Daily Comment (May 27, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. It’s mostly a down day for risk assets in the U.S. this morning. Our coverage begins with economics and policy, with a crypto update to follow. China news is next. Our international roundup comes after, and we close with pandemic news.

Economics and policy: A problem may be developing in the monetary plumbing.

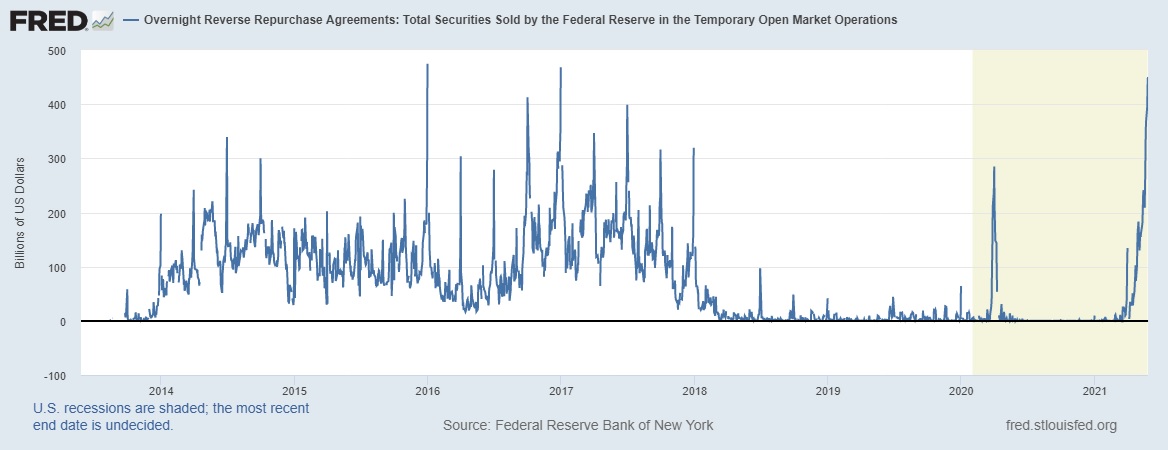

- We have been watching a development in the money markets recently; the Fed has needed to conduct rather aggressive reverse repo operations in recent days.

In these operations, the private sector is putting money on deposit at the prevailing fed funds rate. The current target is 0.125%, but this onslaught of funds has left the effective fed funds rate at 0.06%. There are several factors at work. First, the Treasury has been issuing fewer T-bills, which can also absorb these funds. Second, QE is taking Treasuries and mortgages off the market and replacing them with cash that the banks don’t need. Third, banks are not lending; bank loans and leases have declined compared to last year for the past two months. Thus, banks don’t have a good outlet for cash. Here is where the problem comes in. The closer fed funds fall toward zero, the greater the pressure on money market funds. The Fed can address this by tapering or manually raising the fed funds rate. Tapering would spook the financial markets but increasing the fed funds rate smacks of subsidizing banks for not lending. Although we don’t expect a problem to develop, the rise in reverse repo activity does suggest stress and bears watching.

- Another item we have been watching is which political party goes toward MMT and jettisons the “pay fors” for spending. The GOP appears to be leaning in this direction, as the most recent proposal for infrastructure spending does not insist on raising revenue.

- One of the key differences between agriculture commodities and “hard” assets is the supply response to rising prices. In China’s hog market, last year’s African Swine Fever crisis led to a dearth of pigs. As prices rose, farmers responded by rebuilding herds. Now, prices have fallen so much that farmers are holding pigs off the market, hoping for better prices. This decision has led to a glut of “heavy” hogs. At some point, the animals will have to be brought to market, likely depressing prices further. Meanwhile, miners have been slow to respond to high prices, which is continuing to support base metals.

- Warehouses struggling to find workers and improve productivity are increasingly automating operations. Once jobs are automated, it is highly unlikely they will return.

- On the policy and political front, opposition to higher corporate taxes is growing. Manchin (D-WV) is showing he is in no hurry to get legislation passed. President Biden looks like he will be willing to extend the Memorial Day deadline too.

- There is evidence that immigrants are increasingly moving to the middle of the country.

- Tesla (TSLA, USD, 619.13) is paying for semiconductor chips in advance and is considering building its own foundries.

- The D.C. Attorney General is suing Amazon (AMZN, USD, 3265.16) for illegally raising prices.

- If you are in New Jersey or the vicinity, you might want to go to the docks. The world’s largest container ship, the Marco Polo, is docking there.

- And, drug testing firms report that an increasing number of applicants are testing positive for marijuana.

Cryptocurrencies: China’s crackdown on bitcoin mining is gathering momentum. As many things do in China, it originated from Beijing. The last five-year plan has references to bringing emissions under control. Bitcoin mining runs against that goal, prompting disfavor at the highest levels of the CPC. That message is now moving its way into provincial and municipal governments who are starting to restrict mining activity. Houbi (1611, HKD, 15.80) has indicated it would no longer sell mining equipment into China and cease operating its cryptocurrency exchange. Bitcoin is a bit weaker this morning.

China: It’s official; the era of engagement is over.

- Although the comments didn’t garner much attention, Kurt Campbell, the administration’s coordinator of the Indo-Pacific, admitted yesterday that engagement with China is over and that relations between the two powers are now about competition and rivalry.

- PLA officers have refused to meet their American military counterparts recently, highlighting rising tensions between the U.S. and China.

- At the same time, U.S. and China trade officials held their first virtual meeting yesterday. There were few details available. China did ask for tariffs to be lifted, but we think this is part of all trade meetings. Although it wasn’t discussed in the press, we would also expect that the U.S. side noted China is woefully behind in its commitment to buy U.S. goods. There was speculation that the Biden administration would reverse the Trump era trade policies with China, but so far, the new government has left most measures in place, suggesting that policies are less about personality and more about trends.

- U.S. and EU officials are discussing relations with China, among other items. In some respects, Chinese officials are making it easy for the U.S. to cooperate with the EU against China. China’s Foreign Minister Wang, in response to the charges of the Uighur genocide, noted that “Our European friends know what is genocide,” essentially charging Europe with engaging in similar activities.

- China’s trade relations with Australia have been deteriorating for some time. Australia is managing to find new trading partners, reducing the impact of the loss of Chinese exports. The inability of China to use trade to force changes in Australia’s behavior is evident in reports that Canberra is reviewing a China port lease at Darwin, which is near a U.S. military base.

- U.K. officials are showing a degree of caution towards China’s trade too.

- We note a rising level of concern in China over financial stability. We suspect officials are worried about importing inflation from the U.S. However, this threat could be mitigated as the CNY appreciates. Although a rising exchange rate usually acts to dampen domestic inflation, in China, the effect of appreciation is rather modest.

- We also note that China is trying to quell commodity price inflation, and Chinese officials have warned that a stronger exchange rate can’t completely offset the effects of higher commodity prices. If China is serious about reducing commodity price inflation, the only remaining tool is reducing demand. We doubt this will be enacted.

- Tencent (TCEHY, USD, 78.73) has been ordered to create a financial holding company. Like other Chinese tech firms, the company has been increasing its activity in financial markets in recent years. Chinese regulators want to separate those activities from the overall business. By doing so, efficiencies will be lost, but the financial system will be less prone to risk.

- China is drawing up plans for hydroelectric projects in the Himalayas that would dwarf the Three Gorges Project. These projects in Tibet will raise downstream concerns, especially in India.

- As we saw with Apple (AAPL, USD, 126.72) last week, Tesla (TSLA, USD, 622.33) announced it would store customer data in Chinese data centers, giving the government access to the information. The electric car company faced criticism from Beijing on concerns that the data it was collecting was going back to the U.S. Beijing has restricted the use of Tesla cars by military personnel. This decision should ease concerns in China, but given the state of current relations, raise them in Washington.

- Jonnie Moore, the U.S. commissioner on International Religious Freedom, has been sanctioned by China.

International roundup: The EU and Switzerland are at loggerheads, and the business class is winning Brexit.

- Switzerland and the EU have ended talks about codifying relations between the two nations. Currently, a myriad of rules govern trade and investment. The EU wanted to formalize these regs, but the Swiss didn’t seem all that interested. EU officials warn that without unifying these rules, relations will eventually deteriorate.

- The USS Ronald Reagan has moved from the Far East to the Indian Ocean to assist in the withdrawal of U.S. troops from Afghanistan. For now, there are no carrier groups in the Far East, highlighting America’s need to reduce its focus on the Middle East.

- Brexit was based, in part, on a bit of strategic ambiguity. Business supporters wanted to be freed from EU rules to turn the island into the “Singapore on the Thames.” Populists wanted to protect their home markets from foreign competition, either from goods or immigrants. The U.K. and Australia have come to a trade agreement, and U.K. agriculture is fuming, realizing it will now be competing with highly industrialized Australian farming and ranching. If the business-friendly trend continues, the political fallout will be interesting to observe.

- The Biden administration wants to curtail immigration from Central America by encouraging U.S. firms to outsource business to those nations.

- Syria held presidential elections; it’s no surprise who won.

- Colombia’s President Duque has a negative approval rating of 76%, the poorest reading on record.

- Ukraine wants to join NATO. It would be a “red line” for Moscow and isn’t likely to happen.

COVID-19: The number of reported cases is 168,497,846 with 3,500,348 fatalities. In the U.S., there are 33,191,164 confirmed cases with 591,957 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 359,849,035 doses of the vaccine have been distributed with 289,212,304 doses injected. The number receiving at least one dose is 165,074,907, while the number of second doses, which would grant the highest level of immunity, is 131,850,089. The FT has a page on global vaccine distribution. The Axios map shows that only one state, Wyoming, has rising cases.

- The calls for additional investigation of the Wuhan virology lab are growing. U.S. health officials have recommended such action, and the president is ordering the intelligence community to look into the issue. The incoming Biden administration halted a Trump-era investigation but clearly has reversed itself. The media has also moved on this issue. Facebook (FB, USD, 327.66) will now allow discussions on the Wuhan leak topic. Like many things in our current situation, the Wuhan leak theory became politicized. Instead of investigating potential signs that something may have gone awry at the Chinese facility, the position on it became political signaling.

- As investors, it’s important not to reach premature conclusions. We have noted that on several podcasts, the host, usually from the media, would dismiss the Wuhan theory, only to have the researcher suggest that we really didn’t know for sure what happened.

- It is also important to note that we probably will never know for sure. There are two reasons. First, China isn’t going to allow an investigation it can’t control. Beijing sees no benefit in foreigners pointing out their failings. Second, it is very difficult to establish where a pandemic originates. The origin of the 1918 Spanish Influenza pandemic is still not completely known. The first SARS outbreak was only linked to civet cats after years of research (ironically, this fact was established, in part, by researchers tied to the Wuhan Virology Lab).

- There is growing concern that the Tokyo summer Olympics may not be possible. The U.S. has issued a “do not travel” advisory, and prefectures in Japan are asking for emergency lockdown orders to be extended.

- One of the “known/unknowns” about COVID-19 is if one contracts the disease and survives, does that event grant immunity. We know that with certain diseases, like measles, it does. We also know that getting influenza only offers modest protection from getting another bout. Recent research on COVID-19 suggests that getting the disease does give lasting immunity in some cases. Some of those who are infected don’t have a strong immune response, and some who have been vaccinated may need boosters. And, new variants may make natural immunity less effective. Yet, if some who have gotten the virus are immune, we may be closer to herd immunity than the vaccination data alone would suggest.

- There are currently 84 confirmed cases of reinfections, with three fatalities and 58 known recoveries. The most recent cases have mostly been in Brazil, which is dealing with a new variant.

- We continue to watch developments on the anti-viral front. As David Perron of the St. Louis Blues can attest, being vaccinated doesn’t prevent a person from contracting the disease. Having antibody treatments can prevent a person who contracts the disease from suffering a more serious case. A new treatment from Vir Biotechnology (VIR, USD, 45.76) and GlaxoSmithKline (GSK, USD, 38.71) has shown promise.

- Across the developed world, pharmaceutical firms are pushing back against a proposal to lift patent enforcement on COVID-19 vaccines.

- The COVAX program to distribute vaccines to the emerging world has mostly been a failure. The reason is generally that nations tend to take care of their own citizens first.

- The EU intends to fine AstraZeneca (AZN, USD, 56.54) billions if it fails to deliver promised vaccines.

- The recent outbreak in Brazil has hit expectant mothers and newborns especially hard.