Daily Comment (March 19, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST]

Today is the spring equinox; it’s hard to say if this is a good or bad omen. We update COVID-19 news. Although there is much to say about the financial markets, to some extent, it can be summed up succinctly—there is a dash for cash. Equities are falling again this morning. Congress is working on a $1.0 trillion stimulus bill. Don’t be surprised in a few weeks when we will marvel at how timid this action was. We are paying close attention to today’s initial claims data as it is expected to show a massive increase in layoffs. The weekly energy report is updated on our website. Here are the details:

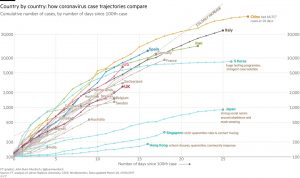

COVID-19: The world now has 222,643 reported cases of COVID-19 with 9,115 fatalities and 84,506 recoveries. Here is a chart of infections from the FT:

The U.S. pace of infections is rising rapidly; this is probably more about increased testing.

The virus news:

- A disturbing trend is developing in infections. Although it is documented that COVID-19 has a higher mortality rate among older people, that doesn’t mean young people (a) can’t get seriously ill from the disease, and (b) can’t die from the virus. In fact, 40% of hospitalizations are between the ages of 20-54. It is clear that some are not taking social distancing seriously. Sadly, they can become vectors of the disease.

- China had no new indigenous infections.

- Two members of Congress have tested positive. There are concerns that if the virus spreads among members of Congress, voting on critical bills may be affected.

- The U.S. is pushing social distancing to combat the virus and downplaying testing.

- Iran may be the hardest hit nation from COVID-19. There are warnings that “millions” may succumb to the disease. Some of this development is due to Iranian government mismanagement. As we have seen elsewhere, Tehran initially tried to downplay the pandemic. In addition, the political class everywhere tries to use crises to boost their own agendas. Internal fights have slowed the response. However, sanctions have also played a role, undermining its economy and weakening its medical system. The S. is adding additional sanctions in a bid to get Iran to release U.S. citizens being held by Tehran. Our fear over Iran is twofold. First, Iran sends operatives throughout the Middle East to project power; it is possible these operatives will become vectors for COVID-19. Second, as political pressure rises on the Iranian leadership, the country may try an external war to distract its citizens. Although it is evident that neither the U.S. nor Iran wants a direct conflict, as desperation grows in Iran, starting a conflict with the U.S. while Washington is distracted could occur. We think this is a low probability outcome, but lately we have been seeing a lot of low probability outcomes occurring.

- The U.S. and Canada have closed its border.

- Putin is apparently using the virus as an excuse to clamp down on protests and ease his term extension.

- Another downside to just-in-time inventories is emerging; reports suggest that basic items required for COVID-19 testing are become scarce. These inventory models are great when everything is functioning well, but they fail miserably under stress. Another worry: ventilators are in short supply in the U.S. and Europe.

And now, financial market news related to COVID-19:

- There have been a series of curious moves in financial markets, which we will discuss below. But, as noted above, they are all tied to a singular desire—cash is king and there is a scramble to acquire it. Risk-off assets have been falling in price. The dollar is on a tear as those who have dollar obligations are scrambling to acquire the greenback. Emerging markets are getting hammered. Mortgage REITS are being hit on funding concerns.

- The ECB announced a €750 billion bond-buying program to narrow the spreads between the north and the south of Europe. We are seeing a rally in bonds this morning in both Europe and the U.S.

- The Fed announced a new backstop for the money market industry. The White House is asking Congress to support money markets as well, likely to prevent a run on this part of the market to prevent a repeat of 2008.

- The administration and Congress are working on programs to support the economy. Paid leave has passed both houses. The president has invoked the Defense Production act. There is a growing sense that the economy needs a massive stimulus package. One of the lessons of 2008 is that it is easy to undershoot stimulus. Another is that cash injections, either in the form of grants, transfers, loans or equity stakes, are the most efficient way to prop up the economy. Shovel-ready projects are a myth. It is politically difficult to execute stimulus in a crisis. The fastest way to deliver funding is to businesses via the financial system. However, if businesses hoard the cash and layoffs occur anyway, it appears that the government doesn’t care about the less affluent. But, getting cash to households, although effective, is slow. Perhaps the best way to attack this problem is to use the same method as dealing with a dessert table—try everything! This will entail a larger stimulus, but, given the sudden stop the economy is facing, it may not be possible to overdo it. In fact, that may be what the financial markets are waiting for. It is worth noting that, similar to what we saw in 2008, state and local governments are facing a major cash crunch; this would be a good time for the Federal government to step in. The claims data, as we show below, is likely to deteriorate further. Households are going to face a serious cash crunch. Again, offering support for firms to keep employees on the payrolls would be good for business and workers. We are starting to also see articles worrying about U.S. debt capacity. This fear is profoundly misplaced. As WWII showed, the Fed could simply set the interest rate across the yield curve and buy any bonds the public didn’t want. Will this eventually be inflationary? Probably, but this is a problem that can be dealt with later.

- The other problem this virus event has illustrated is that the financial markets are not functioning well. The industry has become so obsessed with speed that it ignored the problem of depth. In other words, we have an industry full of algorithmic trading that wants to buy fast but feels no need to support a broadly functioning market. This factor is contributing to market volatility. This issue will be exacerbated tomorrow; we are seeing a quarterly “quadruple witching day.”

Odds and ends: The journalism spat between the U.S. and China continues, with Beijing expelling some U.S. reporters. The trade war continues as the U.S. increases tariffs on European aircraft.