Daily Comment (May 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with reports of a big new housing support program in China. We next review several other international and US developments with the potential to affect the financial markets today, including another possible election-driven tax cut in the UK and expectations for new US tariffs against foreign solar cells and panels.

Chinese Housing Market: The government today announced a large program to prop up the housing market, which was upended in 2021 by Beijing’s clampdown on excess capacity and developers’ high debts. The program encourages local governments to buy up unfinished homes now weighing on the market and convert them into affordable housing for low- and middle-income buyers. It also scraps minimum interest rates on mortgages and reduces minimum down payments by buyers.

- Excess capacity, high developer debt, and faltering home prices have become a major headwind for Chinese economic growth, so investors will be hopeful that the new program will be successful. However, Beijing hasn’t been clear so far about how extensive the program will be and how local governments will fund the home purchases. As they say, the devil is in the details.

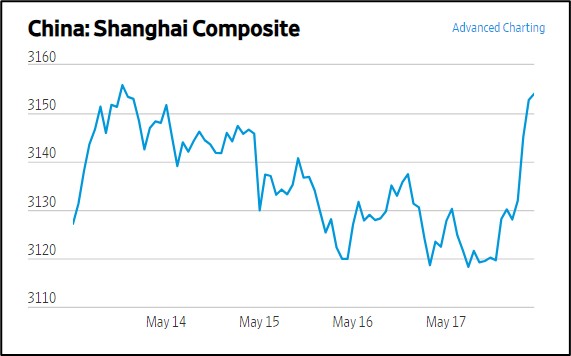

- Despite the lack of detail in the plan, it has apparently helped give Chinese stocks a lift today.

Chinese Economic Performance: April industrial production was up 6.7% year-over-year, beating expectations for a 5.5% rise and accelerating from the 4.7% increase in the year to March. The improving output stems in large part from government support for manufacturing and exports. In contrast, fixed-asset investment in January through April was up just 4.2%, falling short of expectations and slowing from the annual growth of 4.5% in January through March. The annual growth in retail sales also slowed in April.

Russia-Ukraine War: The Ukrainian government said Russian forces have advanced about 10 kilometers from the Russia-Ukraine border toward Kharkiv, leaving them just 25 km from the city. According to the Ukrainians, the Russian troops were stopped as they ran up against the first line of defense around Kharkiv. Nevertheless, the Russian advance in northeastern Ukraine illustrates how they are trying to capitalize on Kyiv’s weakness in personnel and equipment before refreshed aid from the US arrives.

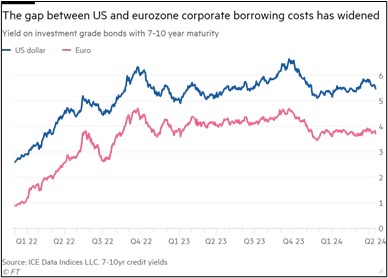

Eurozone: With investors now expecting the Federal Reserve to hold US interest rates higher for longer, many US firms are boosting their euro-denominated bond issuance in Europe. Data from Bank of America shows US firms have borrowed some 30 billion EUR ($32.5 billion) via such “reverse Yankee” deals so far this year, which is on track to match or exceed the record 88 billion EUR ($95.5 billion) in reverse Yankee deals in 2019. This European issuance could help hold down US companies’ interest charges even as they roll over lower-cost debt from previous years.

United Kingdom: With the ruling Conservative Party still trailing by some 20% in opinion polls ahead of the autumn elections, Chancellor Jeremy Hunt today hinted that the government wants to again cut national health insurance contributions, this time to 6% of wages and salary income. If put into place, the Tories will have cut the insurance contribution in half, potentially creating further fiscal challenges for the UK down the road.

US Fiscal Policy: New research by the University of Washington indicates metabolism-related health issues linked to aging and obesity will continue to rise, even as infectious diseases and maternal/child health issues become less prevalent. Since metabolism-driven health issues can be chronic and expensive, we suspect that this will lead to continued spending pressure for programs such as Medicare, Medicaid, and Veterans’ health, making it even harder to cut the federal budget deficit.

US Trade Policy: Just days after announcing a range of big tariff increases aimed squarely at Chinese dumping, the Biden administration today is expected to announce a boost in tariffs on solar panels and cells that will be applied more globally. Because of China’s huge excess capacity for solar-energy manufacturing, global prices for panels and cells have fallen dramatically, boosting US imports from Asian producers such as South Korea, Malaysia, and Vietnam. The new tariffs are designed to protect US producers.

US Financial Market Regulation: Yesterday, the Supreme Court affirmed by a vote of 7-2 that the Consumer Financial Protection Bureau (CFPB) is constitutional, overturning an appeals court ruling that the body’s funding structure was unallowable. The broad consensus on the agency’s constitutionality will likely cement its position in the nation’s financial regulatory scheme.

US Housing Market: New analysis from the Wall Street Journal shows several major cities in Texas and Florida are posting higher inventories of homes for sale and falling home prices due to strong building activity in recent years. While most of the significant cities are dealing with reduced inventories and rising prices, the situation in cities such as Austin and Cape Coral is a reminder that home values could soon start to peak and even turn negative as inventories catch up to demand.