

- The upcoming election is likely to intensify ongoing trade tensions between the US and Canada. While recent momentum has favored Carney, we anticipate that his support will begin to wane as the vote approaches. Consequently, we would not be surprised if Poilievre pulls off an upset or if neither party secures an outright victory. That said, a majority government in Canada would be viewed favorably by financial markets, as it would likely streamline the legislative process.

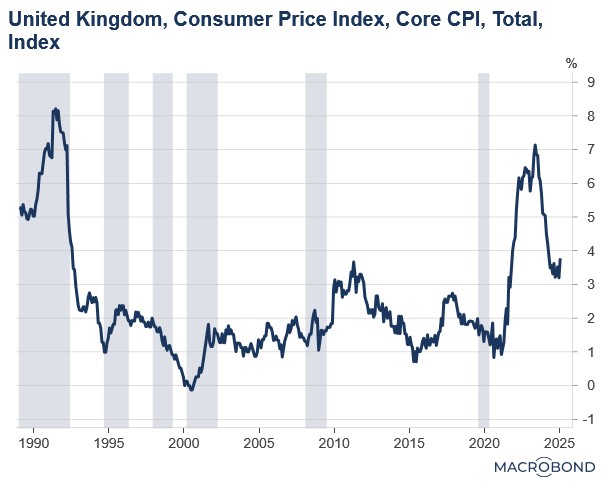

BOE Cautious: The Bank of England voted to keep its benchmark policy rates unchanged and signaled a greater willingness to pause future rate cuts.

- While the decision was widely anticipated by the market, investors observed a more hawkish shift in tone. The Monetary Policy Committee voted 8-1 in favor of holding rates, indicating that one of the two rate-setters who had previously supported lower borrowing costs in the last three meetings switched their vote. The shift has led traders to pare back bets of a rate cut in May.

- The shift in policy may be linked to a pickup in inflation, as well as concerns over escalating trade tensions with the US. In January, core inflation surged from 3.2% the previous month to 3.8%. This rise has sparked concerns that US tariffs could further worsen the inflation outlook in the coming months.