Daily Comment (May 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with several items related to artificial intelligence, the electrification of the global economy, and the resulting impacts on commodity prices. We next review several other international and US developments with the potential to affect the financial markets today, including new signs of economic decoupling between the US and China and several notes on the US labor market.

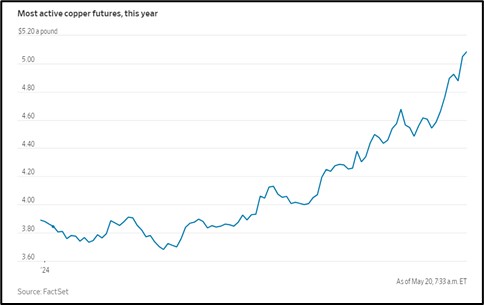

Global Copper Market: Copper prices today have reached yet another record high, with near futures trading at $5.0910 as of this writing. Copper prices are now up more than 30% from the start of the year, reflecting investor expectations for increased demand from electrification (especially for artificial intelligence), re-industrialization, and higher defense spending, as well as potential supply shortages. The surge in copper prices is consistent with our oft-stated view that ongoing geopolitical tensions will likely be positive for commodities going forward.

Global Artificial Intelligence: The UK-based multinational engineering firm Arup said it was duped out of millions of dollars in a sophisticated, innovative new deep-fake scam. The scam was based on a digitally generated version of the company’s chief financial officer that the criminals deployed in a video conference. The fake CFO convinced a Hong Kong employee to send the criminals more than $25 million. The incident shows how deep fakes could be used not just for political manipulation, but also for fraud against companies or individuals.

France-New Caledonia: Large-scale rioting broke out late last week in France’s overseas territory of New Caledonia, which lies in the Pacific Ocean northeast of Australia. The rioting, fueled by hardline, pro-independence leaders of the territory’s indigenous Kanak people, began after the French parliament approved a bill giving more voting rights to the territory’s nonindigenous population. Paris has sent additional police to the territory, but the rioting reportedly continued throughout the weekend.

- The tensions in New Caledonia also reflect today’s global trend toward electrification, especially the growth of the global electric vehicle market. New Caledonia has large reserves of nickel, which is important to a range of electrification technologies.

- Besides the electoral changes from Paris, the territory’s pro-independence parties have been fighting French President Macron’s proposal to lift restrictions on exporting unprocessed nickel from New Caledonia and give priority to shipments to European electric-vehicle battery factories.

China-United States, et al.: The Chinese Ministry of Commerce yesterday said it has launched an anti-dumping probe regarding polyoxymethylene copolymer, a thermoplastic widely used in the consumer electronics and automotive industries, from the US, the EU, Japan and Taiwan. The move is being seen as retaliation for recent US and EU anti-dumping probes against Chinese electric vehicles and other strategic Chinese exports. The tit-for-tat move illustrates how tensions between China and the West continue to spiral, with no easing in sight.

China-Philippines: To counter China’s effort to assert sovereignty over waters claimed by the Philippines, Manila has begun building military and civilian infrastructure on the country’s barely populated island of Pag-asa in the South China Sea. Manila also plans to maintain a support corridor running out to the island, in which it hopes frequent military and civilian operations will deter China from trying to intervene.

- The Philippine government has long used a calibrated military presence in disputed areas of the South China Sea to block China’s territorial aims. For example, it has grounded a World War II-era navy ship on Scarborough Shoal and keeps a contingent of Philippine marines there around the clock.

- With its new facilities on Pag-asa, which will reportedly include both military barracks and a civilian health clinic for the island’s 400 inhabitants, it appears that Manila is broadening its approach. By encouraging a bigger civilian presence, it could make China more hesitant about trying to attack or isolate the island but will also likely worsen tensions between Beijing and Manila.

- As we have noted before, aggressive Chinese operations against Philippine assets in the South China Sea are now probably more dangerous than the situation around Taiwan, especially given that the US and the Philippines have a mutual defense treaty. Under that treaty, the US could be required to come to Manila’s aid if it is attacked by China.

China: In a sign that General Secretary Xi’s plan to make China a “financial superpower” is being implemented, a new press tally shows 30 regulators, bankers, and other financial executives have been arrested for corruption so far this year. Under Xi’s plan, China will use tightened financial regulation to reduce risks and build a world-leading capital market that can support favored manufacturing industries and insulate China from US financial sanctions.

- Naturally, Xi has argued that large, deep, corruption-free capital markets should help support industries he has identified as “new productive forces,” such as electric vehicles, batteries, solar panels, and semiconductors.

- Cleaner financial markets probably would help support Chinese stocks to some extent. However, we suspect the market will continue to struggle in the face of problems such as China’s slowing economic growth, Communist Party intrusion into the private sector, and reduced interest from foreign investors.

Iran: State media has now confirmed that President Raisi died in a helicopter crash in northwestern Iran over the weekend. Supreme leader Ayatollah Khamenei has named First Vice President Mokhber as interim leader of the government until the constitutionally required elections can be held, probably in late June or early July. In Iran’s theocracy, the president serves mostly to execute the clerics’ national strategy, so Raisi’s death isn’t likely to change Iran’s overall strategic direction.

- Even though Raisi’s helicopter went down in bad weather, there will inevitably be some suspicions in the region that Israel, or even the US, was behind the crash.

- If they arise, such suspicions could further stir up tensions in the area, which are already high because of Israel’s war against Iran-backed Hamas militants in Gaza.

Israel-Hamas Conflict: Benny Gantz, a centrist former military chief and rival of Prime Minister Netanyahu, has threatened to pull his party from the national unity government conducting Israel’s war against Hamas by June 8 if Netanyahu doesn’t develop a credible post-war plan for governing the Gaza Strip. In addition, current Defense Minister Yoav Gallant, from Netanyahu’s conservative Likud Party, has backed Gantz’s call.

- Netanyahu’s right-wing coalition alone has the majority of seats in the Knesset, so even if Gantz pulls his party out of the government, the prime minister would likely stay in power.

- However, the demands from Gantz and Gallant lay bare the growing divisions in Israel’s unity government. If Gantz pulls his party out, Netanyahu would likely become even more isolated on the world stage and even more reliant on his far-right coalition members.

- Reflecting Netanyahu’s isolation, the International Criminal Court’s prosecutor has formally requested arrest warrants for Netanyahu and other Israeli and Hamas leaders. To back up his call, the prosecutor says he has reasonable grounds to believe Netanyahu and the other leaders are responsible for war crimes and crimes against humanity.

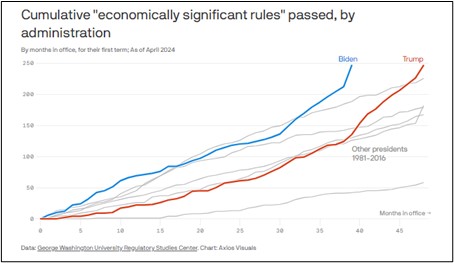

US Regulatory Policy: New research from Axios suggests President Biden’s recent flurry of new regulations is designed to cement his agenda in government policy even if former President Trump wins re-election in November. Under the Congressional Review Act of 1996, rules that have been in place for a certain period would be much harder for Trump to kill unilaterally. Legal scholars disagree on the minimum period, but the Axios research estimates that Biden would have to institute his rules by this Wednesday or by September at the latest.

US Labor Market-Unions: The National Labor Relations Board said workers at a Mercedes-Benz plant in Alabama voted against joining the United Auto Workers by a vote of 56% to 44%. Coming just weeks after the UAW won a vote at a Volkswagen plant in Tennessee, the result suggests it will remain difficult for unions to organize workers in the South. Although today’s labor shortages have boosted wage rates and workers’ bargaining power, it appears the economy could avoid the kind of mass unionization that hamstrung the labor market decades ago.

US Labor Market-Immigration: An article in the Financial Times today compiles statements from various US business organizations and firms warning that new restrictions on immigration or mass deportations would be costly and weigh on economic growth. The statements come from organizations ranging from the Associated General Contractors of America to the National Retail Federation and the National Restaurant Association.

- The businesses have issued their warning as both President Biden and Former President Trump adopt stronger anti-immigration rhetoric ahead of the November elections.

- The businesses are concerned because COVID-era changes in the labor market have left a large “hole” in the supply of relatively less-skilled workers. We describe that situation in depth in our latest Bi-Weekly Geopolitical Report, due to be published later today.