Daily Comment (May 21, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! Equity markets are taking a breather this morning. China is preparing for its CPC spring meetings. Germany bends (a little) on a Eurobond. We touch on the Fed minutes and update the COVID-19 news. The Weekly Energy Update is available, as is our most recent podcast. Here is what we are watching:

COVID-19: The number of reported cases is 5,016,171 with 328,471 deaths and 1,913,103 recoveries. In the U.S., there are 1,551,853 confirmed cases with 93,439 deaths and 294,312 recoveries.

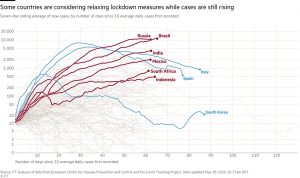

For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases and fatalities between nations, scaled by population. One chart worth noting: the virus is rapidly becoming an emerging world problem. This is partly because these nations can’t absorb the costs of lockdowns.

The virus news:

- The good news:

- Although details are sketchy, there are reports that Chinese scientists have created an antiviral using human antibodies from plasma. Drug companies have been using two tracks on the virus—vaccines and antivirals. The latter would be useful for those who have contracted the disease. At present, the drug works on animals. If it progresses, it remains to be seen if it can be made in scale. However, if true, this would be a major breakthrough.

- Two antibody stories suggest that being infected with COVID-19 grants some degree of immunity. These were animal studies but were peer reviewed.

- Vaccine research continues, with standard and novel approaches being deployed. A prototype has generated immunity in monkeys, setting the stage for human testing.

- Broad lockdowns do prevent the spread of the virus but at high (and unsustainable) costs to the economy. As we learn more about the virus, scientists are analyzing what behaviors are risky and which are safer. One behavior that stands out as being risky is mass gatherings, events that put lots of people in close contact, e.g., sporting events (except for Marlins games), concerts, large church gatherings, mass transit, etc. Studies from Germany suggest that curtailing these events significantly reduces the spread.

- The bad news:

- Chinese doctors dealing with a new outbreak in the northern provinces of Jilin and Heilongjiang report that COVID-19 appears to be mutating. Compared to what was observed in Wuhan, patients appear to be asymptomatic longer, which facilitates the spread of the disease. At the same time, they are reporting fewer cases of widespread organ problems; instead, they are seeing the more serious cases concentrated on lung issues.

- Although children have mostly been spared from the worst of COVID-19, there are rare cases where a few children suffer from severe inflammation. Here is what to look for.

- A Chicago area auto plant was forced to close soon after reopening after a supplier closed. Another plant in Michigan closed as a worker tested positive for COVID-19. We continue to closely watch Mexico’s return to work, which will be critical for the auto industry.

- The head of the CDC warns of another uptick in infections later this year.

- The experience of the polio vaccine offers a cautionary tale for the eventual COVID-19 vaccine. After Jonas Salk developed the vaccine, a number of drug companies licensed the process to distribute it to the public. Sadly, one of the drug companies made a serious error. The Salk process involved a vaccine that used dead polio viruses. The drug company in question inadvertently failed to kill the virus; instead of sending out a vaccine, it sent out live polio viruses. The company sent out 165k vials of the tainted vaccine which not only infected some of those who received it, but the newly infected, in some cases, passed it on to other family members. As one would expect, there was a great rush to distribute the vaccine which likely contributed to the error.

- Although this story has been mostly lost to history, we doubt the drug companies have forgotten. If they don’t get some protection from lawsuits, they will be very careful in testing the vaccine before distributing, which will inevitably slow its dispersal.

- At the same time, the news of a vaccine will raise the clamor for distribution, which will increase the odds of a mistake. Given the rising skepticism about vaccination, in general, an error would have serious ramifications.

- On this topic, the EU has been slow to spend on vaccine research, increasing the chances it will be in the back of the line when the eventual vaccine is distributed.

- Vaccine nationalism is another risk. The moral quandary of vaccine distribution will become a problem at some point. Discussing how we should distribute the vaccine once it emerges would make sense.

The policy news:

- Earlier this week, Treasury Secretary Mnuchin and Chair Powell testified before Congress. Although the media has mostly focused on the “compare and contrast” between the two testimonies (Mnuchin was upbeat, while Powell pushed for more fiscal stimulus), the most critical part we found was that the Treasury secretary indicated that his department was ready to “take losses.” One of the unknowns has been that as the Fed’s balance sheet expands to accommodate its backstops, the central bank is really not able to take losses. If it does, it will eventually need to be recapitalized by the Treasury. Mnuchin admitted that this will be the case.

- The Fed minutes were no surprise; the minutes from the late April meeting showed a Fed that remains deeply concerned about the long-term changes coming from the current downturn. The FOMC is also committed to deploy all its tools to deal with the impact of the slowdown on financial markets. The signal is clear—no one will likely be refused liquidity aid. There was also some discussion of returning to guidelines to signal to the markets when extraordinary aid would be curtailed, perhaps a growth level, or unemployment rate. We suspect this idea is coming from the hawks.

- Speaker Pelosi is working on revamping the small business lending program. The Paycheck Protection Program, put together in haste, has suffered serious flaws. Companies and non-profits that probably didn’t need the support got it, while small firms that needed it were denied. Banks were unsure how to make loans, so they concentrated on existing relationships. Small companies became afraid they would be audited; the short time frame to use the funds has discouraged firms from taking the loans. The fact that Congress is taking a second swing at this is good news.

- Meanwhile, the Senate continues to slow walk the recently passed House bill. Majority Leader McConnell (R-KY) has indicated that enhanced unemployment benefits won’t be extended. These benefits have been controversial; although welcomed by households, the benefits, especially outside the coastal urban areas, often exceed what employees earned on their jobs. Thus, they have an incentive to avoid finding new employment.

- Although we are on the record as forecasting deglobalization, the fact remains that reversing the trend of the past four decades will not be easy. Companies have become adept at managing far-flung supply chains that lower costs. Getting them to “come home” will be hard and probably require incentives. Economic advisor Kudlow floated tax breaks for firms that relocate back to the U.S. as one idea to foster reshoring. Additionally, we are seeing examples of the government supporting reshoring by contract distribution.

The finance news:

- There is an old saying that the inverse of a supply chain is a payments chain. In other words, as goods and services flow one direction, payments flow the other. This situation is becoming clear in real estate. Retail firms and restaurants, which often lease space, are dealing with collapses in revenue. They are, in turn, asking for rent relief from their landlords. Landlords, understandably, are cool to the idea. Still, as landlords face these calls and, in some cases, face tenants who go out of business, they are seeking relief from bondholders who often own bonds tied to real estate. We continue to watch carefully for “holes in the dike” that are not filled by policymakers. Real estate is an area we are monitoring closely.

- Delinquencies on credit cards are rising as well.

- The U.K., for the first time ever, sold gilts that priced at a negative yield. Buyers are expecting the BOE to increase QE and thus buy these bonds at a higher price.

- Argentina is preparing for its ninth default.

- The WSJ has a good article about the stresses seen in the financial system in March. It was those stresses that, in our opinion, led to the downturn. In March, it became apparent that the economy was facing three threats: the virus, the collapse in oil prices and the freezing of the financial system. This report offers detail on what occurred.

- The Treasury has reintroduced the 20-year T-bond; the first action was well received.

The economic news:

- As the economy tentatively reopens, airlines are reporting a rise in bookings.

- As border restrictions rose, farmers, especially vegetable and fruit growers, found that their immigrant labor force was disrupted. In the U.S., farmers were able to receive selective visa relief. In Germany, the solution was airlifts. The food industry is also looking at robotics as a long-term solution.

The foreign news:

- In a surprising move this week, Germany decided to support a common Eurobond to fund a €500 bn recovery fund. This is a significant move, and a reversal of Germany’s historic stance. It’s not a done deal. As true of all such measures, passage requires consent from all 27 members of the EU. It is quite possible that other northern European nations (e.g., Netherlands, Finland and Austria) may scuttle the proposal. On its face, it would appear this decision would be unpopular with conservative Germans. However, German conservatives have generally signed off on the arrangement due to its limited scope, suggesting the real problem isn’t a specific mutual Eurobond, but a general one. So, think of this deal as being similar to a municipal bond for a specific project. Of course, once a bridge is crossed, doing it again is easier. Today, the Eurobond may be limited; tomorrow, maybe not.

- Markets liked the proposal; Italian and Greek yields fell on the news.

- Despite the historic concession, Italy warns it isn’t enough.

- In the U.K., for the first time in centuries, Wales is putting up barriers to English citizens over London’s virus policies.

- China news:

- The CPC’s spring meetings, the National People’s Congress, begins tomorrow. We are watching closely to see the GDP target (if there is one issued). The Chinese economy is recovering but also clearly hurting as well. Unemployment is up, which is a threat to any government. Beijing has been parsimonious with stimulus spending; business is pushing for more help. Additionally, the military, facing threats from the U.S., wants a bigger budget. The most likely path of new spending will be infrastructure.

- One reason for China’s reluctance to spend could be fears that debt is becoming unmanageable. China’s gross debt has hit 317% of GDP.

- Hong Kong policy will also be discussed. Although it isn’t getting much coverage in the U.S. media, conditions in Hong Kong are deteriorating. In the legislature, pro-Beijing groups forcibly took control to pass bills. There are worries about a return to mass protests this summer.

- Although there was a slow start, China appears to be ramping up purchases of agricultural goods, a key element of the Phase One deal.

- The U.S. is adjusting policy on Chinese IPOs, making it harder for Chinese firms to list on U.S. markets. This decision is opening the door for London exchanges. Additionally, the Senate passed a bill increasing scrutiny on Chinese firms, requiring U.S. style audits to remain listed.

- Technology is becoming a battleground with China. The U.S., as noted above, is stepping up efforts for reshoring; technology is becoming a focal point for these efforts. In addition, the S. is clearly trying to use China’s lack of chip production against it. This is leading Beijing to try to fill this gap by building an indigenous semiconductor industry, including its firms building capital for future investment. Meanwhile, the U.S. is employing Taiwan as a “tip of the spear” against the Chinese tech industry. Needless to say, China is taking this action as a threat and is increasing its military posture against Taiwan. Taiwan’s President Tsai Ing-wen started her second term yesterday; the U.S. congratulated her and this made Beijing mad.

- Meanwhile, U.S. attitudes toward China are deteriorating as well.

- China is applying tariffs on Australian barley in response to Canberra’s insistence on an international investigation of Beijing’s handling of the coronavirus outbreak. Australia is threatening to take China to the WTO.

- The CPC’s spring meetings, the National People’s Congress, begins tomorrow. We are watching closely to see the GDP target (if there is one issued). The Chinese economy is recovering but also clearly hurting as well. Unemployment is up, which is a threat to any government. Beijing has been parsimonious with stimulus spending; business is pushing for more help. Additionally, the military, facing threats from the U.S., wants a bigger budget. The most likely path of new spending will be infrastructure.

Brexit: Westminster announced its tariff plans for the EU if a Brexit deal is not reached. Meanwhile, PM Johnson sketched out a trade deal with the EU, similar to the one the group struck with Canada. Brussels is not happy with that proposal. Positions between the two sides are hardening. And, quietly, the Johnson government is admitting there will be customs checks at the shore of the Irish Sea for trade going to the British Isles.

Libya: The civil conflict in Libya continues to rage, causing widespread hardship. For the past year, Gen. Khalifa Hifter, who has support of the Gulf States and Russia, has been expanding his area of control, from east to west, heading toward Tripoli. However, over the past week, Hifter has suffered some significant setbacks as U.N. backed forces centered in the east have seized a key airfield and taken control of two cities. As turmoil increases, we could see Libyan oil exports fall and there may be a rise in refugees to Europe.

Turkey: The TRL has been under pressure for months due to falling reserves and rising inflation. Under normal circumstances, Turkey could petition the U.S. for help; the Fed has been remarkably generous in providing liquidity to nations to ensure ample dollar liquidity. However, Ankara has fallen out of favor with the U.S. for its treatment of the Kurds and for accepting delivery of a Russian-built S-400 missile system. So, as its reserves dwindle, it is facing increasing pressure to either (a) raise interest rates to stop the outflows, (b) ask the IMF for help, or (c) find help elsewhere. The first two options will entail pain, so Turkey went with the third option, getting a boost in its swap line with Qatar. Qatar is on the outs with other GCC nations and Turkey has been supportive, keeping troops there to discourage the other GCC nations from military adventurism. It looks like it has been rewarded for its efforts with Qatar.