Daily Comment (May 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of how right-wing parties have finally consolidated power in the Netherlands. We next review several other international and US developments with the potential to affect the financial markets today, including increased signs that the Bank of England may be inadvertently laying the groundwork for new financial instability and a discussion of US polling trends as the nation begins to focus more on the November elections.

Netherlands: After months of post-election horse trading, a right-wing coalition has nominated career civil servant Dick Schoof to be prime minister. Formerly, Schoof was chief of the Dutch intelligence agency, the top civilian in the ministry of justice, and the head of the national immigration service. That made Schoof especially attractive to Geert Wilders, the anti-immigrant firebrand whose far-right Freedom Party won the most votes in the November election. Wilders was forced to abandon his goal of becoming prime minister to secure a right-wing coalition.

- With Schoof in place as prime minister, the Freedom Party will rule in coalition with the conservative New Social Contract, the populist Farmer-Citizen Movement, and the conservative liberal VVD party of outgoing Prime Minister Mark Rutte (who is expected to become the new head of the North Atlantic Treaty Organization).

- Among its chief aims, the new government plans to cut immigration, reduce foreign development aid, freeze government salaries, and roll back some environmental policies.

United Kingdom: Upward pressure on short-term interest rates has raised concern that the Bank of England is being too aggressive in its quantitative tightening program. Unlike most other major central banks, the BOE isn’t just letting its government bond holdings run off as they mature, but it is also selling them outright. The volatile, surging short-term rates are a concern because they could portend a broader financial crisis at some point.

Russia-Ukraine War: French President Macron said he will approve Ukraine’s use of its French-supplied Scalp cruise missiles to strike targets in Russia, so long as they are used against sites that have launched attacks on Ukraine. The move by Macron, who has also supported sending North Atlantic Treaty Organization troops to Ukraine, is another small step raising the risk of an eventual direct clash between NATO and Russia. Steps on the Russian side include increasingly aggressive sabotage and influence operations by Russian intelligence agencies.

- In the latest case of Russian activity, French and Belgian police today searched the offices of an employee of the European Parliament on suspicion that he has been working for the Russians.

- In any case, President Biden and other NATO leaders continue to impose tough restrictions on the weapons they have provided to Ukraine in order to limit the risk of escalation.

Taiwan: Despite popular protests, the opposition-controlled legislature has passed legislation giving it increased control over newly inaugurated President Lai and his government. The measures give the legislature extensive authority to investigate government policies and projects, including powers to summon military officials and review classified documents.

- The measures, passed by the relatively pro-Beijing Kuomintang and the Taiwan People’s Party, could heavily hamstring the independence-minded Lai as he seeks to strengthen Taiwan’s defenses against a potential Chinese invasion or blockade.

- Of course, it is highly possible that the opposition effort to tie Lai’s hands was supported by Beijing.

North Korea-South Korea: To retaliate for pro-democracy leaflets released over North Korea by activists in the south, Pyongyang has reportedly sent over 150 balloons carrying garbage and animal feces into South Korea. Of course, the North Koreans have much more dangerous weapons that they could send southward. Nevertheless, the incident illustrates how the relationship between North Korea and South Korea just keeps getting crappier (sorry).

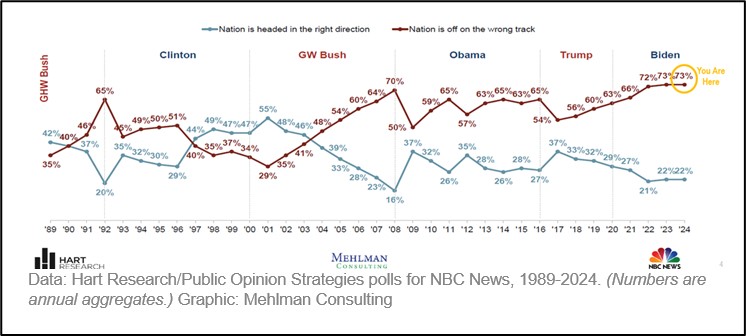

US Politics: A new slide deck by pollster Bruce Mehlman contains an interesting graphic showing the share of voters who think the US is “on the wrong track” has now reached a record high of 73%. Perhaps most interesting, the graphic shows that percentage has actually been climbing since 2002, albeit with a flat period during the Obama presidency.

- The 2002 date is significant because it is just about the time when the shock of China’s entry into the World Trade Organization began to be felt. That’s consistent with our view that the growing malaise and populism since then can be traced largely to the US effort to maintain global hegemony in the face of the Chinese onslaught.

- With the US trying to maintain hegemony by keeping its economy open to trade and providing the world’s reserve currency, the result was intense foreign competition for US producers, de-industrialization, and reduced opportunity for relatively less-skilled workers.

- To the extent that is true, we expect government policy in the US will likely remain populist in the coming years, no matter who wins the November election. For example, the US will likely see even more trade protectionism, industrial policy initiatives, near-shoring of production, and reindustrialization.

US Energy Industry: Oil giant ConocoPhillips has struck a deal to acquire Marathon Oil in an all-stock transaction valued at $17.1 billion. The takeover is the latest sign of sweeping consolidation in the nation’s oil and gas industry after years of capital discipline and good pricing have provided the financial resources to scrape together new assets for increased efficiency.