Daily Comment (May 31, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] Chinese equities rose sharply overnight as MSCI takes another look at adding this country’s equities to its emerging market indices. In one sense, the exclusion of China’s equities in these key equity indices is hard to justify. After all, China is an important country; its GDP is the second largest in the world and it has provided the bulk of global growth for most of this century. However, index officials are concerned about the degree of government intervention in China’s securities markets. China has put obstacles in the way of short selling. Currently, companies can, nearly without notice, suspend trading of their shares. According to media reports, MSCI is worried about this practice. It should be noted that Bloomberg is reporting a surge in short selling against the FTSE China A50 index, which trades in Hong Kong and has fewer short selling restrictions. We suspect the Xi government would like to see MSCI add Chinese equities to its indices as a sign the country is becoming developed. At the same time, the Chinese government has become increasingly uncomfortable with allowing financial markets to set prices. Although such sentiments are part of every Chinese policy plan, in practice, China seems to like market pricing until prices do something the government doesn’t like. Then, it reverts back to intervention. The recent behavior of the CNY is a clear example of China’s policy toward markets. The PBOC supported letting the CNY float in a wider range until it looked like a weaker currency was triggering capital flight. Since then, the PBOC has simply set the exchange rate. We expect MSCI to add China to its indices; after all, the company makes money from licensing, and excluding China from its indices makes those products less attractive. Unfortunately, if China is added, the indices will become affected by Chinese government’s actions.

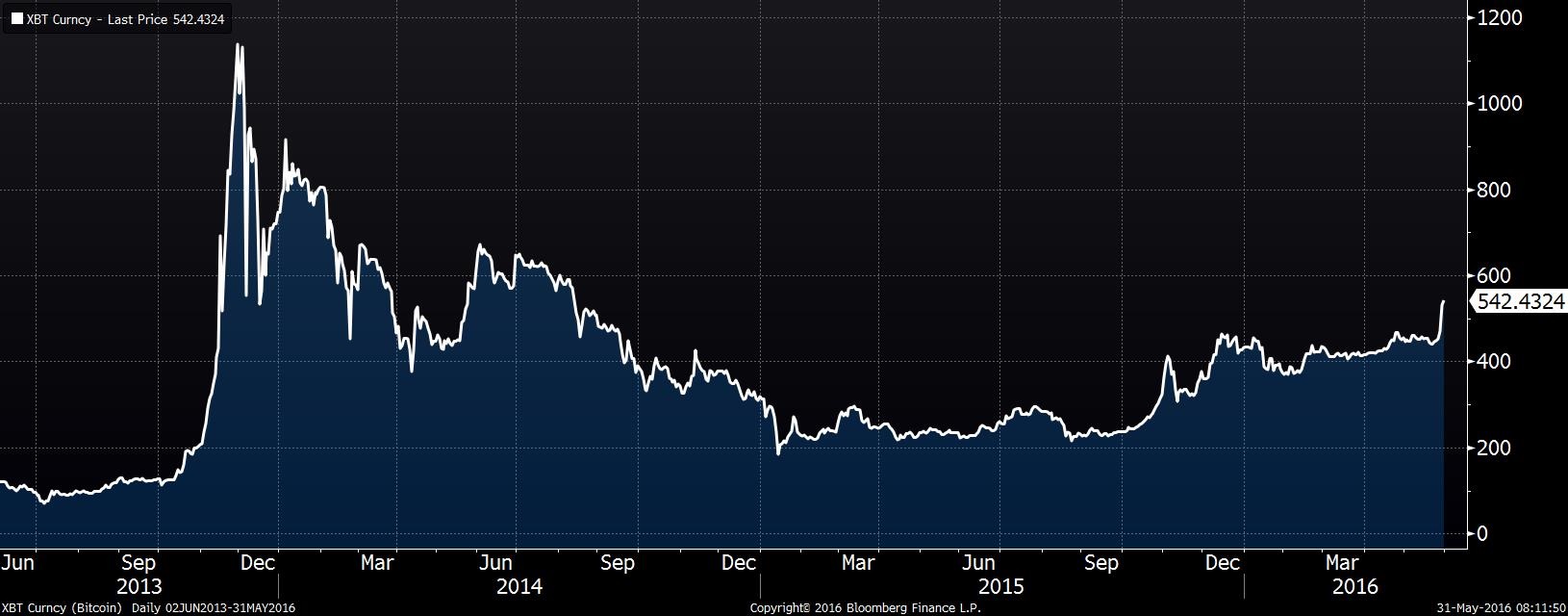

Another trend we are noting is that the bitcoin exchange rate is steadily rising and the uptrend is accelerating.

This chart shows the level of bitcoin in USD. After the 2013 spike, the cryptocurrency’s value steadily dropped into early 2015 and was mostly range bound until last autumn when prices began to rise. Over the past couple of days, we have seen a surge in value. Bloomberg, quoting the website bitcoincharts.com, notes that 90% of bitcoin trading is coming from China. We suspect Chinese investors are using the currency as one avenue for capital flight. Given the cryptocurrency’s anonymous structure, it is attractive to investors and others trying to keep their assets invisible to governments. The recent spike in bitcoin may be a signal of growing financial system problems in China.

Yesterday, the JPY weakened considerably and it is steady this morning. Now that the G-7 meeting is out of the way, we look for Japan to take steps to strengthen its economy via fiscal and monetary expansion. We expect a fiscal stimulus package of at least 1% of GDP. It will likely include actual spending and a delay of a VAT increase. On monetary policy, about the only avenue left would be to expand QE as NIRP hasn’t worked as expected.