Daily Comment (March 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures have mostly failed to hold yesterday’s gains as long-duration Treasury yields continue to move higher. Our coverage begins with economics and policy with a focus on the FOMC and monetary policy. China news comes next as U.S. and Chinese officials prepare to meet in Alaska. Pandemic coverage follows. Our roundup of international news comes next, wrapping-up with technology. We finish with a cautionary ESG tale.

Economics and policy: We recap the Fed and other items.

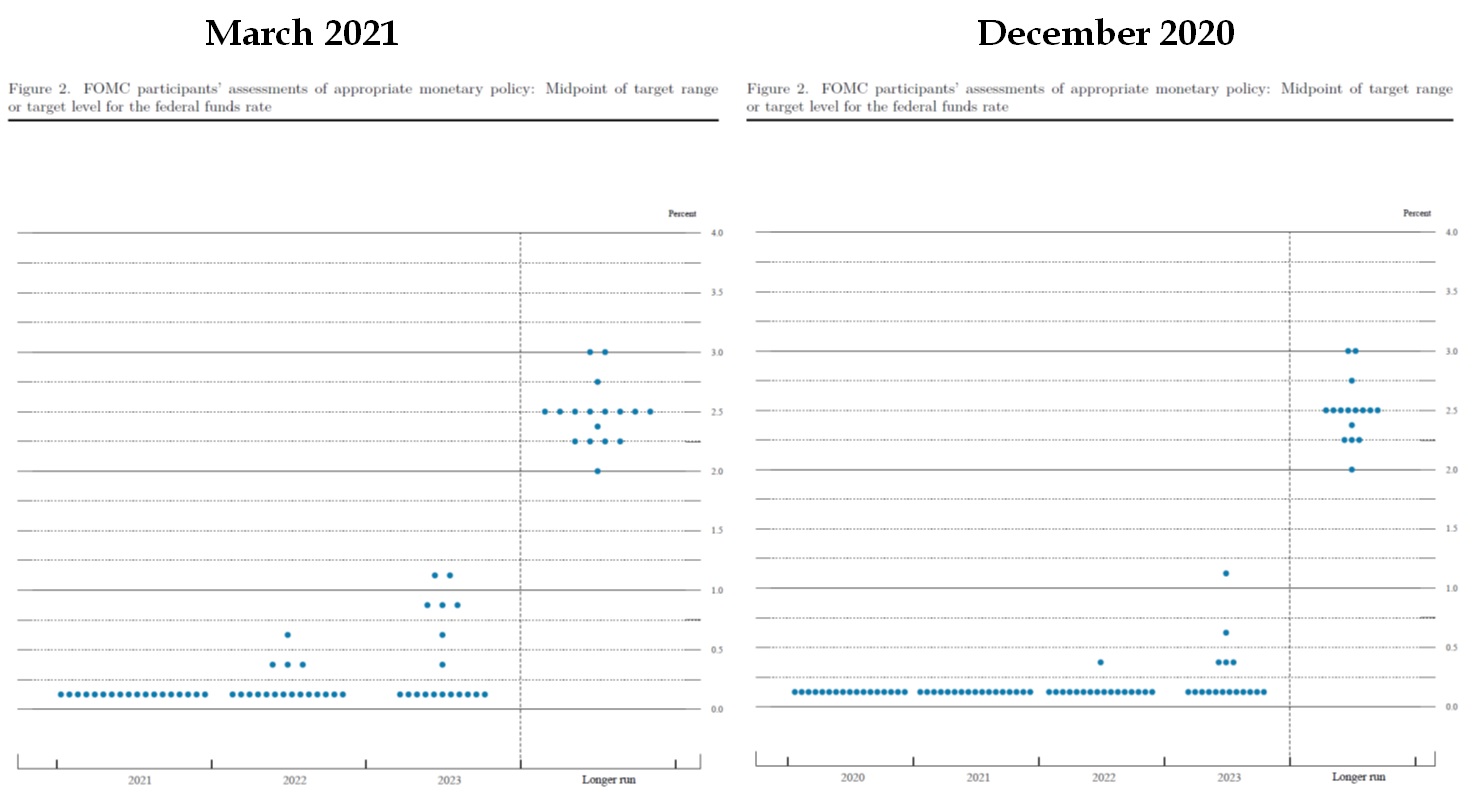

- The Fed didn’t exactly surprise anyone. Policy rates and QE remained unchanged. However, in the forecasts, the FOMC has lifted its GDP forecast to 6.5% for this year, up from 4.2% in December. The forecast for core PCE was lifted to 2.2% this year, from 1.8% in December. Inflation is expected to fall in 2022-23. So, the FOMC is indicating that inflation will be transitory. The “dot” plot showed a modest rise in support for a higher policy rate in 2023, but the majority still expect to keep rates steady through the end of 2023.

Overall, market action in the wake of the decision was surprisingly bullish. Equities rallied, the dollar declined, precious metals rallied, but long-duration Treasuries did end the day with higher yields. It’s not obvious what the financial markets were expecting. There appeared to be great concern about rising long-duration Treasury yields going into the meeting. Nothing about yield curve control or increasing QE was revealed. The Fed did not decide on supplemental reserve ratios, and if last year’s adjustment is not extended, bank demand for Treasuries will likely decline. Going into the meeting, it appeared the fear was the FOMC would allow inflation to rise unrestrained. It’s hard to see how that was addressed. It is not clear if the rally described above was merely a relief rally that won’t be sustained, or somehow, without saying much, the Fed managed to calm concerns. Market action this morning suggests that yesterday’s rally is fading. In the cold light of morning, it is clear the Fed hasn’t resolved the issue of long-duration interest rates. It looks like we are probably on a path for 10-year T-note yields to approach the 1.90%/2.00% area; the key question is whether that level will trigger financial stress.

- There is a growing recognition that the U.S. fiscal stimulus action is far surpassing other developed economy nations. This development will have multiple effects. First is that U.S. economic growth will be much stronger than Europe or developed Asia. Second, and one area that seems to be overlooked by economists as they lift their economic forecasts, is that U.S. imports will likely rise. The past four decades have shown countries that make strong unilateral fiscal expansions tend to see much of it lost to imports. France in the 1980s was a classic example. However, the impact on the U.S. might be less. The U.S. is less globally integrated which will tend to mitigate the impact, and much of the recovery spending will likely focus on services, which face less import competition.

- Treasury Secretary Yellen is supporting a global minimum corporate tax. One of the problems in taxing capital is that if one nation has a low tax rate, corporations can shift activity to that nation, leading to lower taxes. By supporting a corporate minimum, this “race to the bottom” could be avoided. Such a provision would be a negative for earnings.

- Surprisingly, Congressional Democrats seem to be declining to use the Congressional Review Act, which allows Congress to reverse regulatory changes occurring near the end of an outgoing administration. However, the actions must be taken within 60 days of the new regulation. Simply put, time is running out, meaning that many of the late Trump-era regulations could stay on the books.

- Here’s something to watch—many states raise payroll taxes, which pay for unemployment insurance, after a recession. This is done to rebuild reserves. This tax hike could slow hiring as the tax is paid on the number of employees. Essentially, this tax raises the cost of rehiring.

- Samsung (005930, KRW, 82300) is warning that the semiconductor shortage could increase in the near term.

China: The U.S. and China meet today in what looks to be a tense atmosphere, and Myanmar is a growing problem for China.

- As China and U.S. officials prepare to meet, the U.S. has revealed a series of new sanctions and restrictions. First, 24 officials in Hong Kong have come under sanction for their actions on restricting elections in the former colony. Second, the Commerce Department has served subpoenas on several Chinese tech and communications companies. The FCC has joined in by announcing it has begun efforts to revoke authorization for two companies, China Unicom Americas (0762, HKD, 4.61) and Pacific Networks (3021, JPY, 3550), to operate in the U.S. China’s plan for this meeting was to ask Washington to roll back Trump policies; the actions today suggest that isn’t likely.

- The EU has joined the effort, announcing sanctions for Chinese nationals and one company due to human rights violations. The names have not been released yet (that is scheduled for Mar. 22). It is the first time the EU has applied sanctions on China since Tiananmen Square.

- China is opening trials for two Canadian nationals who were seized shortly after Meng Wanzhou was detained in Canada in late 2018.

- SoS Blinken and SoD Austin have completed a tour of Asian nations before today’s meetings with Chinese officials. The pair recently stopped in Tokyo to build support with Japan. Kurt Campbell, the diplomatic coordinator for the U.S., also noted that relations with China cannot be normalize until the Chinese/Australian trade dispute is resolved. One change we see from the previous administration is the desire to create a coalition to confront China. What remains to be seen is what these coalition partners want in return.

- On a side note, Pyongyang finally responded to U.S. diplomatic activities, with Kim’s sister warning against U.S./South Korean military exercises.

- The U.S. Coast Guard is expanding its mandate into the Western Pacific to counter China.

- As we noted earlier this week, protestors in Myanmar are targeting Chinese company assets in-country, and Beijing is getting angry about this development. Workers at Chinese companies are finding themselves in the crossfire. In response, the military has been increasingly using deadly force against protestors.

- China is making it difficult to gather information on conditions in Xinjiang. Without information, firms run the risk of trafficking in products made by labor in concentration camps, and nations struggle to know how and what to sanction over this issue.

- Beijing is expressing concern about the U.S. stimulus package, likely worried about the market disruption that may follow. The rise in 10-year T-note yields is probably behind their concern.

- This worry comes in the context of Chinese regulators working feverishly to contain shadow banking to restrain credit growth. The problem is that these credit restrictions will tend to cut liquidity to the private sector, further harming economic growth.

- The U.K. has formally declared that China is in breach of the 1984 Hong Kong declaration. It is unlikely that there will be any repercussions from this decision.

- Chinese regulators are increasingly worried about the property market. They have proposed changing land sales to a regular auction period, hoping to reduce bidding issues. The expectation is that a regular auction would make it more difficult for less stable property developers to bid. However, this will reduce prices, which would harm local governments.

- The supply of land dedicated for rental properties will also be increased in a bid to reduce prices.

- One of the areas of internet growth is to provide service via satellite. That would provide broadband coverage to less populated areas. In the U.S., the private sector is involved in sending up small satellites for this purpose. China has indicated it intends to compete in this area.

- China is suffering from massive dust storms. This has led to flight cancellations and caused some roads to close due to visibility problems.

COVID-19: The number of reported cases is 121,319,246 with 2,682,660 fatalities. In the U.S., there are 29,608,162 confirmed cases with 538,093 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 147,590,615 doses of the vaccine have been distributed with 113,037,627 doses injected. The number receiving at least one dose is 73,669,956, while the number of 2nd doses, which would grant the highest level of immunity, is 39,989,196. The FT has a page on global vaccine distribution. U.S. case counts are steady or falling in most states.

Virology

- The concerns about the AstraZeneca (AZN, USD, 49.35) vaccine in the EU is turning into a geopolitical problem. As Germany decided to pause the use of the vaccine, other EU nations were generally forced to at least consider suspending the use of the vaccine or run the risk of appearing not cautious. It seems the scientific consensus is the EU’s actions are an overabundance of caution. The fact that blood clots followed injections runs the risk of the classic post hoc ergo propter hoc error. Simply put, just because an event follows a prior event doesn’t mean there is a causal relationship. Most researchers believe that the blood clotting was happenstance. Also, there is likely a lack of perspective on relative risks. All vaccines carry some degree of risk; it’s important to weigh the risks of the vaccine relative to contracting the disease.

- The handling of the vaccine situation has put the EU bureaucracy in a bad light. Several errors were made. First, focusing on cost instead of availability has reduced vaccine supply. Second, a strong anti-vaccine movement in Europe has led to an overabundance of caution. Third, the inability to police member states has led to individual countries, such as Hungary, approving the use of the Russian and Chinese vaccines.

- We note that the EU drug regulator supports the AstraZeneca vaccine. They will rule on its safety soon. However, the controversy will likely slow the vaccine rollout.

- Meanwhile, EU Commissioner von der Leyen is threatening to cut off vaccine exports to countries that refuse to share their vaccines, a direct threat to the U.K. Naturally, Britain isn’t pleased with this development. The U.K. NHS is warning that vaccine shortages will start to slow the pace of vaccinations.

- Already, the EU has export restrictions in place that have been extended until the end of Q2.

- As all this concern about vaccines rages in the EU, the bloc is facing a surge in cases, looking like a third wave is underway. Italy has already established new lockdown measures, and Poland will lockdown starting this weekend.

- We should note that it isn’t all bad news in Europe. Serbia has the second-highest vaccination rate in Europe. It has approved the Russian and Chinese vaccines to aid distribution.

- The EU is planning on vaccine passports to support summer tourism. Iceland has announced it will allow vaccinated travelers to visit.

- China is now restricting travel visas to visitors who have had a Chinese vaccine.

- There is steady evidence that the vaccine expansion in the U.S. is bearing fruit. Movie theaters are reopening, as are theme parks. The New York theater district is planning a spring season. The U.S. is now extending vaccinations to remote areas.

- Another country that has done a good job in vaccine distribution is Chile.

- Moderna (MNRA, USD, 143.65) is now testing its vaccine on children.

- Research continues on “long COVID” patients.

International news: There were elections in the Netherlands, and protests are emerging in Lebanon.

- The center-right People’s Party for Freedom and Democracy, the party of PM Mark Rutte, looks to retain power, although the makeup of his new government will likely have more center-left representation.

- EU officials are suggesting that the €750 billion fiscal package passed last year might be too small. The ECB is also offering banks regulatory flexibility on bad loans.

- Protests in Lebanon are escalating as the currency plummets in value. Although the official rate remains around 1500 LBP/USD, the black market rate is now around 15,000. The country has been through a series of trials, from COVID-19 to a massive port explosion. So far, the political system has not generated a plan for recovery.

- In light of a crush of immigrants on the U.S./Mexican frontier, Mexico is conducting immigration raids to slow the flow.

- Brazil’s central bank has raised rates as inflation surges.

- The U.S. may keep troops in Afghanistan past the May 1 deadline.

Technology:

- There are numerous items on the labor front. Overall, the tech firms are seeing a clear upturn in labor activism.

- In the U.K., Uber (UBER, USD, 56.07) is giving drivers “worker,” as compared to “employee” status. This change will make them eligible for benefits that will boost the costs of operating. The change came after the company lost a legal battle to have its workers retain contractor status.

- Next week, Amazon (AMZN, USD, 3130.56) will face a unionization vote in Alabama. Working conditions appear to be the biggest issue. The company is aggressively trying to beat back the effort.

- Workers at Google (GOOG, USD, 2088.25) have voted in a minority union. This is a union that won’t have formal NLRB recognition, thus not allowing it to collectively bargain. The situation at Google shows a difference between white and blue-collar workers. The former is more concerned about company activities and less about wages and working conditions.

- The Biden administration has put together a team on industrial organization that is clearly moving to overturn the Bork standard. Here is a roundup of the team.

An ESG cautionary tale: Danone (DANOY, USD, 14.31) has been something of a “poster child” for ESG. For example, last summer, the company officially adopted a French legal status, enterprise à mission, or a purpose-driven company, signaling to shareholders that it would not be solely focused on profit maximization. Emmanuel Faber, the CEO and chairman who implemented these changes, has been ousted due to poor stock performance. Investors like the conscience soothing that comes with ESG investing as long as it doesn’t affect equity performance.