Daily Comment (March 21, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are looking for clues on consumer sentiment, as tariff uncertainty impacts demand projections. In sports, the NCAA tournament’s low rate of perfect brackets (1.65%) highlights its unpredictable nature. Today’s Comment will cover Europe’s NATO contingency plans, US critical minerals production efforts, and other market-relevant developments. As always, the report will include a summary of key domestic and international data releases.

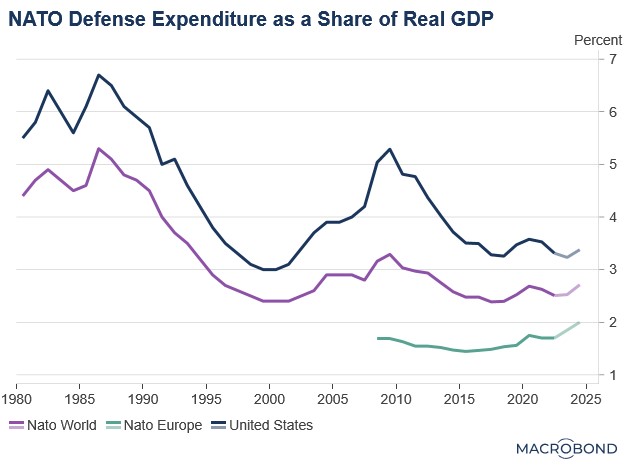

Amerexit? European leaders are formulating transition plans for a potential US withdrawal from NATO, aiming to bolster their own security capabilities while enabling the US to redirect more of its strategic focus toward China.

- The UK, France, Germany, and Nordic countries are spearheading a plan to substantially boost defense spending across the alliance, positioning Europe to assume the bulk of the financial and operational responsibilities for continental defense in the event of a unilateral US withdrawal from NATO. The agreement outlines a 5- to 10-year timeline for Europe to strengthen its military capabilities, ensuring a smooth transition and the ability to independently safeguard its security interests.

- This initiative emerges as the Trump administration intensifies its pressure on Western allies to significantly increase their defense spending. On Thursday, reports revealed that NATO will call for Europe and Canada to boost their expenditure on military equipment and weapons by 30%. Simultaneously, the US is urging member countries to raise their defense spending to 5% of GDP — a figure that surpasses the current 2% benchmark and even exceeds the percentage of GDP that the US allocates to its own defense.

- The move coincides with widespread expectations that the US is poised to scale back its military presence in Europe. Last month, a Pentagon official confirmed that the US is considering relocating up to 100,000 troops from the region, signaling a potential shift in its strategic priorities.

- Growing doubts about the US commitment to Europe have intensified pressure on European nations to develop contingency plans to support Ukraine. The UK has signaled its willingness to assist Ukraine in enforcing a ceasefire by potentially deploying ground troops, as well as air and naval forces. Simultaneously, the EU is advancing efforts to allocate 5 billion EUR ($5.4 billion) to secure ammunition for Ukraine, though France and Italy are pushing for adjustments to the proposal before finalizing the agreement.

- The increase in military spending across EU countries is expected to elevate their debt levels, as governments may need to borrow additional funds to fulfill their defense obligations. This could lead to a rise in bond issuance by individual nations. We are closely monitoring the potential for implicit backing of defense-related bonds by EU institutions, which could enhance the attractiveness of these securities and help lower borrowing costs across the EU bloc.

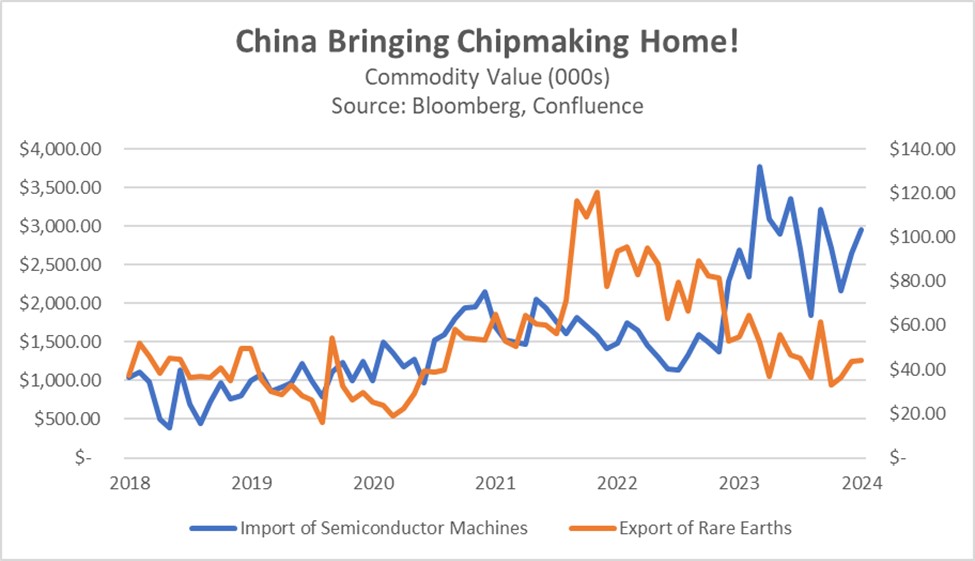

More Mining Please! President Trump has invoked war powers to facilitate the mining of critical minerals, a strategic move aimed at bolstering the United States’ competitive edge in military technology amid an intensifying rivalry with China.

- On Thursday, the president signed an executive order invoking the Defense Production Act to expedite and streamline the production of critical minerals, underscoring the importance of national security. The order empowers the government to fast-track project permitting and provide financial support, including loans, to bolster the domestic mining industry. This action aligns with the president’s broader mission to secure the resources necessary for developing advanced technologies.

- The Trump administration’s efforts to secure critical resources extend beyond its borders. The US is currently exploring a deal to gain access to Ukraine’s mineral reserves as part of the proposed peace negotiations with Russia. Additionally, the administration’s interest in acquiring Greenland may, in part, be driven by its rich deposits of rare earth elements. Meanwhile, the Democratic Republic of the Congo has sought to leverage its mineral wealth to gain US support in its fight against rebel groups.

- The US is accelerating efforts to diversify its critical mineral supply chains due to growing vulnerabilities, particularly concerning its reliance on China. China’s dominance, notably its 70% control of global rare earth production (as shown in the chart below), has become a strategic concern. Recent export restrictions on chip-related minerals, imposed in response to US semiconductor technology limitations, underscore the escalating strategic rivalry.

- The Trump administration’s push to increase production of critical resources is likely to benefit chipmakers in the long term, as it could lead to lower input costs. However, this move also signals a deepening rivalry between the US and China. While we remain cautiously optimistic that this competition will not escalate into direct conflict, the ongoing AI arms race offers little reassurance and underscores the growing tensions between the two global powers.

US Earnings Concern: Just weeks before the president is set to implement new tariffs, there are growing concerns that businesses are already experiencing significant margin pressures.

- FedEx Corporation has lowered its profit outlook for the third consecutive quarter, citing ongoing weakness and “uncertainty in the US industrial economy” as primary concerns. The company’s freight business has been particularly impacted, with fewer shipments and lower weights continuing to drag down earnings. FedEx’s CEO highlighted that the unpredictable demand in the current economic environment has further exacerbated these challenges, intensifying concerns about the company’s near-term performance.

- Retail giant Nike has also expressed unease by warning that its sales are likely to suffer in the current quarter. The company attributed the anticipated downturn to the impact of new tariffs and a significant decline in consumer confidence. This gloomy outlook appears to align with the findings of the University of Michigan’s consumer survey, which revealed that 66% of consumers expect unemployment to rise over the next 12 months.

- Amid widespread concerns about the economy, it’s worth noting that hard data still does not provide strong evidence of a recession. In the upcoming quarter, earnings reports will be a critical focus. If companies manage to deliver positive surprises, equities could potentially overcome the current negative sentiment and weather the concerns about tariffs. However, if earnings disappoint, the markets may face significant turbulence.

UK Trouble Builds: The Starmer government faced a double blow of bad news within the last 24 hours. Borrowing in February significantly overshot expectations, while the country’s largest airport was forced to shut down due to a fire.

- The government ran a budget deficit of 10.7 billion GBP ($13.8 billion) last month, significantly surpassing the Office for Budget Responsibility’s forecast of 6.5 billion GBP ($8.4 billion). This shortfall was driven by lower-than-expected tax revenues and higher public expenditures, casting doubt on its ability to meet self-imposed fiscal targets. The overshoot is likely to heighten pressure on the government to curb spending as it strives to balance the current budget — excluding investment — by the 2029-30 fiscal year.

- At the same time, Heathrow Airport was forced to shut down for the remainder of the day after a nearby fire disrupted power to the hub. While the cause remains unclear, authorities have launched an investigation, including the possibility of terrorism. The airport closure is likely to heighten concerns about the resilience of the country’s critical infrastructure, particularly at a time when security has become an increasingly pressing issue throughout Europe.

- While UK Prime Minister Keir Starmer has seen a recent surge in popularity due to his handling of the Trump administration, his net approval rating remains deeply negative at -23. This could worsen if he is compelled to implement unpopular decisions, such as budget cuts, or if he faces additional security threats. The uncertainty surrounding his administration is likely to weigh on government bonds, as it raises doubts about his ability to restore the country’s fiscal stability.