Daily Comment (May 22, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and Happy Friday! As a reminder, financial markets will be closed on Monday, so the next Daily Comment will come to you on Tuesday. Hong Kong tensions are depressing global equity markets. We cover the crackdown on Hong Kong. As usual, we also update the latest on COVID-19. Here is what we are watching:

COVID-19: The number of reported cases is 5,125,612 with 333,382 deaths and 1,964,097 recoveries. In the U.S., there are 1,577,758 confirmed cases with 94,729 deaths and 298,418 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases and fatalities between nations, scaled by population.

The virus news:

- The good news:

- The CDC has confirmed that COVID-19 primarily spreads from person-to-person and not from contaminated surfaces, and our pets are not a vector either. Instead, the virus is transmitted by droplets from people, and dense congregations of people are risky.

- The U.S. is investing $1.2 bn into a potential vaccine that is being researched jointly by Oxford and AstraZeneca (ANZ, 55.28). Their vaccine candidate is being tested in humans.

- The bad news:

- New research from Imperial College, London indicates that most of the U.S. has a R0 that exceeds 1, meaning that the rate of transmission is still prone to rise.

- Brazil is becoming the world’s hot spot for the virus.

- The head of the government’s Substance Abuse and Mental Health Services Administration warns that another round of lockdowns would pose risks to American’s mental health.

The policy news:

- The Fed continues to warn that there are significant risks for the economy. Chair Powell described the current downturn as “without modern precedent.” We would concur. Vice-Chair Clarida agreed and warned that the U.S. faced a problem of deflation, not inflation. He also said that rate guidance might not return until fall—in March, the Fed refrained from publishing a dots chart.

- As noted yesterday, Congress is working to address flaws in the small business support measures. What is unknown is if they will be able to stem a likely jump in business failures. Sadly, the Senate adjourned without approving any adjustments, meaning nothing will occur until next month.

The finance news:

- Chinese entities have been borrowing in dollars over the past few years. A court case in Beijing is considering whether “keepwell bonds” offer protection to foreign dollar lenders. A state borrower tied to Peking University is defaulting on debt and the school is refusing to back the debt. If the court finds in favor of the university, it will raise doubts about the safety of about $100 bn of these keepwell bonds currently outstanding.

- Earlier this week, the BOE admitted it was considering negative policy rates. British banks warned against such measures, which tend to narrow net interest margins.

- On banking, the head of the IMF, Kristalina Georgieva, suggested that all banks suspend dividends and buybacks to rebuild capital bases.

- Meanwhile, in Europe, one of the problems of the monetary policy has been revealed. A central bank can lower the cost of funds for banks, but doing so doesn’t necessarily mean banks will lend. This is what is known as ‘pushing on a string.’ Borrowers in Europe are complaining that banks are not lending despite strong incentives from the ECB.

- In a sign of how desperate corporate borrowers are becoming, firms are aggressively borrowing against assets. Over the years, such borrowing has become rare as credit standards have become lax. Now that fear has returned, banks are demanding collateral, although taking the collateral is fraught with risk.

- Collateralized debt obligations (CLO) are coming under scrutiny again as risky borrowers are struggling to service their debts due to the downturn. CLO’s are created through financial engineering and create various classes of debt based on the primacy of the payment stream. Usually the first lender in line gets a high rated debt instrument with a low rate; at the back end, a much higher rate is offered. However, as we saw in 2008, a portfolio of risky borrowers is still risky regardless of how the payment line is structured. As we have been saying all along, we are watching for ‘holes in the dike’ of the financial system that the Fed fails to plug. This could be another one.

The economic news:

- There is growing evidence that the economy is bottoming. We are seeing data in both Europe and the U.S. that support the idea that conditions are bad, but not getting worse. That usually means the recession will end once the trough is met. If so, this will be, perhaps, the deepest but shortest recession on record.

- As businesses reopen, the new conditions for conducting operations is becoming apparent. Costs will undoubtedly rise as firms need to support social distancing and enhanced sanitation. Who bears the costs of these measures will be key.

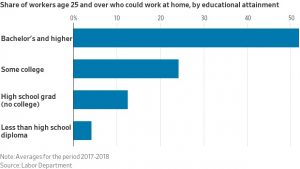

- One of the effects of the stay-at-home orders is the discovery by firms that some employees are effective away from the office. A number of firms are indicating that work from home rules will be relaxed, allowing some workers to continue to work from home on a regular basis. In general, the ability to work from home appears to be a function of education.

The foreign news:

- China…lots of news:

- As we noted earlier this week, the National Party Congress meetings begin today. However, policy changes have been announced already, highlighting the ‘rubber stamp’ nature of these meetings. It’s not that the meetings aren’t important, it’s just that the approval of policy is not dependent on the votes of the congress.

- The most market moving event was the new security law for Hong Kong. Beijing has been steadily undermining the “one country, two systems” that was put in place when the U.K. relinquished the colony back to China in 1997. However, under Xi, the undermining has accelerated. Here are the details and ramifications:

- China may base security agencies directly in Hong Kong. This would essentially end the independence of Hong Kong’s police. Even if Beijing doesn’t put offices in place, the mere threat will probably lead the local forces to do China’s bidding.

- The new proposal outlaws sedition, treason and succession. Since China follows the “rule by law,” these factors will be defined so broadly that they will be used to prevent anything the CPC wants banned.

- It is hard to see how Hong Kong’s relative independence will be maintained. We all knew that the two systems fiction would end in 2047 when the 50-year deal China signed with Britain expired. However, this is happening much faster than expected.

- Widespread protests are expected, and we will be watching to see how the local police respond.

- Perhaps the bigger issue is how does the world (read: U.S.) respond. In a rare bipartisan moment, the Senate is calling for sanctions in response. President Trump offered an unspecific response as well. The White House is in a delicate spot; if calls for a crackdown escalate, the Phase 1 trade deal could be at risk. It is also clear that Chairman Xi is making the control of Hong Kong a major priority. If the U.S. pushed back hard, personal relations between President Xi and President Trump could fray. Given how tensions are rising, the end of their personal chemistry may be inevitable.

- The end of Hong Kong as a semi-independent entity will have significant financial market ramifications as well. The financial world has tended to treat Hong Kong as a developed world enclave for financial matters. If this ends, look for talent and capital to flee the former colony.

- As we noted yesterday, increased scrutiny of Chinese listed companies is rising. The Chinese search engine Baidu (BIDU.O, $110.03) indicated it was considering delisting from NASDAQ (NDAQ, 113.99). The Committee on Foreign Investment in the U.S. (CIFUS) told Esko Bionics (EKSO, 3.04) to break up a joint venture with Chinese investors. The firm was making exoskeleton products that ostensibly allow people with disabilities to use their limbs, but it could also create ‘super-soldiers’ who could wear the exoskeletons to increase their strength and stamina. We continue to closely watch the delinking between the two countries for its impact on individual companies.

- In light of the pandemic, China has dropped its GDP target. In some respects this wasn’t a surprise. Given the severe decline in growth, no target this year made sense, although there was speculation they might opt for a multi-year target. Dropping the target is important, however. As we have noted before, China can achieve any GDP number it wants; it merely has to increase debt growth and invest the proceeds to hit the target. By dropping the target this year, it may be signaling that Beijing finally intends to deal with the debt overhang. This is bad news for commodity producers; high Chinese growth has been key to supporting prices. Although we do expect some degree of stimulus, not having a target does relax the need for stronger growth.

- The U.S. has sold $180 mm of advanced torpedoes to Taiwan.

Odds and ends: The U.S. has indicated it will withdraw from the Open Skies Treaty. This treaty allowed commercial airliners to film the ground to see if nations are adhering to treaties. Russia has been violating conditions for some time, so the U.S. decided to end its participation. The U.S. does plan to have new arms talks that would include China. Tensions between Greece and Turkey are rising again. Turkey is constructing a nuclear power plant in southern Turkey which is worrying Greece. Turkey is also increasing overflights over the eastern Aegean Sea.