Daily Comment (May 31, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are trading higher after the PCE price index showed that inflation continues to stay in line with expectations. In sports news, the Dallas Mavericks defeated the Minnesota Timberwolves, setting up a final’s matchup with the Boston Celtics. Today’s Comment dives deep into Thursday’s GDP report and explores reasons for our continued economic optimism. We’ll also analyze the West’s further crackdown on chip exports and offer a primer on the upcoming elections in Mexico this weekend. As usual, our report concludes with a round-up of domestic and international data releases.

GDP Breakdown: While GDP revisions confirmed a first-quarter slowdown, uncertainty lingers about whether it’s a temporary dip or a sign of more significant trouble.

- US economic growth in the first quarter was weaker than initially estimated. GDP was revised downward to an annualized rate of 1.3%, down from 1.6%. Both consumer spending and inflation were lower than previously reported, with consumer spending growth revised down to 2.0% from 2.5% and the PCE price index for the quarter coming in at 3.6%, down from the initial estimate of 3.7%. While underlying fundamentals suggest the economy isn’t in immediate danger of recession, there are signs of waning economic momentum.

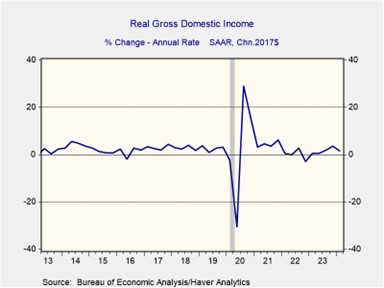

- Gross Domestic Income (GDI), released only after the second GDP estimate, confirmed potential weakness in economic output. The report showed that growth slowed from an annualized growth rate of 3.6% in Q4 2024 to 1.5% the following quarter. While both reports should theoretically reflect similar trends, they can actually tell different stories. The GDP report, which is focused on production activity, reveals a drag from declining inventories and rising imports. In contrast, GDI, which measures income earned by residents, suggests corporate profits also took a hit, contracting 1.7% in the first three months of the year, down from the previous quarter’s rise of 3.9%.

- While recent data suggests slowing growth, it’s important to consider the historical context. The past four recessions were all triggered by unforeseen events: the 2020 pandemic, the 2008 Lehman Brothers collapse, the 9/11 attacks in 2001, and the Gulf War in 1990. Hence, a slowdown doesn’t necessarily foreshadow an immediate downturn. While the economy faces challenges, we remain cautiously optimistic that it can weather these headwinds, absent any major disruptions such as a mass mobilization war, commodity supply shock, or pandemic. That said, a period of subpar growth is still a possibility for 2024.

More Export Controls on Chips: The West’s crackdown on semiconductor sales to its adversaries has been extended to the Middle East, reflecting concerns about potential leaks.

- US regulators are scrutinizing the national security implications of artificial intelligence (AI) development. As a precaution, they’ve tightened export controls on AI accelerator chips specifically for certain Middle Eastern countries. These chips are in high demand because they excel at processing large datasets while consuming less energy. The technology has become crucial for companies and governments looking to build out their AI infrastructure. Companies like Nvidia, AMD, and Intel Corp have been waiting on the sideline for approval to sell these chips to countries such as Saudi Arabia, Qatar, and the United Arab Emirates.

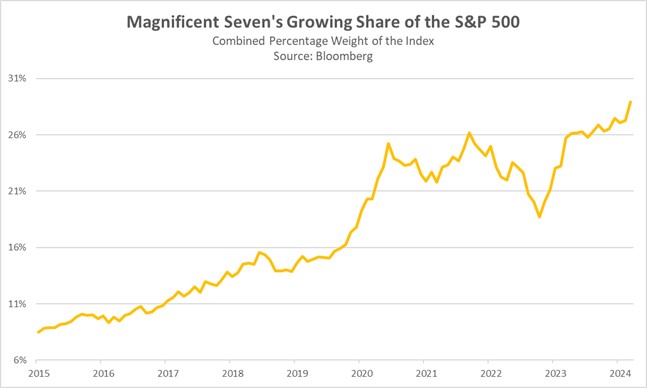

- This national security scrutiny comes amid a surge in AI stocks. For instance, Nvidia, the third-largest chipmaker by revenue, has fueled more than 30% of the S&P 500’s total returns this year, highlighting the booming AI market. Bloomberg analysis suggests that this is the largest share of a market leader at this point of the year in at least a decade. This dominance highlights the tech sector’s increasing concentration within the index. While concentration isn’t new, the current level is unprecedented. The “Magnificent Seven” tech companies now account for over 30% of the S&P 500, a significant jump from 20% in 2020.

- The tech industry faces heightened scrutiny due to growing geopolitical tensions, which is why we closely monitor the landscape. As countries form blocs, trade restrictions could disproportionately impact the revenue of large tech companies heavily reliant on foreign markets, particularly those with significant exposure to China. While these companies aren’t facing immediate risks, the future holds uncertainty due to geopolitical tensions. To mitigate portfolio risk, investors might consider small and mid-cap companies, which generally have attractive valuations relative to their large cap counterparts but also tend to have a more domestic focus that can make them less vulnerable to shifting trade patterns.

Mexican Elections: Elections in Mexico are set to take place over the weekend as the country looks to replace its controversial but fiscally prudent leader.

- Current polls indicate that Claudia Sheinbaum, the chosen successor of President Andrés Manuel López Obrador (AMLO), is heavily favored to win the election. Sheinbaum is leading her opponents, Xóchitl Gálvez and Jorge Álvarez Máynez, by a wide margin. The latest data suggests that she is poised to secure more than half of the vote, with Gálvez projected to receive around a third and Máynez anticipated to garner the remainder. Despite her lead, there have been talks that high voter turnout for the opposition may lead to an upset, as her popularity has shown signs of waning during the run-up to the election.

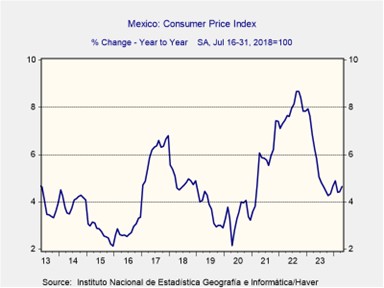

- Sheinbaum is expected to carry on the legacy of her predecessor, AMLO. Under his administration, the country’s inflation rate has stabilized, returning to its long-term average in a relatively short time. Additionally, the government exhibited fiscal prudence during the pandemic’s onset, incurring smaller deficits than most Latin American nations. This fiscal responsibility, coupled with an increase in foreign investment, has benefited the Mexican peso (MXN), which has largely outperformed its peer currencies. However, the next administration will face challenges, including rising gang violence, a sluggish economy, and concerns about border security.

- The success of the next administration will likely hinge on how the next president handles relations with their northern counterpart. Despite border security disputes, AMLO maintained relatively good relationships with both former President Donald Trump and current President Joe Biden. However, concerns are growing that Mexico has become too close to the United States’ rival, China. Several Chinese automakers are exploring the possibility of building factories in Mexico. These facilities would strategically position them to sell electric vehicles in the US market, bypassing hefty tariffs. Should this come to fruition, the US might seek to update or renegotiate the USMCA trade agreement.

In Other News: Former President Trump was found guilty in the hush money trial. Although his conviction does not impact his eligibility to run for office, it may damage his perception among voters. Meanwhile, President Biden has permitted Ukraine to use US-made weapons to strike military targets in Russia; this marks a significant escalation in tension and could pave the way for a broader war.