Daily Comment (March 3, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some key observations on Friday’s disastrous summit meeting between President Trump and Ukrainian President Zelensky. We next review several other international and US developments with the potential to affect the financial markets today, including key reports on consumer price inflation from the eurozone and Turkey and signs that the paused US tariffs on Canada and Mexico will finally take effect tomorrow.

United States-Russia-Ukraine: By now, we assume that those who care about global affairs and understand that international relations can profoundly affect their personal lives have already started to digest President Trump’s failed meeting on Friday with Ukrainian President Zelensky. We therefore won’t try to rehash all the details here. Rather, we provide a quick summary of the meeting and then focus on what it says about Trump’s evolving foreign policy and what it portends for US investors.

- To recap, the meeting was set for the two leaders to sign a preliminary deal in which the US would get a cut of Ukraine’s future mineral profits to repay the US’s past support and, supposedly, to cement the US’s interests in Ukraine and deter further Russian aggression. The meeting devolved into acrimony when Zelensky warned that Russian President Putin can’t be trusted. It broke up with Zelensky evicted from the White House and the deal left unsigned.

- Neither Trump nor any top administration official has provided a comprehensive statement of the president’s global goals and strategy. As we’ve written before, one thrust so far has been to punish traditional US allies – especially Canada, Mexico, and the European members of the North Atlantic Treaty Organization – for supposedly taking advantage of the US since World War II. But unleashing brutal rhetoric, tariffs, and military threats against the allies doesn’t seem to be the whole story.

- One great mystery about Trump’s foreign policy is why he has seemed relatively soft on China so far and why he seems so intent on excusing Putin – a dictator who essentially aims to recreate the Russian Empire and, therefore, is a threat to Western Europe’s wealth, economic potential, territory, technology, democratic institutions, and cultural development, all of which have made the region such a valuable ally for the US over decades.

- In the Trump-Zelensky meeting, it’s striking that the point at which it “went south” was when Zelensky said that Putin can’t be trusted. After a quarter-century of evidence pointing to Putin’s brutality and duplicity, the question arises as to why that statement would so easily set off Trump and Vice President Vance. It also highlights how administration officials and nominees have apparently been instructed to avoid any criticism of Putin and to parrot Russian talking points on global affairs.

- As we’ve noted before, some observers think Trump is trying to pull a “reverse Nixon” or “reverse Kissinger” by splitting Russia away from China. Secretary of State Rubio, a relatively traditionalist Russia hawk, even articulated this view recently. However, there are many reasons to doubt this possibility, from the lack of any obvious Chinese-Russian political tensions to exploit to the paucity of economic advantages the US could gain from closer relations with Russia.

- Another potential reason for Trump’s embrace of Russia is the possibility that he aims to divide the world into spheres of influence, with the US taking the Americas (possibly with outposts in Greenland, the Middle East, and some Pacific islands), Russia taking Europe, and China taking Asia up to the “first island chain.” If so, it seems like a bad deal for the US to trade Europe for a freer hand in the Americas. This strategy would also require trusting Beijing and Moscow to respect the US sphere.

- A final potential reason that we explore here is political affinity. Alliances often are built on a common political outlook, so Trump’s embrace of big, authoritarian, strong-man countries such as Russia and Saudi Arabia could simply signal his comfort level with that style of government. Since Trump has positioned himself as a champion of the US’s conservative working class, who are looking to him to break the political and economic hold of the elites, such an embrace of assertive politics may be well received by his base.

- In sum, it’s true that Europe has lost some luster as a political, military, and economic partner for the US. However, surrendering the region to the China/Russia geopolitical bloc potentially sets the stage for further international chaos. Even if peace in Ukraine and the reopening of Europe to Russian energy gives a boost to European stocks in the near term, greater Russian influence on the Continent could constrict US economic opportunities over the longer term.

United Kingdom-France-Ukraine: British Prime Minister Starmer hosted French President Macron, Ukrainian President Zelensky, and other European leaders yesterday to try to hash out their own peace plan for Ukraine. According to Starmer, the Europeans’ aim is to develop a plan that would entice President Trump to commit the US to help provide security guarantees for Ukraine.

- Late yesterday, Macron indicated that the Europeans are working on a one-month ceasefire that would stop Russia and Ukraine from conducting air and sea assaults and attacks on each other’s infrastructure. The ceasefire proposal would not apply to ground attacks due to the difficulty in policing them.

- A second part of the developing plan would involve Ukraine signing a mineral deal with the US, similar to the one that was supposed to be signed at Friday’s Trump-Zelensky meeting.

- However, it’s important to note that the UK and Ukraine today have both distanced themselves from the plan Macron suggested.

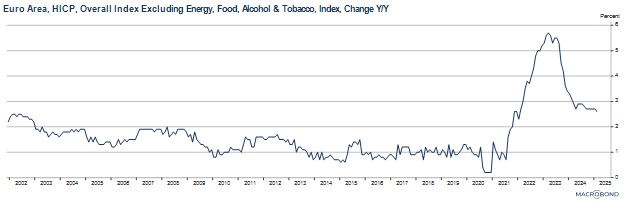

Eurozone: The February consumer price index was up just 2.4% from the same month one year earlier, not quite as tame as the expected 2.3% but better than the 2.5% recorded for the year to January. Stripping out the volatile food and energy components, the February core CPI was up 2.6% compared with 2.7% in the year to January. The decline in inflation last month should help bolster the case for further interest-rate cuts when the European Central Bank holds its next policy meeting later this week.

Turkey: The February consumer price index was up “just” 39.1% from the same month one year earlier, matching expectations and cooling from the 42.1% increase in the year to January. The data marked the ninth straight month in which Turkish inflation has cooled, likely setting the stage for the central bank to keep cutting the country’s sky-high interest rates in the coming months.

United States-Canada-Mexico-China: Commerce Secretary Lutnick yesterday said the paused US tariffs against Canada and Mexico will indeed go into effect on Tuesday, but President Trump is still deciding whether to apply them at the originally planned 25% rate or at some lower rate. Lutnick said the new 10% additional levy against China is “set” and will also go into effect on Tuesday.

- The big, new tariffs against the US’s largest trading partners could disrupt economic activity, but it’s still too early to know if they’ll worsen consumer price inflation.

- In any case, tariff risks continue to drive investors into stock market sectors that are more domestically oriented and therefore are perceived to be more insulated from Trump’s new trade policies. The Health Care, Consumer Staples, Real Estate, and Financials stock sectors are all up more than 5% so far this year versus a gain of just over 1% for the overall market.

US Public Lands Policy: President Trump on Saturday signed an executive order directing federal agencies to examine ways to bypass environmental regulations that control timber production in US national forests and other public lands. The directive suggests Trump will try to boost domestic timber output to offset planned restrictions on imported wood. If so, any quick boost in domestic production could help reduce the costs of newly built homes and other buildings as labor and other costs keep going up.

US Cryptocurrency Market: President Trump yesterday named five cryptocurrency tokens that will be included in his new US digital-currency reserve. The tokens included will be Bitcoin, ether, solana, Ripple-linked XRP, and cardano. As might be expected, overnight prices for the tokens jumped, with the increases ranging from about 9% for Bitcoin to more than 60% for cardano. Nevertheless, prices for Bitcoin and other major cryptocurrencies remain far below their most recent highs.