Daily Comment (May 8, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and happy Friday! Global risk markets are rising at the same time Treasury yields are falling. It’s employment Friday; we cover the data below but, suffice it to say, it’s historic and not in a good way. We update the COVID-19 news. This week’s Asset Allocation Weekly is published below. And, podcasts are back! Despite being unable to utilize our recording studio, our sound engineer, Dane Stole, has figured out how we can record remotely. Check it out! Here are the details:

COVID-19: The number of reported cases is 3,862,174 with 269,881 deaths and 1,291,490 recoveries. In the U.S., there are 1,256,972 confirmed cases with 75,670 deaths and 195,036 recoveries.

For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases and fatalities between nations, scaled by population.

The virus news:

- The good news:

- The FDA has approved a vaccine for the second phase of clinical trials. Moderna (MRNA, 53.19) announced its vaccine will move on to Phase 2. Phase 1 determines if the drug or vaccine is safe; Phase 2 determines if it is effective. If it passes this phase, it will move on to Phase 3, which tests the vaccine for safety and effectiveness on a larger scale. If it passes all three, it may be available for the general public early next year.

- A new study confirms that anyone who has had COVID-19 does create antibodies to the disease. It isn’t clear how much immunity this gives a person, but it does suggest that it gives at least some protection for an unknown period of time.

- The bad news:

- As we have noted before, COVID-19, like all viruses, tends to mutate. Often, they mutate into a less virulent form. A recent study confirms earlier reports that the virus that hit Europe and the East Coast was different than the one that struck Wuhan. The virus in China may have been more deadly but was less transmissible. A mutating virus increases the challenge for vaccine manufacturers.

- One of President Trump’s personal valets has tested positive for the virus. The president himself has not.

- Given our general lack of knowledge about COVID-19, nations around the world are reopening their economies without knowing what risks they are undertaking. In a sense, we are seeing a series of real-time experiments that will be difficult to analyze on the fly. There is no doubt that future historians will write about what worked and what didn’t, but it’s a lot harder actually living through the process.

- Sweden has been one of the important “test cases” for the response to the virus. The government there implemented rather soft measures, allowing restaurants to remain open, for example. Its fatality rates have been rather high but what surprised us is that the easier measures led to only modest economic improvements relative to others. It’s early in the process, but that’s what we see so far. Some of this may be due to the fact that even without official lockdown orders, Swedes mostly followed them on an informal basis. Another factor is that exports represent 46.7% of Sweden’s GDP, making it more susceptible to slowing global growth.

- Although it is well documented that children generally avoid the worst of the virus, it isn’t exactly clear why this is true.

- There is growing concern that the antibody tests are flawed and may be giving false comfort to some recipients.

The policy news:

- House Democrats are putting together a fourth coronavirus stimulus package. Early reports suggest a number around $2.0 trillion. However, we would not be surprised to see this number go higher. Lobbyists realize this will probably be the last one for a while so they are trying to get the “last shot” at their goals. We do note negotiations with the GOP, both Senate and White House, have not started. We expect a rather frosty response from the Senate, but perhaps a more positive one from the executive branch.

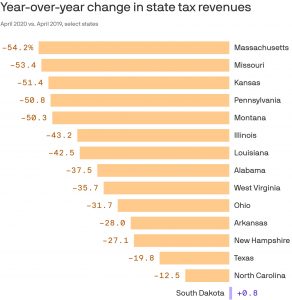

- One of the lingering concerns about the policy response to COVID-19 is that much of the funds come from the states, which mostly lack the ability to deficit spend. In the recovery from the 2007-09 recession, falling state spending mostly offset higher federal spending, blunting the policy response. The decline in state tax revenues is widespread. A bill has been introduced to shore up state revenue.

(Data: Lucy Dadayan/The Urban Institute. Chart: Andrew Witherspoon/Axios)

- The Small Business Administration has reduced the loan size for the Economic Injury Disaster Loan Plan from $1.0 mm to $150k. Not to be confused with the new Paycheck Protection Program, the former plan is a long-standing program that has been overwhelmed with requests. Thus, to cope with the demand, the SBA is tightening the eligibility criteria.

- The SBA is reporting that demand for its loans has slowed rather dramatically. It appears there are several reasons for the slowdown, but one concerning issue is that firms are worried about the terms, fearing they will fall afoul of the rules and could find themselves in legal trouble.

- Although the Fed has continually panned implementing negative interest rates, financial markets are starting to discount the chances that the FOMC will be forced to take policy rates into negative territory. The two-year T-note hit a record low yesterday, and fed funds futures have started to price in a negative rate.

The economic news:

- As states reopen, companies are struggling to restart their businesses. Three major problems have emerged. First, generous unemployment benefits are keeping workers at home. Second, with schools closed as well as many day-care centers, workers who might be willing to return to their jobs can’t due to the lack of child care. Third, many of these laid off workers may not have a job to return to as bankruptcies rise. These factors may slow the recovery even as shutdown orders ease.

- There is growing labor unrest in the meatpacking industry. Union leaders strongly criticized the decision to use the Defense Procurement Act to force facilities to reopen that had been closed due to virus infections.

- This isn’t just a U.S. problem. Concerns over the lack of safety measures have led to a walkout at an auto factory in Spain.

The market news:

- Fed forex swap data show that Asia has had the heaviest users of the credit lines. This development bears watching because it may signal underlying financial stress.

The foreign policy news:

- A few China notes:

- It appears Secretary Pompeo is walking back some of his comments on the origins of COVID-19. One reason is that he isn’t getting much support from Australia, which has publicly questioned the theory that COVID-19 leaked from a Chinese biology lab. The WSJ editorial page suggested that if the White House had evidence, it should release it. And, the chair of the Joint Chiefs of Staff has indicated that evidence of the virus’s origin does not suggest it came from a lab or was manmade. If we see officials back away from this story, it may ease tensions.

- Beijing is pushing for the WHO to investigate the origin of the virus.

- Meanwhile, the U.S. is making the case that Taiwan should be allowed to attend the WHO summit. This position will infuriate Beijing.

- It is becoming noticeable that China’s fiscal and monetary response to this crisis has been rather modest. Yesterday, we noted the spat between the Finance Ministry and the PBOC, where the latter is balking at monetizing the former’s new debt issuance. This modest effort contrasts with the massive stimulus China implemented after 2008. Why the smaller action this time around? The 2008 stimulus led to a massive rise in debt; it appears the Xi regime doesn’t feel comfortable with a similar rise in debt this time. If this pattern continues, China’s only way to lift growth may be through exports, which will not be popular with its trading partners.

- On the issue of trade, U.S. and Chinese trade negotiators discussed getting Phase One going. The talks came after President Trump threatened the deal. China, in part due to the impact of the coronavirus, has been lagging in fulfilling its requirements for purchasing U.S. goods.

- The EU has failed to develop a Eurobond in response to the crisis and has been less than generous in assisting the southern nations hard-hit by the virus. But, it is allowing Italy to tap ESM funds with very little oversight, a small victory for the country.

- Spain’s deputy PM, Pablo Iglesias, is calling for EU-wide minimum income guarantees, warning that the EU and the Eurozone may fall apart if such a program isn’t implemented.

- As Iran eases restrictions on religious worship, COVID-19 cases are rising again.

Argentina: The country’s biggest bondholders are balking at the restructuring deal being offered by the government. The Kirchner government wants a 62% reduction in interest payments and a 5.4% write-off.

China: There are reports that a new computer virus, called Aria-body, was developed by a group with ties to the Chinese military. The virus can take control of a computer and apparently cover its tracks. It is passed invisibly through emails. Its primary purpose appears to be information gathering.

Middle East: The U.S. is pulling Patriot missile batteries out of Saudi Arabia. These were initially put in the kingdom in response to the missile attack last year. The decision to remove the missile defense system could reflect a number of factors. First, it is possible that the kingdom has improved its own defenses and no longer needs the U.S. support. Second, backchannel contacts with Iran may have reached some sort of agreement not to repeat the missile attack; as we noted yesterday, Israel noted that Iran appears to be pulling back from Syria. It may be that Iran simply lacks the resources to threaten Saudi Arabia and the U.S. is reacting to that fact. Finally, there is a clear move to reduce the American military footprint in the Middle East and this action reflects that. We do note that Islamic State is stepping up its activities as the U.S. and Europe reduce troop strength in Iraq.