Daily Comment (November 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely watching the latest producer price inflation data for insights into the Fed’s upcoming rate decision. In sports, the Cleveland Cavaliers extended their unbeaten streak to thirteen, becoming the sixth NBA team to reach this milestone. Today’s Comment will cover our analysis of the latest CPI data, explore why gold and the US dollar are moving in opposite directions, and provide an update on Brazil. As always, we’ll conclude with a roundup of key international and domestic data releases.

CPI on Target: While inflation progress showed signs of stalling in October, the report still leaves the door open for a December rate cut.

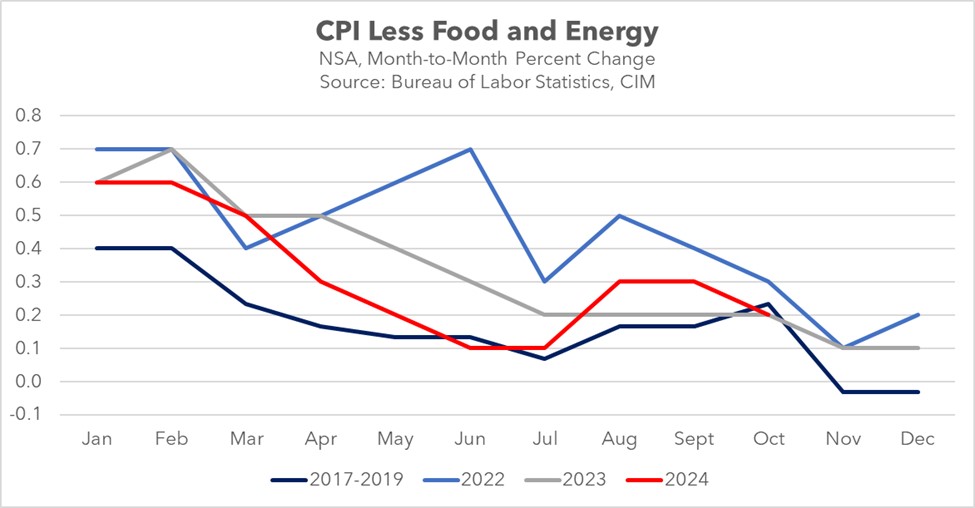

- October’s Consumer Price Index (CPI) data, released by the Bureau of Labor Statistics, revealed a slight uptick in annual inflation from 2.4% to 2.6%. While this figure met market expectations, it also underscored the persistence of inflationary pressures and the ongoing challenge of reaching the Federal Reserve’s 2% target. Core inflation, which excludes volatile food and energy prices, remained relatively stable at 3.3% year-over-year. This stability was attributed to a combination of factors, including a resurgence in used car price inflation and volatile shelter prices.

- The temporary pause in inflation progress can largely be attributed to seasonal adjustments. A more accurate picture emerges when examining non-seasonally adjusted data, which is not susceptible to annual revisions. This data reveals a deceleration in inflation from the previous month, with the October rate falling below the three-year pre-pandemic average and matching the previous year’s pace. This modest easing of price pressures likely explains the market’s increased confidence in a December rate cut, which accelerated from a projected 65% likelihood to over 80% yesterday.

- The true test of the Fed’s progress toward its 2% inflation target will come with the release of next month’s report, a week before the Fed’s upcoming meeting. November typically sees the year’s lowest inflation readings. If inflation doesn’t show signs of easing, the Fed may be reluctant to lower its benchmark interest rate. The Cleveland Fed’s current estimate of a 0.27% change for both core and headline CPI in November is unlikely to appease policymakers. As a result, we believe that market expectations of another rate cut may be overly optimistic.

Gold and the Dollar: Gold has plummeted but the dollar has gained since the election as investors weigh the impact of tariffs on the global economy.

- Since Trump’s election, gold bullion prices have dropped by 5% as investors grow increasingly concerned about the potential impact of US tariffs on the global economy. This recent sell-off reflects fears that US trade restrictions could further strain major exporters already facing weaker GDP growth. Bundesbank President Joachim Nagel cautioned that tariffs could reduce Germany’s GDP growth by 1%, while tariffs on Chinese goods risk exacerbating China’s overcapacity issues, complicating Beijing’s economic stimulus efforts.

- The decline in gold prices has coincided with a sharp appreciation of the US dollar, signaling a potential policy shift. Markets are factoring in the inflationary impact of import tariffs, which could constrain the Fed’s ability to cut rates next year. Speculation also suggests that policymakers in China and the EU may reconsider aggressive stimulus measures, aiming instead to keep exports competitive. Trump’s election has fueled expectations that China may ramp up fiscal spending, while Europe is anticipated to pursue deeper rate cuts.

- The inverse relationship between gold and the dollar is likely a short-term trend, as markets gain clarity on US fiscal and monetary policies. The market appears to have largely priced in the potential negative impacts of a trade war. We expect gold to bottom out in the coming days as growth concerns subside. We also anticipate that the central bank will prioritize protecting the labor market over counteracting inflationary pressures from tariffs. As a result, both the dollar and gold are likely to lose momentum in the near future.

Brazil’s Delicate Dance: Latin America’s largest economy will likely face a tough test as it decides whether it will prioritize its relationship with the US or China.

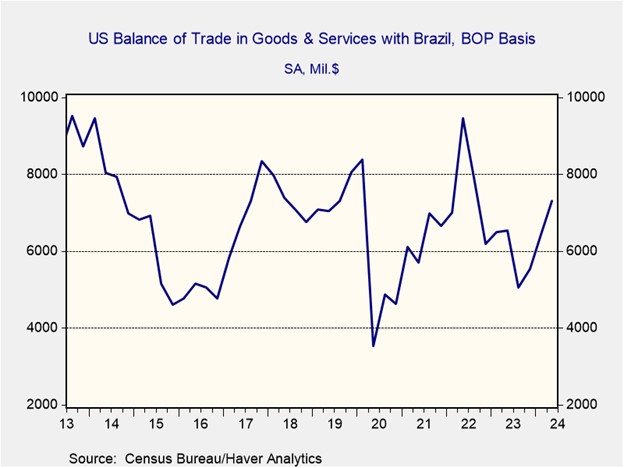

- Brazilian President Luiz Inácio Lula da Silva has prioritized deepening Brazil’s relationship with China, often at the expense of its ties with the United States. This shift will be highlighted as Xi Jinping meets with Latin American leaders at the APEC forum in Peru, attends the G-20 summit in Rio de Janeiro, and travels to Brasilia for a state visit. Lula is expected to advocate for an increase in Chinese infrastructure investment to reduce shipping times, elevate Brazil’s position in the global value chain, and boost its economic potential.

- Despite its traditional non-aligned stance, Brazil has increasingly tilted towards China, drawing US criticism. Last month, Brazil’s agriculture minister advocated joining the Belt and Road Initiative as a shield against Western protectionism. This move could further solidify Brazil’s position within China’s sphere of influence, potentially provoking a negative response from a Trump administration that favors clear-cut alliances. Furthermore, Brazil’s growing competition with the US agricultural sector in the Chinese market is likely to intensify tensions between the two countries.

- While our analysis indicates a slight tilt towards China, Brazil’s economic growth hinges on maintaining strong relationships with both the US and China. To navigate this delicate balance, Brazil must demonstrate its independence from either power. Failure to do so could lead to potential US retaliation, particularly in the form of reduced foreign direct investment. The Biden administration’s recent establishment of an outbound investment security program, aimed at monitoring countries supporting Chinese development, underscores this risk as this will be passed onto the next administration to use as well.

In Other News: President-elect Donald Trump has selected a slew of controversial leaders to take over various government positions, in what looks to be a test of his influence within the party. US dockworkers have decided to end negotiations in a sign that another strike could take place in January.