Daily Comment (March 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still digesting the latest economic data. In sports news, Ole Miss pulled off an upset victory over number four ranked Tennessee. Today’s Comment will cover Europe’s decision to ramp up defense spending, the challenges in assessing the current state of the US economy, and other market-related developments. As usual, the report will conclude with a roundup of domestic and international data releases.

Europe Arms Up: The EU has intensified discussions to strengthen its defense capabilities, as it no longer trusts that the US will honor its security commitments. This shift has triggered a surge in European bond yields, as the EU not only works to enhance its defense infrastructure but also revises its fiscal targets.

- EU leaders are convening an emergency summit in Brussels to talk about bolstering their defense capabilities in support of Ukraine. European officials will use the meeting to advance a series of new proposals aimed at enhancing the bloc’s ability to allocate funds for defense. This move comes as Germany and France have taken more assertive steps to ensure their security in the event of a potential US withdrawal of support.

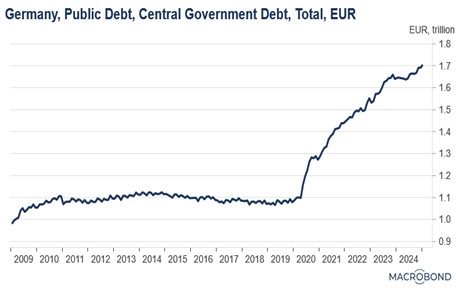

- Germany’s incoming Chancellor Friedrich Merz has agreed to support expanding the country’s fiscal limits to facilitate increased spending on defense and infrastructure. The new initiative is expected to allow for unlimited defense spending and establish a 500 billion EUR ($541 billion), 10-year fund to drive infrastructure investments. The increasing in spending is on a pace not seen since the fall of the Berlin Wall.

- However, the legislation still requires a two-thirds majority in parliament to become law, which could prove challenging given the reluctance of the far-right AfD and far-left parties — who collectively hold roughly 27% of seats — to support increased military spending. There is also likely to be some pushback from German lawmakers that are more fiscally conservative.

- In France, President Emmanuel Macron is advocating for the EU to consider how his country’s nuclear weapons could serve as a deterrent against Russia. His comments follow a proposal from Merz, who has called for Germany, France, and the UK to develop their own nuclear sharing network as a potential alternative to relying on the US.

- The main takeaway from this shift in tone regarding defense spending across the EU is that member states will likely need to borrow significantly. One key development to watch is the potential creation of another joint European bond, similar to the one used to fund pandemic-related expenditures. This move could also bring the EU closer to forming a fiscal union, which would likely impact global bond markets and pose a challenge to the dominance of US Treasurys.

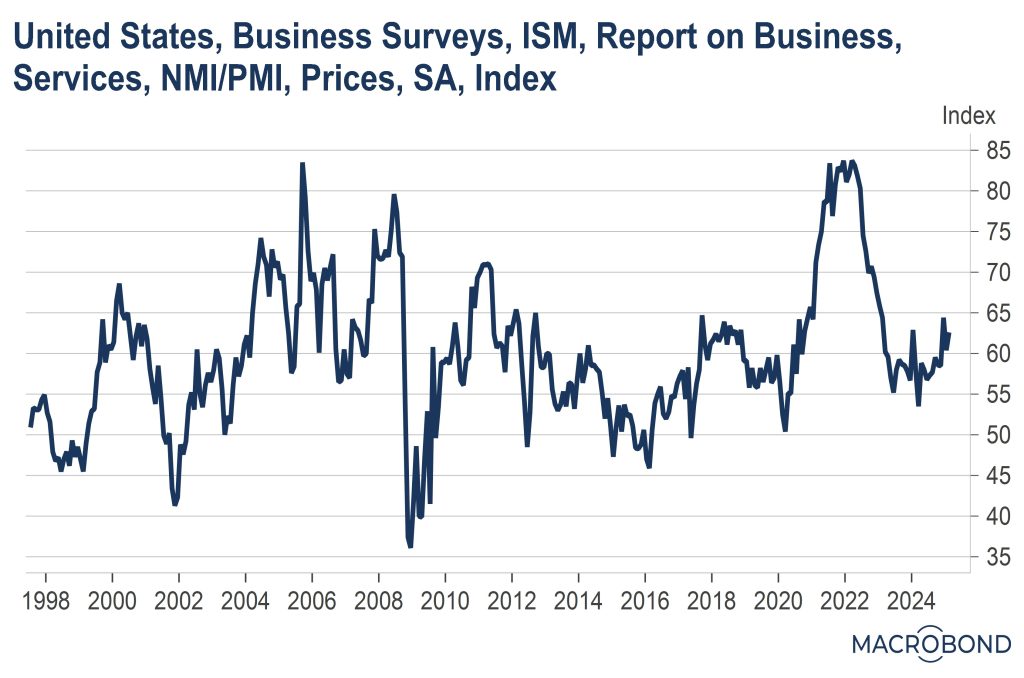

Mixed Economic Signals: A strong February PMI Services survey from the Institute for Supply Management (ISM) has bolstered optimism that the economy remains in expansion territory. However, both the index and the Federal Reserve’s Beige Book highlight growing concerns among firms about the potential for a downturn. These conflicting signals are likely to exacerbate ongoing market uncertainty.

- The ISM Services PMI unexpectedly rose from 52.8 to 53.5 in February, driven by a sharp increase in new orders, employment, and inventories. However, the report also highlighted growing inflationary pressures, as input prices surged to their highest level since early 2023. While the data has alleviated some concerns about an imminent downturn, it has raised fears of a potential reacceleration in inflation.

- The PMI report also highlighted that firms remain concerned about persistent uncertainty and the outlook for future business activity. Additionally, survey respondents expressed unease over potential deep cuts to government spending. The wariness has led to concern that economic activity could start to slow.

- The latest Federal Reserve Beige Book indicated that GDP growth may have improved slightly since mid-January, despite most regions not experiencing actual growth. The report revealed that eight out of twelve districts reported either no growth or a contraction during recent weeks. While some of this slowdown was attributed to adverse weather conditions, there were also reports of firms expressing concerns about rising prices.

- Currently, investors are closely monitoring economic data to assess the impact of tariffs and government spending on the economy. The market is likely to sell off at any sign of consumers cutting back on spending or firms laying off workers, while rallying in the opposite scenario. Although there are some indications that a downturn may be on the horizon, there is no conclusive evidence of one yet.

Steering with Open Ears: The president has decided to hold talks with business leaders as he aims to shape his agenda in a way that minimizes the impact on businesses. While these discussions may result in adjustments to some of his policies, a full reversal is unlikely.

- The Trump administration has announced a one-month delay in tariffs on all goods eligible for duty-free treatment under the USMCA, a move specifically benefiting the auto industry. This exception follows intense lobbying from the sector, which warned that the import taxes could severely disrupt supply chains. Estimates suggest that the tariffs could increase the cost of a vehicle by approximately $10,000.

- Chipmakers and computer hardware developers also plan to visit the White House, as they have raised concerns about import and export restrictions. This move coincides with the president’s broader shift in policy, which includes not only tariffs and export controls but also a move away from the previous administration’s approach of fostering domestic industry through public investment. Instead, the focus is now on a strategy centered around foreign direct investment.

- While the administration has shown a willingness to compromise with tech leaders to prevent an economic slowdown, it appears unwilling to abandon some of its more controversial policies. This reluctance to compromise suggests that the president and his team may be aiming to drive significant changes in the country, for better or worse. At this stage, the situation remains highly fluid, with developments evolving rapidly. As a result, expect considerable volatility in the near term.

China’s Response: Beijing appears to be better prepared to handle a trade war with the US compared to President Trump’s first term, signaling that the trade tensions could persist for longer than many are expecting.

- The government plans to implement policy measures aimed at achieving its growth target of around 5% for 2025. These measures not only include further monetary policy accommodation, with the People’s Bank of China expected to lower its policy rate and the reserve requirement ratio, but also include an increase in the fiscal deficit target to accommodate higher spending.

- In the meantime, businesses are struggling to compel their Chinese suppliers to absorb the majority of the tariff costs. For instance, Walmart has asked its suppliers in China to shoulder the full burden of the tariffs, only to face pushback, as such a move would force these companies to operate at a loss. This development suggests that American firms may have to absorb some of the costs themselves or pass them on to consumers.

- While we still believe the trade war is likely to exacerbate China’s economic challenges, we are closely monitoring political developments within the region, as they could play a decisive role in Beijing’s ability to manage escalating trade tensions with the US. That said, we remain confident that Beijing will strive to contain the trade war as much as possible, including pursuing a potential deal with the US.