Daily Comment (May 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an interesting observation on the Chinese market by JPMorgan CEO Jamie Dimon. We next review several other international and US developments with the potential to affect the financial markets today, including a new program in South Korea to promote its semiconductor industry, data pointing to a falling population in Europe, and approval for new spot cryptocurrency funds in the US.

China-United States: JPMorgan CEO Jamie Dimon admitted on Thursday that part of the firm’s investment banking business in China has “fallen off a cliff” in recent years. The statement is important because Dimon has been a poster child for the US business elites in technology, finance, and other industries who have vocally resisted US-China decoupling in the interest of national security. His statement suggests JPMorgan may now be suffering from the same abusive Chinese economic policies that have helped spark the calls for decoupling.

- Those policies include China’s long-standing effort to attract top foreign firms, learn from them, and then strangle them while the government helps promote China’s own “national champions.” If that’s what is happening, it seems that Dimon and the rest of JPMorgan’s leadership should have seen it coming.

- But even if that’s not happening yet, China’s new goal to become a “financial superpower” suggests it could happen soon. The new goal calls for China to clean up, broaden, and deepen its financial markets to support cutting-edge industries such as electric vehicles and semiconductors. The plan also calls for China to foster several of its own world-class investment banks, which would naturally take Chinese market share from foreign firms such as JPMorgan.

Russia-Finland-Lithuania: The Russian defense ministry’s website this week temporarily showed a plan to unilaterally move Russia’s maritime border in the Baltic Sea at the expense of Finland and Lithuania. Although the plan was quickly deleted, Finnish and Lithuanian officials condemned it as a serious provocation or hybrid attack. At any rate, the incident could mean the Kremlin is becoming more confident in provoking the North Atlantic Treaty Organization as Russia regains momentum in its invasion of Ukraine while NATO members slow their support.

Tunisia: Autocratic President Kais Saied has launched another crackdown on political dissent ahead of elections planned for later this year. The clampdown appears to focus on lawyers, journalists, and social activists, some of whom have already been jailed. This raises the risk of social upheaval in an important energy producer and conduit for African migration into Europe.

South Korea: The government yesterday unveiled a plan to provide about $19 billion to Korean manufacturers of non-memory semiconductors. Aimed at chipmakers such as Samsung and Hynix, the money will subsidize the construction of new facilities to produce cutting-edge processors. The program is yet another example of how countries around the world are now embracing “industrial policy” to incentivize the domestic production of key goods.

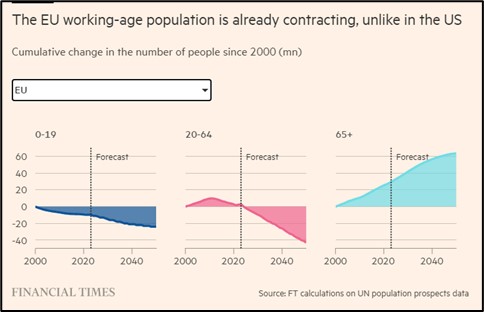

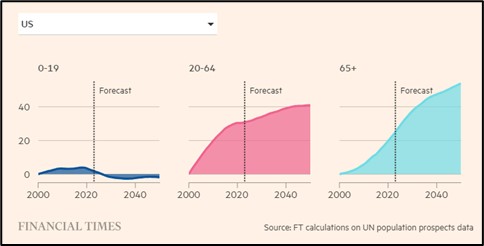

European Union: New data suggests Europe’s population may have already started a long, drawn-out decline, about two years earlier than demographers had anticipated. The expected decline largely reflects falling birth rates. Until now, the rising participation of immigrants and women in the labor force has offset the accelerating loss of older workers. However, soon those factors will not be enough, and the EU’s total work force will begin an extended decline that will make it harder to achieve economic growth.

France-New Caledonia: On an emergency trip to France’s overseas territory of New Caledonia, President Macron agreed with local leaders to suspend a new law that would have expanded voting rights for non-indigenous people. The new law has sparked more than a week of rioting by indigenous Kanaks on fears that it would dilute their political power and make it harder to eventually win independence. As of this writing, it is not clear whether Macron’s suspension of the law will quell the violence.

US Cryptocurrency Market: In a surprise move yesterday, the Securities and Exchange Commission approved the US’s first exchange-traded funds for spot ether, the second-biggest cryptocurrency after bitcoin. The 10 or more asset managers that applied to offer the ETFs now must have their individual funds approved before they can offer them to the public. Given that existing futures-based ether funds haven’t garnered much interest, it is unclear whether any of the upcoming spot ether ETFs will attract much buying.

US Sports Market: Yesterday, the National Collegiate Athletic Association and five of the nation’s top athletic conferences agreed to drop their century-old policy that saw college athletes as strictly amateur and not entitled to share in the revenue they generate for their school. The deal, which settles a lawsuit filed in 2020, follows a separate settlement from several years ago in which athletes gained the right to profit from their name, image, and likeness. A final deal will allow colleges and universities to directly pay their college athletes.