Daily Comment (March 28, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely processing the latest inflation and spending data. In sports, Duke secured a spot in the Elite 8 — congratulations to the Blue Devils! In today’s Comment, we’ll break down the rising tensions between the US and EU over Ukraine, analyze global reactions to new US auto tariffs, and cover other key market-moving developments. As always, we’ll wrap up with a roundup of today’s domestic and international data releases.

America First, Europe Out: The Trump administration is reportedly preparing to pursue an exclusive resource partnership with Ukraine, a move that would deliberately sideline Europe.

- The US is pushing for a “right of first offer” on all infrastructure and critical mineral projects in Ukraine, a demand that reflects Washington’s effort to secure priority access to development projects once the war concludes. Although the arrangement has yet to be finalized, the Trump administration appears determined to include it. Ukrainian President Volodymyr Zelensky has expressed openness to the idea but remains hesitant to commit due to the potential economic implications.

- America’s insistence on securing final approval over foreign investment in Ukrainian mineral resources comes as European nations have shown growing interest in similar arrangements. Since October, France has been negotiating with Ukraine to secure access to its critical minerals that could be used to bolster’s Europe’s military ambitions. As part of the potential agreement, France is working with the rest of Europe on deploying “reassurance troops” to Ukraine to help enforce any future peace deal.

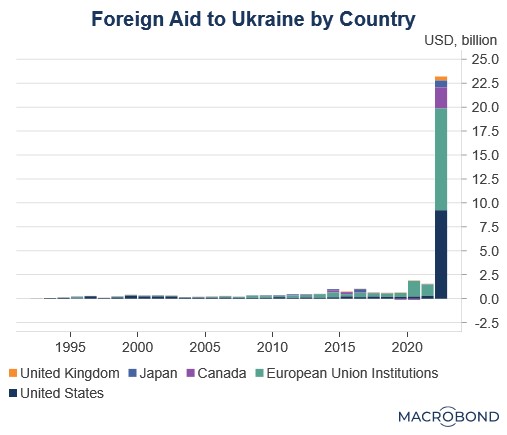

- The competition for access to Ukrainian resources underscores the widening rift between the US and Europe. Although America has been the largest financial supporter of Ukraine’s defense against Russia, it has declined to provide the long-term security guarantees Ukraine would need to deter any future aggression from Russia. Meanwhile, some European nations have shown a willingness to offer limited security assurances post-war but consensus on this approach remains elusive.

- The approaching end of the war in Ukraine may signal the first signs of fraying in US-European relations. While both sides will likely seek to maintain their alliance, growing mutual distrust has become undeniable. This emerging divide could accelerate Europe’s push for strategic autonomy, particularly in defense capabilities independent of US support. Such a shift may prove transformative for European defense industries, fueling their long-term growth and technological development.

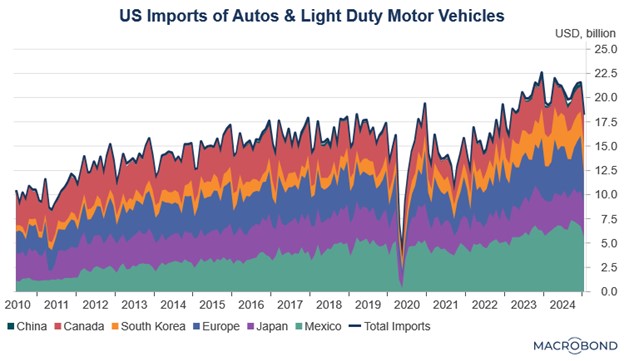

Auto Tariff Fallout: President Trump’s decision to impose auto tariffs has triggered retaliatory measures from foreign governments, as nations seek both to shield domestic industries and avoid escalating tensions with Washington.

- Canada and the European Union were among the first to respond to the tariffs. Canadian Prime Minister Mark Carney warned that the US action would permanently alter bilateral relations, affecting both trade and security cooperation. Across the Atlantic, France and Germany have advocated for a coordinated EU-wide response to the auto tariffs, potentially targeting the US services sector as it vows not to yield to the Trump administration.

- Despite their combative public posturing, signs are emerging that key Western allies may be pursuing backchannel compromises. The European Union is actively considering reduced penalties for Meta and Apple — a conciliatory signal aimed at de-escalating tensions. Simultaneously, Canadian PM Carney has indicated a willingness to negotiate a new trade agreement with the Trump administration, one that would diversify Canada’s export markets beyond its current heavy reliance on the US.

- Asian economies are bearing the brunt of the auto tariffs, given the centrality of vehicle manufacturing to their economic ecosystems. Japan, while reserving the right to impose retaliatory measures, is currently focused on mitigating the anticipated economic fallout. Taiwan, meanwhile, has proactively sought to appease the US through unilateral concessions, including lowering its own import tariffs and significantly boosting American energy purchases.

- While the outcome of the highly anticipated “Liberation Day” on April 2 remains uncertain, the potential fallout could be significant given possible retaliatory measures from key trading partners. That said, we maintain cautious optimism that reality may fall short of expectations, as behind-the-scenes concessions could prevent uncontrolled escalation in global trade tensions. Should this scenario materialize, equity markets may see a meaningful rally next week.

US Federal Debt: A government watchdog warned that the US national debt burden could exceed World War II levels, signaling that federal spending remains on an unsustainable trajectory.

- The Congressional Budget Office (CBO) projects that the US debt-to-GDP ratio will rise to 107% by 2029 and could soar to 156% by 2055. Although these figures remain alarmingly high, they are below previous projections due to the assumed reductions in Medicaid, lower interest rates, and higher tax revenues. However, the estimate excludes potential extensions of current tax cuts — a policy that, if enacted, could add another 47 percentage points to the debt ratio by 2054.

- The estimate follows Moody’s recent warning that the Trump administration’s tariffs could undermine the government’s ability to manage mounting debt and higher interest rates. While the ratings agency acknowledged America’s economic growth and resilience should support debt financing, it cautioned that trade tensions might weaken demand for US Treasurys. Moody’s also highlighted unfunded tax cuts and economic tail risks as potential threats to long-term fiscal sustainability.

- Despite ongoing concerns about the national debt, the Trump administration has initiated efforts to reduce spending. Elon Musk, leading a task force focused on this issue, has identified $130 billion in potential savings to date, with a target of $1 trillion in total cuts by May. The group is prioritizing workforce streamlining within the government as a key strategy.

- Debates over whether the US can sustainably manage its debt burden are likely to intensify following the passage of the long-anticipated tax bill. While proponents argue that lower taxes will spur faster economic growth and, in turn, increase government revenue, this dynamic could be complicated by ongoing tariffs on imports. Moreover, as long as uncertainty persists regarding the trajectory of fiscal policy, Treasury yields are likely to remain elevated, all else being equal.

German Coalition: Europe’s largest economy is nearing the formation of a new government after February’s election brought the Conservative party to power.

- The new government will likely form from a coalition between the Conservative Party and the Social Democrats (SPD), though the two sides remain divided on key fiscal policies. The primary disagreement centers on the country’s financial direction. The Conservatives propose cutting corporate taxes from 15% to 10% while implementing stricter unemployment benefit requirements. Conversely, the SPD advocates raising capital gains taxes from 25% to 30% and maintaining current welfare spending levels.

- Although the coalition parties will likely finalize an agreement, the prolonged budget negotiations reveal fundamental tensions in reconciling the country’s competing priorities. The government faces a difficult balancing act between significantly boosting military expenditures and maintaining robust social safety nets — a combination that appears increasingly unsustainable given the nation’s growing debt burden.

- We believe markets will remain skeptical about debt sustainability until policymakers demonstrate a credible path for addressing these contradictory fiscal objectives, suggesting bond yields may face persistent upward pressure.