Daily Comment (May 18, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Friday! Financial markets are mostly flat this morning. This is what we are watching:

Italy: The FT[1] is reporting that the Five-Star Movement and the League have reached a deal to form a government, although the prime minister post has not been settled. We would expect a compromise candidate, a figurehead, to emerge at some point for this role. The final deal does remove the talk of a return to “pre-Maastricht” and calls on the Italian bonds held by the ECB to not count against debt/GDP calculations. But, the agreement calls for both tax cuts and increased spending which will almost certainly lead to fiscal deficits that will run afoul of Eurozone rules.

What really caught our attention, however, was the government’s proposal to issue “mini-BoT,” which are short-term, small denomination sovereign bills. Denominated in euros, they are designed to be “tax anticipation notes.” Cash-strapped governments have issued such instruments; California did so eight years ago.[2] Still, previous notes were electronic entry; Italy plans to use its lottery presses to print these BoT, which makes them bearer bonds and potentially a parallel currency. Now, as one would expect, the coalition is downplaying this potential, indicating that no entity will be required to accept BoT. But, if the government follows through on this plan, it is a major threat to the Eurozone. It should be noted that the former Greek FM Yanis Varoufakis proposed similar instruments in 2015. In fact, the Five-Star and League negotiators consulted with Syriza on how to structure these instruments, yet even the radical Varoufakis wouldn’t go so far as to issue printed bearer bills. It isn’t hard to envision how these notes, issued at a discount to face value (say, €90 with a face value of €100), would fall to even deeper discounts as more are issued. Essentially, the BoT will potentially become a way for Italy to expand its fiscal debt in a quasi-currency. This coalition is turning into a significant threat to the Eurozone.

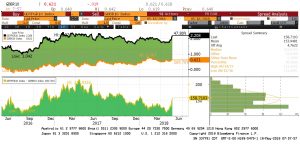

This chart shows the level and spread between German and Italian 10-year sovereigns. What is notable is that German yields have been steady to lower since the run up in Italian yields. We would expect Italian capital flight to develop and usually Germany is the first stop. We are also not seeing any unusual behavior in the Swiss franc. Perhaps investors are waiting for the PM to be appointed before deciding a populist threat in the Eurozone’s third largest economy is meaningful.

In the short run, the problems in Italy are bearish for the euro. But, if we get a north/south split, the euro becomes the new D-mark and a new southern euro becomes the new lira/drachma. The euro soars, while the southern euro depreciates. That may be the final outcome but getting there could easily mean a period of euro weakness.

Trade: There were two items on trade. First, there are reports that China will offer $200 bn in trade concessions.[3] Essentially, China will offer to increase its imports from the U.S. if the Trump administration relaxes the technology trade restrictions. Implied is the idea that Beijing will help in the negotiations with North Korea. The president now finds himself facing a problem often seen with his predecessors; the U.S. has multiple goals and has to “thread the needle” to meet all of them. And, in reality, it is usually impossible to get everything you want. China’s desire to expand and develop its tech industry seems paramount and it is willing to promise to buy grain,[4] natural gas and perhaps even oil to narrow the trade deficit if it will allow Beijing to maintain access to U.S. intellectual property. The problem is, of course, that this runs at cross-purposes to the U.S. goal to maintain tech supremacy. In addition, the buying China does with the U.S. means that other nations, e.g., Brazil, Argentina, Australia and perhaps Iran, will see their exports to China fall. Second, it appears that the NAFTA negotiations have failed. It isn’t clear if the administration will simply leave the treaty or if it will remain in limbo as talks drag on.

Venezuela: Elections will be held on Sunday; there is little doubt to the outcome.[5] President Maduro will likely win. Real opposition candidates have been prevented from running. Only two independent candidates share the ballot with Maduro and they won’t likely win more votes than Maduro unless powerful people in the ruling class have decided Maduro needs to go. If the expected occurs, most governments have already indicated they don’t recognize this election as legitimate which could mean new sanctions are imposed. If we get a surprise and Maduro is forced out, outside governments will have to decide whether this illegitimate election is now legitimate. Our expectation is that Maduro wins and Venezuelan oil supplies are further reduced.

[1] https://www.ft.com/content/e0cd0f22-5a7c-11e8-bdb7-f6677d2e1ce8

[2] https://www.municipalbondstoday.com/tag/california-revenue-anticipation-notes/

[3] https://www.nytimes.com/2018/05/17/us/politics/china-trade-trump-concessions.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=first-column-region®ion=top-news&WT.nav=top-news

[4] https://www.wsj.com/articles/china-drops-probe-into-u-s-sorghum-shipments-1526629000

[5] https://www.ft.com/content/edd6c4a0-5906-11e8-b8b2-d6ceb45fa9d0?emailId=5afe55bf3305f4000487e5a5&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22