Daily Comment (March 25, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity markets have turned lower this morning. Our coverage begins with the pandemic, with a focus on the mess that Chancellor Merkel finds herself in with elections coming in autumn. China coverage follows; the diplomatic spat between the EU and China has intensified and Beijing and Moscow continue to tighten relations. International coverage is next, followed by economics and policy, and we close with technology news.

COVID-19: The number of reported cases is 124,894,108 with 2,745,702 fatalities. In the U.S., there are 30,011,551 confirmed cases with 545,746 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 169,223,125 of the vaccine has been distributed with 130,473,853 of doses injected. The number receiving at least one dose is 85,472,166, while the number of second doses, which would grant the highest level of immunity, is 46,365,515. The FT has a page on global vaccine distribution. The weekly Axios map shows a mixed bag; some states are reporting falling cases, but there is a disturbing rise in others. Due to reporting issues, we have seen a jump in U.S. infections to 86K.

Virology

- Germany is facing a jump in infections that is leading to a political crisis. In light of a slow vaccine rollout and after a meeting with regional leaders, Chancellor Merkel decided to issue not only a lockdown order but to extend the Easter holiday by two days. The backlash was strong; protests broke out and the political opposition was critical of the move. The suddenness of the action and the lack of planning for how businesses and households would handle the changes to the holiday raised hackles. And so, in the face of strong opposition, Merkel reversed her order and publicly took sole responsibility, asking Germans to forgive.

- There is growing political fallout from the current government’s handling of the pandemic. Although Germany’s actions, at first, were considered strong, the inability to distribute vaccines, the persistent waves of infections followed by ineffective lockdown measures, and the fact that there appears to be “no light at the end of the tunnel” have weighed on the government. Political standouts of the CDU, possible successors to Merkel, have seen their stars fall, raising the possibility that the CDU/CSU/SPD will fall from power in September.

- Belgium has announced a lockdown over Easter; however, the measures don’t appear to be all that strict and there hasn’t been a notable public response.

- The EU’s vaccine program has been something of a mess. The leadership focused on price rather than securing supply. In a globalized world, this has led to a situation where vaccines produced in the EU are being shipped to other parts of the world, where nations paid higher prices. Europe is considering restricting vaccine exports in response, which will not make its trading partners happy. But supply isn’t the only problem. Logistics and clear lines of authority have been a problem, too.

- A recent example has been a raid by Italian authorities on a vaccine manufacturing facility in Italy. Police found 29 million doses; the concern was that despite export restrictions AstraZeneca (AZN, USD, 48.79) was preparing to ship the doses outside the EU. The company argued the vaccines were simply in the final stages of preparation before shipping.

- The EU’s crackdown on exports has raised fears in the U.K. that doses it contracted won’t be shipped. Officials on both sides claim that the EU and U.K. have worked out their differences, but no details of an agreement have emerged.

- The U.K. is signaling that it will restrict travel between France and the U.K. due to the surge in COVID-19 cases in the EU.

- AstraZeneca has revised down its efficacy rate to 76% from its original report of 79% due to data integrity problems.

- The UAE has been aggressive in acquiring vaccines, allowing China and Russia to conduct clinical trials in return for vaccine supply. The Sinopharm (SHTDY, USD, 12.04) vaccine has been distributed; we note that health authorities are notifying some of the recipients who received two injections that they should receive a third, suggesting the prior inoculations were ineffective. China claims a 79% efficacy rate, but never released any supporting data. This vaccine has also been distributed in Egypt, Cambodia, Senegal, and Peru. If it turns out the vaccine is ineffective, it would require these countries to source vaccines from other nations and would be a blow to China’s prestige.

- Studies published in the New England Journal of Medicine suggest that out of 8,121 fully vaccinated employees at the University of Texas Southwestern Medical Facility, only four contracted COVID-19 after inoculation. A similar study in Los Angeles hospitals shows seven out of 14,990. Although we doubt the current vaccines will give us sterilizing immunity, these studies suggest it will be close. In addition, those who did contract the disease reported mild symptoms, suggesting that getting the shot will keep a recipient from a serious case of the disease.

China: China’s foreign relations with the EU and U.S. are getting increasingly difficult. In response, Beijing is getting close to Russia.

- After chilly meetings in Alaska, U.S. officials are meeting with EU officials to build a common front against China. EU officials have been cool to an assertive stance on fears of disrupting business ties, but, recently, the EU did sanction Chinese officials over Xinjiang abuses. This has led China to respond in kind.

- The recent Comprehensive Agreement on Investment, a China-EU pact, looks to be in trouble. The European Parliament canceled a meeting to discuss the treaty and it may not come up for a while. The postponement appears designed to give both sides a chance to cool tensions. However, the U.S. is clearly trying to take advantage of the tensions by working to build a united front against China.

- On a related note, the Chinese military was at the recent Alaska talks. Reports argue that the meetings did allow for both the U.S. and Chinese military to discuss methods to avoid accidents.

- Faced with increasing hostility, China is moving to tighten relations with Russia. Not only has China faced criticism from the U.S. and EU over human rights, but the U.S., as noted above, has met with EU officials and held a virtual leaders meeting with the “Quad” states. Foreign ministers from China and Russia met earlier this week and proposed to break Western hegemony. We also note that China has been dressing down the EU and U.S. as well. It would appear that Beijing is uncomfortable with the U.S. lining up allies against it.

- The SEC is starting to implement regulations that could result in Chinese firms being delisted from U.S. exchanges. Under Sarbanes-Oxley, all public companies must be audited by the U.S. Public Company Accounting Oversight Board. Chinese-listed firms have refused to participate. Until the last administration, the rule was generally not enforced. Now, it appears the Biden administration is prepared to follow through on this regulation. U.S.-listed Chinese companies have been weaker on this news.

- This is the 100-year anniversary of the creation of the People’s Liberation Army. It is being celebrated by loyalty lessons (no parade plans, so far). We must admit we are a bit puzzled by this decision; the fact that a century remembrance requires loyalty classes suggests General Secretary Xi is uncomfortable with his military’s allegiance.

- China continues to lag on its commitments to buy U.S. goods as part of the Phase I trade deal.

- Adm. John Aquilino told the Senate Armed Forces Committee that China is closer to being able to take Taiwan by force. Although such comments are sometimes used for budgetary reasons, we tend to agree with the admiral.

International news: Israel is trying to form a government, North Korea launched missiles, and the Indian farmers’ strike continues.

- Israeli politics is always difficult for outsiders to fathom. There are multiple parties, many of which have splintered off from larger ones. Coalition-building is difficult, leading to unstable governments and repeated elections. Recent elections were inconclusive, so PM Netanyahu may be forced to bring an Islamist party into his coalition in order to form a government. That means his coalition, if it forms in this manner, would include orthodox parties and an Islamist one. If that is what develops, we would expect elections before year-end.

- North Korea doesn’t want to be ignored. Accordingly, it has launched a couple of missiles to remind everyone it is still a problem.

- The farmers’ strike continues in India against market reforms. The current subsidy program generates costly surpluses and general inefficiencies. This situation is common as countries develop. In the preindustrial stage, agriculture dominates the economy and occupations. As economies industrialize, former farmers are forced into urban areas to work in industry, and agriculture itself becomes increasingly efficient. One of India’s problems is that it never really industrialized. Dana Rodrik, an economist, has raised concerns that automation in the current industrialized economies might trigger reshoring and prevent industrialization from occurring in developing nations. If so, the farmers in India may have legitimate fears; if reforms reduce labor in Indian agriculture, there may not be an industrial sector to provide new jobs.

- Lebanon’s economy continues to spiral lower as a collapsing exchange rate is triggering food shortages and food price inflation.

- The U.K. has established a government-backed lending program to support businesses. However, the EU warns that if Northern Ireland firms participate in the program, it may mean they have received improper subsidies that would violate the terms of Brexit. This situation highlights the problematic circumstances for Northern Ireland.

- A group of senators are lobbying the White House to officially recognize the Armenian genocide. The 1922 event is controversial; no U.S. administration has taken this step for fear of undermining relations with Ankara. Candidate Biden seemed to indicate he was open to such a declaration. Given current testy relations with Turkey, we might see this step taken. If so, a hard break with Turkey becomes more likely.

- We continue to watch what appears to be a housing bubble in Canada. Unlike the U.S., Canada didn’t exactly address its housing market in 2008 and it has continued to rise in value. As the U.S. experience showed, the end of a housing bubble has serious ramifications for an economy.

- The Sweden Democrats, a right-wing populist party, is poised to join the center-right coalition for next year’s elections. The party has been isolated from power for decades, but party leaders have been working to become a mainstream, anti-immigrant party.

- The opposition in Myanmar is hardening and appears to be evolving into a guerrilla movement. If this continues, it will be interesting to see how Beijing reacts. China views Myanmar as a conduit for its Belt and Road project, and if the country becomes unstable, it would make it less reliable for transmitting goods.

Economics and policy: The Suez Canal remains blocked, rental arrears continue to be an issue, we are watching what households do with the “stimmy,” and inflation worries are rising.

- The Suez Canal remains blocked, roiling global shipping. Over 100 ships are stuck, waiting for authorities to move the vessel.

- One of the concerns about the aftermath of the pandemic is squaring up rents in arrears. Landlords need to be paid to remain current on their mortgages; without rental payments, defaults at that level may start. At the same time, if evictions begin, it may be difficult for landlords to find renters at current rental levels and could create a homelessness problem. So far, the government’s response has been to delay evictions and hope for a resolution. The current extension expires in a week; the government is considering an extension into July.

- Part of the recently passed rescue package has $47 billion of relief to households. The expectation is that some (or all) of this money may be used for back rent and utility bills. There is a concern about delays in receiving these checks, which is why the extension is being considered.

- Surveys of college-age Americans who received stimulus checks suggest the majority will be used for savings and debt reduction. If so, the forecast growth that is expected may not immediately materialize. At the same time, these actions would improve household balance sheets and improve the chances of better future growth.

- Surveys of businesses conducted by the Atlanta FRB suggest supply worries are becoming the most significant concern among businesses. This fear is reflected in ISM surveys as well. Supply bottlenecks are exacerbating inflation issues; the Suez situation is just one of these concerns.

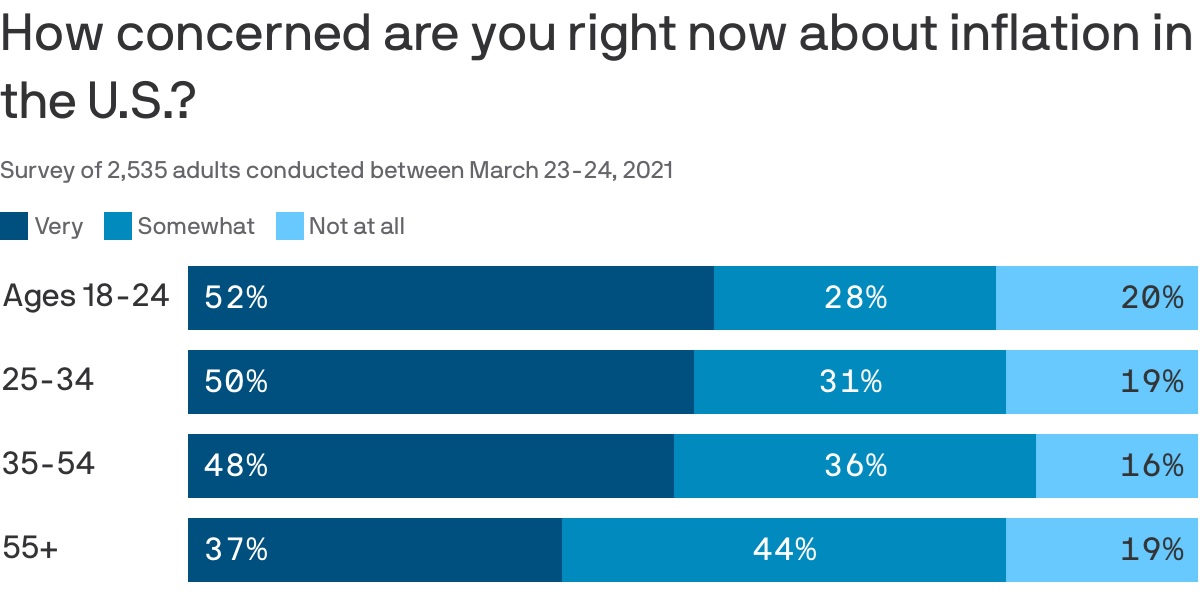

- Perhaps even more unsettling are surveys suggesting the youngest Americans are the most concerned about inflation. This is odd because they haven’t experienced it to any great degree. Their worries may not express themselves as they did for baby boomers; the millennials may buy bitcoin instead.

- Despite problems caused by the pandemic’s supply disruptions, European automakers continue to maintain support for just-in-time inventory methods. We suspect that, as U.S. hegemony fades, we will shift to just-in-case inventory methods, but, at least in Europe, faith in the current model remains.

- Democrats are looking to raise taxes to “pay” for an infrastructure package. Their plans appear to be to pass a package in parts, using normal legislation to pass the less controversial elements, and reconciliation for the rest, including tax measures. We expect a bruising fight. One thing to watch is that tax increases may act to stem the recent rise in long-term interest rates.

- Looking for another reason to dislike bitcoin? Mining is apparently also tightening semiconductor supply.

Technology: Tech leaders testify before Congress and Amazon (AMZN, USD, 3087.07) faces a union vote.

- The leaders of the major tech firms will be before Congress today to discuss the issues of disinformation and censorship. Although Congress is pretty much aligned against tech firms, the parties are not unified on their concerns. We would expect the leaders to use that to their advantage. Their goal is to avoid regulation; if that fails, the secondary goal is to use regulation to benefit themselves or harm their competition.

- Facebook (FB, USD, 282.14) announced it has taken down a group of China-based accounts that were used by China to spread malware to monitor Uyghur dissidents outside of China.

- By the end of the month, Amazon will know the outcome of the unionization effort in Alabama. Regardless of the outcome, the company will face increasing pressure as policy moves to favor labor.

- Jack Ma announced that Ant Financial will increase commissions on loans it makes for banks in a bid to lift its eventual IPO price.