Daily Comment (March 14, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Pi Day![1] It’s a very quiet day so far this morning. U.S. equity futures are modestly lower. Here is what we are watching:

Brexit: As expected, MPs voted to avoid a no-deal Brexit, despite an 11th hour plea from the PM to vote against it.[2] May appears to want another round on her proposal,[3] suggesting that either they accept her program or put Brexit into what may be a never-ending delay process.[4] Today, MPs vote to ask for an extension of the deadline; to be precise, they are voting on four amendments: (a) delay Brexit and try to build a new deal, (b) hold a second referendum, (c) indicate a non-binding vote on the future of Brexit proposals (e.g., joining the Customs Union), and (d) make PM May’s proposal the final version of Brexit. An amendment to rule out a second referendum will not come up for a vote, torqueing off the hard Brexiteers.

Although we expect the EU to give the U.K. an extension, the noise coming out of Brussels does suggest the EU will need cause.[5] The EU wants to avoid a hard Brexit, but it also wants to prevent the U.K. from voting in the European Parliament elections in May. And, finally, if the May government does allow Brexit without a hard border between Ireland and Northern Ireland, it will create conditions for a thriving smuggling economy as U.K. tariffs will become effectively unenforceable.[6] It could also shift trade routes away from France and toward Ireland.

Trade: It appears, as has been rumored, that the trade summit between China and the U.S. will be delayed until later in April.[7] Gary Cohn, a former administration economic advisor, was quoted on a podcast as saying that President Trump is “desperate” for a trade deal with China.[8] No surprise there, but coming from someone who was in the administration adds confirmation to other similar comments. It appears that farmers are banking on either (a) trade relief with China, or (b) increased sales elsewhere because intentions for soybean planting remain high. Of course, some of this decision is due to the lack of alternatives.[9]

According to reports, Democratic Party leaders in Congress are “cool” toward USMCA.[10] If the new law fails to pass, it could lead to an end to the treaty. This would have adverse effects on the economies of Canada and Mexico.

Facebook (FB, 173.37): The company, along with other tech firms, is being criminally investigated for data arrangements made to collect user data.[11] Increased scrutiny of these tech firms could affect the overall equity market.

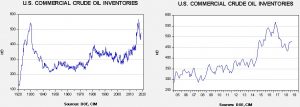

Energy update: Crude oil inventories fell 3.8 mb last week compared to the forecast rise of 3.0 mb.

In the details, estimated U.S. production fell 0.1 mbpd to 12.0 mbpd. Crude oil imports fell 0.3 mbpd, while exports fell 0.5 mbpd. Refinery runs rose 0.2%, roughly on forecast.

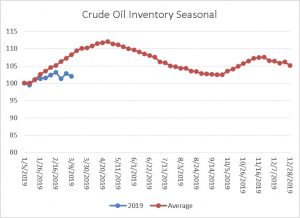

This is the seasonal pattern chart for commercial crude oil inventories. We would expect to see a steady increase in inventories that will peak in early May; the pattern coincides with refinery maintenance. This week’s decline puts the market further behind the storage injection curve and is bullish.

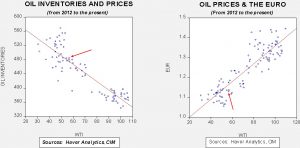

Based on oil inventories alone, fair value for crude oil is $57.63. Based on the EUR, fair value is $52.91. Using both independent variables, a more complete way of looking at the data, fair value is $53.76. By all these measures, current oil prices are at the high end of fair value. Without some dollar weakness soon, oil prices will likely be rangebound until spring.

OPEC cut production in February by 0.2 mbpd, taking the year-to-date reduction to about 1.0 mbpd. Much of the reduction came from falling Venezuelan output.[12] The latter situation continues to support prices. The U.S. is taking additional steps to enforce sanctions on Iranian oil exports, with the aim of reducing Iran’s exports to under 1.0 mbpd by May.[13]

[1] https://www.nytimes.com/2019/03/14/science/pi-math-geometry-infinity.html

[2] https://www.nytimes.com/2019/03/13/world/europe/brexit-no-deal.html?emc=edit_mbe_20190314&nl=morning-briefing-europe&nlid=567726720190314&te=1

[3] https://www.politico.eu/article/theresa-may-brexit-no-deal-uk-asks-for-one-more-week/?utm_source=POLITICO.EU&utm_campaign=e4c483d49a-EMAIL_CAMPAIGN_2019_03_14_05_48&utm_medium=email&utm_term=0_10959edeb5-e4c483d49a-190334489

[4] https://www.ft.com/content/2fc6b504-45c5-11e9-a965-23d669740bfb?emailId=5c89d5514f943b00041f8d07&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[5] https://www.politico.eu/article/eu-negotiatior-michel-barnier-brexit-extension-for-what-no-deal/?utm_source=POLITICO.EU&utm_campaign=e4c483d49a-EMAIL_CAMPAIGN_2019_03_14_05_48&utm_medium=email&utm_term=0_10959edeb5-e4c483d49a-190334489 and https://www.ft.com/content/c985950e-45af-11e9-b168-96a37d002cd3?emailId=5c89d5514f943b00041f8d07&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[6] https://www.politico.eu/article/smugglers-paradise-ireland-no-deal-brexit/?utm_source=POLITICO.EU&utm_campaign=e4c483d49a-EMAIL_CAMPAIGN_2019_03_14_05_48&utm_medium=email&utm_term=0_10959edeb5-e4c483d49a-190334489

[7] https://uk.reuters.com/article/usa-china-trade-stocks/european-stocks-and-chinas-yuan-hit-by-report-of-delay-in-china-us-trade-summit-idUKL8N211359

[8] https://www.washingtonpost.com/business/economy/gary-cohn-says-trump-is-desperate-for-trade-deal-with-china/2019/03/13/56af2396-45c9-11e9-8aab-95b8d80a1e4f_story.html?utm_term=.4524af084582

[9] https://www.reuters.com/article/us-usa-trade-china-soybeans/why-u-s-growers-are-betting-the-farm-on-soybeans-amid-china-trade-war-idUSKCN1QV0CP

[10] https://www.reuters.com/article/us-usa-trade-democrats/democrats-cool-toward-nafta-replacement-question-labor-standards-idUSKCN1QU2PC?il=0

[11] https://www.nytimes.com/2019/03/13/technology/facebook-data-deals-investigation.html

[12] https://www.wsj.com/articles/opec-slows-pace-of-production-cuts-11552564800

[13] https://www.reuters.com/article/us-usa-sanctions-iran-oil-exclusive/exclusive-us-aims-to-cut-iran-oil-exports-to-under-1-million-bpd-from-may-sources-idUSKCN1QU35V