Daily Comment (May 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are off to a slow start due to a hotter-than-expected PPI report. In sports news, the Boston Celtics were able to snatch a 3-1 lead in the series against the Cleveland Cavaliers. Today’s Comment will explore why white-collar workers are facing a tough job market, explain the rise in demand for used electric vehicles despite weakening overall demand, and discuss China’s potential economic stimulus measures ahead of its July Politburo meeting.

Labor Losing Leverage: While the labor market remains tight for the broader population, there are signs that certain sectors are struggling.

- Walmart, the country’s largest employer, is set to lay off hundreds of corporate jobs and ask many of its work-from-home staff to return to the office. This shift aligns with a broader trend within the company. In April, the company announced that it plans for 65% of its stores to be serviced by automation by the end of 2026. Last year, it closed three of its tech hubs, requiring workers to relocate to other hubs in the country. This shift comes as the firm looks to shrink its workforce as a way to cut costs and improve its profitability.

- The recent cooling of the labor market has been unusual in that it has disproportionately impacted the services sector. Hiring for white-collar jobs is up 0.6% from the previous year, while the overall job market is up 1.8%. The reason for the slowdown may be related to costs. Proprietary data from Vanguard shows that the greatest demand for workers comes from jobs that pay less than $55,000 a year. This preference for low-wage workers may be related to some firms’ reluctance to hold onto higher-paid workers whose skills are not essential for their current needs.

- The selectivity of the labor market may complicate the Federal Reserve’s ability to balance its price stability and maximum employment mandate. Since many of these roles are relatively high-paying, laid-off workers may rely on savings before turning to government assistance. This could delay their appearance in unemployment figures and potentially raise the chance that the Fed may keep rates higher for longer than the economy can tolerate. While a hard landing is not our base case for this year, we do believe the risks are elevated given the signs of sticky inflation.

Renewable Comeback: While electric vehicle (EV) sales are hurting the bottom lines of major automakers, the used car market is seeing an uptick in the sales of EVs.

- A report from used car retailer Carvana showed that demand for EVs has more than doubled from the previous year. The demand rose by 4.8% in the last quarter, which is more than double the rate observed in the same period of 2023. The increase in sales comes amidst a surge in supply in the used car market, which has helped push the price of EVs down, making them more accessible to the typical consumer. According to the sales data, the difference in selling price for an EV and an internal combustion engine has dropped from $13,000 to $7,000.

- The rising demand for EVs comes at a time when automakers are struggling to contain a drop in profitability. Major US automaker Ford announced that it is losing $100,000 on every EV it sells, while a Kelley Blue Book report showed that new EV sales were down in the first quarter of the year. This weakness in the sector is likely driven by two factors: a surge of new EVs entering the market and waning demand from consumers. Consumers who cannot afford the high sticker price or who don’t see the need for an EV due to relatively low gasoline prices are contributing to the slowdown.

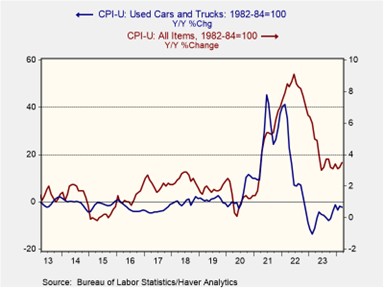

- The improved affordability of EVs will likely serve the US’s needs both geopolitically and domestically. The US government is promoting a switch away from combustion vehicles as a way to wean households off their reliance on energy sources increasingly dominated by countries with hostile governments. At the same time, the drop in used car prices has been a major contributor to the decline in overall inflation. As the world fights for market share in the green energy space, we can expect volatility in the electric vehicle market.

China Boom: Beijing may use fiscal and monetary policy to help boost the economy in time for the Third Plenum.

- On Monday, China’s Ministry of Finance announced plans to raise over 1 trillion CNY ($138 billion) in its fourth such issuance of long-dated bonds in 26 years. The new funds will be used to finance national strategies, including improvements to its defense capabilities and the semiconductor industry. Additionally, there is speculation that the People’s Bank of China (PBOC) could use its tools to improve market liquidity by buying and selling bonds. The recent collaboration between the central authority and monetary policymakers paves the way for improved policy coordination as Beijing seeks to reassure skeptics that it can address the country’s ongoing economic challenges.

- China’s first-quarter economic growth surpassed expectations, but challenges persist. The prior quarter witnessed a slowdown in consumption and investment spending, fueled by a reluctance to lend by banks. The PBOC has required banks to have the capacity to absorb 16% of risk-weighted assets by 2025 and 18% by 2028. This requirement is designed to protect the broader economy from the ongoing property market meltdown and prevent it from leading to a broader financial crisis. However, this change is likely behind the unprecedented contraction in aggregate financing seen in April.

- The lack of lending by banks may explain why the government is taking a more proactive role in stimulating the economy. It likely needs to take the lead until banks improve their balance sheets. The increases in bond issuance may be a prelude to a much larger announcement at the Third Plenum. While the exact nature of the announcement remains unclear, there is a strong possibility that the government could use the funds to help stabilize the real estate market. If true, this may help give the economy an extra jolt but could also weigh on the yuan.

In Other News: The US and China are set to meet to discuss AI as the two sides look to prevent a possible miscalculation. The return of Roaring Kitty has led to a surge in GameStop shares, a sign that retail investors are still willing to take on risk.