Daily Comment (May 7, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Good morning; it’s the 75th anniversary of Germany’s surrender in WWII. Despite expectations of dreadful labor market data tomorrow, equity futures continue to move higher. The BOE maintains current policy. We update the COVID-19 news. Our Weekly Energy Update can be found here. Here are the details:

COVID-19: The number of reported cases is 3,769,150 with 264,111 deaths and 1,250,579 recoveries. In the U.S., there are 1,228,609 confirmed cases with 73,431 deaths and 189,910 recoveries.

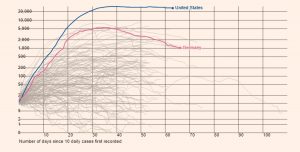

For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases and fatalities between nations, scaled by population.

The virus news:

- The good news:

- Epidemiologists and health economists are working to discern which social distancing measures are worth the cost. This exercise is an important next step in establishing how society should operate in the absence of established therapies for COVID-19. In this current stage, epidemiologists dominated the conversation and were focused mostly on reducing infections. The next phase will be figuring out which mitigation measures save the most lives compared to the costs entailed in implementing them. This process will be difficult because we know so little about the virus. And, it may lead to governments permitting activities only to find that this was a bad idea. Still, this is progress because it is the process of learning to cope with the virus being with us for the foreseeable future.

- There may be more UV light in our future; UV light disinfects the air and surfaces but tends to burn skin and eyes, reducing its usage as a safety measure. Scientists at Columbia have created a version of UV lighting that doesn’t burn skin or eyes that could be used as a continual disinfectant in public areas. If this works, it would reduce the odds of transmission in public places and speed the return of opening businesses and restaurants. We could see businesses, arenas and airports have visitors pass through such light to reduce transmission of viruses.

- Mass testing has been something of a problem for many countries. Without testing, it is difficult to know the extent of the virus’s spread. Researchers are investigating if they can trace the degree of infection in a community in sewage. It is known that the virus does leave the digestive tract. Measuring the “back end” may tell mayors and governors that a problem is developing before it becomes evident in hospitalizations.

- Here’s another drug to watch—EIDD-2801, an antiviral that is currently under trial in the U.K. and will begin phase 1 in the U.S. later this month. It is designed to work similarly to remdesivir but can be taken as a pill; remdesivir must be administered intravenously.

- There is some promising work being done with llamas to create a potential therapy for COVID-19. Their blood can generate unique antibodies to the virus. The good news is that it would give a person immediate immunity to COVID-19; the bad news is that the immunity wanes rather quickly, in one to two months. However, it could be used to protect health care workers until a vaccine is developed.

- Germany, Europe’s largest economy, is beginning to reopen. Its reported cases are in clear decline. The secret of Germany’s success was widespread testing and general compliance with social distancing. Germany’s recovery would help the EU economy, which, as we note below, is in very bad shape overall.

- The bad news:

- Coronaviruses are known to mutate. There are reports that the current virus is a version that began to emerge in mid-March and is different than what originally came from China. The new version isn’t necessarily more virulent, but it may replicate faster, making those infected sicker than what was seen in the initial version.

- One debate governments are having is when to reopen schools. There is evidence to suggest that children are less susceptible to the worst of COVID-19 and thus probably face less danger in reducing social distancing (assuming, of course, no preexisting conditions exist). However, there is a potential problem with reopening schools—children may become vectors for COVID-19 by harboring asymptomatic infections and putting their families at risk. We should note these studies conflict with others suggesting children are not necessarily a risk.

- As noted yesterday, nursing homes remain an area of great risk for COVID-19.

- There are reports that France may have had a fatality from COVID-19 as early as December. If true, it means the virus was circulating around Europe well before February.

- Over the past few weeks, we have noted the various ways COVID-19 attacks the human body. This report is a recap of what is currently known.

- There has been a rise in apparent suicides among Russian medical staff. It is believed that stress related to COVID-19 is to blame.

The policy news:

- One of the issues we have been watching for is a policy mistake. The biggest is when central banks or fiscal authorities inadvertently cause systemic risk because they didn’t backstop a certain area of the financial market. The ECB may be introducing this risk because it has refused, so far, to offer support to the European high yield market.

- In the U.S., there were provisions in the stimulus package to aid student loan borrowers. Unfortunately, some borrowers, many of whom took out loans prior to 2010, find that the provisions don’t include their loans. It doesn’t appear there was a rationale for the exclusion and seems to be a simple oversight.

- There has been massive fiscal and monetary support to the economy. However, one area that has been repeatedly rebuffed in getting support is private equity. The lack of support shows how politically toxic this sector has become.

- There is also a political standoff brewing between the White House, which is pushing for additional stimulus, and the right-wing establishment in Congress, which is becoming uncomfortable with the level of spending. This is more of an intra-party conflict within the GOP.

- Part of the stimulus package was a boost to unemployment insurance. In addition to the usual state payments, the federal government is kicking in an additional $600 per week. This measure was pushed by the representatives from large urban areas with high living expenses. However, outside major cities, unemployment benefits exceed what many workers were making before the shutdown. Needless to say, there is an incentive to simply exhaust the unemployment insurance before returning to work. We are seeing reports that some businesses, which have been given permission to reopen after lockdown, are struggling to find workers, in part due to the generous benefits given for not working.

The economic news:

- Tomorrow, the BLS will release April’s employment report. As yesterday’s ADP report showed, job losses are going to be historic. The current forecast is for a drop in nonfarm payrolls of 21.0 mm. The largest previous drop in history, starting in 1939, was 1.959 mm in September 1945, due in part to war demobilization. The unemployment rate for April is forecast at 16.0%. Although there are great hopes that the economy will rebound quickly and workers will only face temporary layoffs, some businesses won’t recover from this drop in business, turning temporary layoffs into permanent ones. At the same time, some real time data does suggest there is an element of stabilization in the economy; it’s not recovering fast but it isn’t getting worse.

- The economic situation in Europe is terrible. The EU warns that the virus has affected nations differently and the uneven nature of the shock requires a unified response. The BOE warned that the K. economy could contract by 25% in Q2.

- An idea that is emerging is the concept of the flexible lease. Currently, lease payments are fixed; under normal circumstances, that makes sense. The building owner doesn’t see his sunk capital costs drop in a recession. But, in the wake of the current downturn, some landlords are showing openness to the idea of setting rent based on business revenue. This could create some rather interesting situations; for example, a REIT may be valued based on the business growth of tenants, not how well leased a building is. If this practice were to become widespread, it would tend to turn real estate investments into more of an equity product and less of a fixed income product.

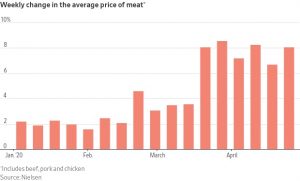

- We have been documenting the growing problems in the protein supply chain. Stores are beginning to put limits on meat purchases and prices are rising. Until we see processors reopen, supplies will likely remain constrained.

- One of the arguments used to end restrictions on interstate banking was that larger banks would have economies of scale that would improve their efficiency and reduce costs. This was more of a faith-based idea; there wasn’t much evidence at the onset that it was true. In some aspects of banking, scale turned out to be important. The handling of transactions has improved with concentration, for example. And, there is no doubt that scale helps with creating and building technology. However, for relationship banking, there is scant evidence that scale improves service, especially for smaller firms. Community banks have proven this in the COVID-19 situation, being much more effective in tapping the government programs to provide loans to small businesses.

- As we detail in the data table below, China’s April exports bounced unexpectedly, although much of this may be clearing up the backlog from Q1. We also note that Chinese car sales are starting to recover.

The market news:

- The battle for the USPS is underway. The postal service has been losing money most years, in part due to its mandate to deliver letters. In general, delivery services make their money on parcels, while regular mail is a loss leader. Delivery companies have reduced the USPS hold on parcels and electronic mail has made letter carrying even less attractive. In addition, the unionized workforce of the USPS makes it difficult for the service to adapt to changes in the marketplace. The White House has appointed a new postmaster and is pressing to renegotiate labor contracts and delivery arrangements that are unfavorable to the USPS. We note that online retailers who tend to benefit from these delivery arrangements are lobbying hard to maintain the current status and are asking Congress for a bailout of the postal system.

- Years ago, we participated in a conference call with a client and her advisor. The client wondered if she should buy one-ounce gold coins or quarter-ounce coins. We responded by noting that four of the latter equal the former, to which the client said, “If I need to bribe the border guards, am I better off with smaller coins?” We responded, “If we get to that degree of societal breakdown, you will be better off with booze, bullets and tobacco.” Much to the chagrin of the advisor, the client agreed with us.[1] Recent market performance appears, at least to some extent, to support this notion.

The foreign policy news:

- Tensions with China continue to escalate:

- An internal report from the China Institutes of Contemporary International Relations (CICIR), a think tank in China, suggested that the Xi government’s handling of COVID-19 was becoming another Tiananmen Square in terms of international standing.

- Op-ed columnists in Hong Kong warn that U.S. efforts to seek damages from China over COVID-19 might spark a hot war.

- China is pressing the argument that its system was superior to that of the U.S., suggesting the virus has proven the U.S. is no longer the global hegemon. At the same time China is touting its prowess, it is demanding that nations receiving its aid “kowtow” and praise Beijing for its largess. Germany has reported such actions recently.

- The EU is embroiled in a scandal where Brussels succumbed to Chinese pressure to censor references to COVID-19 originating from China. However, a number of European nations apparently didn’t get the memo and released the original document.

- The U.S. is moving missiles and other weapons to the Pacific, continuing the process of focusing on China and reducing America’s footprint in Europe and the Middle East.

- The White House is continuing to encourage companies to reduce supply dependence on China.

- The rise in tensions has, so far, not dramatically affected equities. But, if the Phase One trade deal is scuttled because of the increase in hostilities, we would expect a negative reaction.

- A surprising fight has emerged between China’s Finance Ministry and the PBOC. The Finance Ministry wants the Chinese central bank to monetize its spending. In other words, the ministry wants the PBOC to directly purchase its debt. It is unusual for such fights to occur in the open; we suspect the battle is underway because the government’s leadership doesn’t know how it wants to handle increased fiscal spending. We have been noting evidence that China is reverting to its “tried and true” methods of boosting the economy via infrastructure spending. Apparently, Chairman Xi hasn’t decided how he wants to fund that spending quite yet. And so, the PBOC is pressing to maintain some semblance of independence. There may be an element of entertaining a foreign audience as well. It is becoming clear that the Fed is steadily seeing its independence erode. If the PBOC appears to “win” this one, it might boost the status of the CNY relative to the USD.

- Recent oil losses have not just affected oil producers. Retail clients in China purchased products designed to follow the price of oil. Apparently, they were structured a bit like futures contracts; you can lose more than your initial investment. When oil prices fell into negative territory last month, these speculators took losses they didn’t expect. Apparently, regulators are pressuring Chinese banks to absorb some of these losses to quell investor unrest.

- The impact of COVID-19 on Russia has been escalating recently. President Putin was planning on a referendum of sorts and expanding infrastructure spending this year; both have been disrupted by the virus. Putin has tended to foster close relations with the Russian Orthodox Church, something a bit unusual for a former KGB agent. However, social distancing rules have created divisions between the church and the government. Although we don’t expect Putin to face any real threats to his position, he is clearly having a rough time.

- An issue we are watching with increasing interest is Germany’s Constitutional Court, which ruled that the ECB engaged in monetary practices outside of mandate and the approval of these measures by the Court of Justice of the European Union (CJEU) were in error. Germany’s court ruled that the ECB must give it adequate justification for its bond-buying or the Bundesbank will no longer be permitted to participate in the program. This situation is a problem on various levels. First, it violated the ECB’s independence for a German court to dictate policy. Second, it clearly undermines the authority of the CJEU. If Chancellor Merkel doesn’t thwart the German court, then she will be creating a situation where the ECB may not be able to continue to act in any way that defies Germany, and it will seriously weaken EU governing bodies. In some respects, we have been expecting the EU and the Eurozone to eventually fall apart; without the Soviet Union to act as a threat to work in concert, and without the U.S. providing costless security, the EU and the Eurozone were in grave danger. However, we didn’t expect a court ruling to be the event that triggers the potential breakup. We would not be surprised to see Merkel try to resolve this problem; at the same time, it is hard to see any other German leader with the power and authority to buck the court’s ruling. When she is gone, the chances that Germany goes its own way increase. We are starting to see other European leaders criticize the German court, seeing it as a threat to stability.

- On the topic of the ECB, the European central bank has been offering loans to European commercial banks to maintain credit lines. However, the banks have been turning down the programs because they are already burdened with bad loans from the last downturn. In addition, the recovery in the EU has been rather sluggish anyway, meaning that many companies were unable to grow out of their bad debt. EU policymakers have limited capacity for fiscal spending and rely on banks for stimulus. However, if the banks can’t be forced to lend, the support will fail to work.

- We have been keeping close watch on a number of GOP senators who have been crafting a right-wing populist agenda. Their policy mix is based on deglobalization and anti-trust. Who is involved? Hawley (R-MO), Sen. Cotton (R-AK), Sen. Rubio (R-FL) and Sen. Cruz (R-TX). Hawley recently published an op-ed calling for the end of the WTO. Three of the four sent letters to the White House calling for a suspension of temporary work permits granted to foreign workers due to the virus-driven job losses. Anti-immigration is part of this policy mix. Our position is that populism in the U.S. is on the ascendency; the only question is the variant, i.e., right- or left-wing. So far, it appears the right wing is winning the most influence.

[1] Again, this is Bill’s story and he is using the imperial “we.”