Daily Comment (November 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning on the eve of a major lunar eclipse! U.S. equity futures are moving higher this morning, and oil prices are ticking higher as well, despite U.S. pressure for a wider SPR release. Our coverage begins with comments on debt market stability. There is a lot of China news as we try to analyze recent CPC meetings. Up next is economic and policy news, with the international news roundup afterward. We close with our regular pandemic update.

Market stability: One area we watch closely is the resiliency of the Treasury market. Treasuries are the backbone of the financial markets and the internal financial plumbing of the financial markets. Recent market events, such as the repo crisis in August 2019 and the March 2020 financial freeze, are all tied to the market’s inability to manage the flow of credit. We are seeing some hints of problems now. Our take is that the massive borrowing by the Federal government, coupled with capital requirements of the primary dealers, is leading to instability. The recent poor 30-year T-bond auction appears tied to this issue. Regulators are attuned to the problem but seem to lack a deep understanding of how to address it. Regulators met yesterday to discuss the issue. The general conclusion is that central clearinghouses are the answer. Perhaps. We have long experience with futures clearinghouses, and we know they are very good at protecting the exchanges and the clearinghouses themselves but generally don’t care about the participants. At the same time, a properly functioning clearinghouse can force participants out of positions before they become a systemic problem. Another potential response is to fortify the Fed’s lender of last resort to become a dealer of last resort. However, until these issues are resolved, the financial system will remain susceptible to sudden stops in liquidity that can trigger financial crises.

China news: A crackdown on crypto, an easing on real estate lending, and more on the recent party conference lead today’s comments.

- The crackdown on crypto mining in China snared a high-ranking CPC provincial official in Jiangxi. According to party documents and reported in the media, Xiao Yi was accused of taking bribes and other nefarious activities in allowing crypto mining operations to be established in the province. Although Texas has seen an influx of mining operations, Chinese operators are apparently moving their talents to Singapore, which has a large Chinese diaspora.

- In the face of continued pressure in the real estate market, Chinese officials appear to be easing regulations to increase available liquidity to the sector. State-owned real estate developers are boosting land auction activity, a key funding source for local governments. Regulations on asset-backed security (ABS) sales appear to have eased as well, leading to increased issuance. The ability to borrow using assets as collateral will increase available liquidity.

- The recent party meetings where Xi was portrayed as the natural successor to Mao and Deng are still resonating; analysts are combing through the lengthy documents for clues to future behavior.

- The “throwback” references to the Mao era in Xi’s writings are remarkable. Deng was able to move on from Mao by openly discussing his failures. Xi appears to be using Mao’s nostalgia to undercut Deng’s policies. It is clear that Xi is portraying himself as the next major CPC figure. He has indicated that his drive to consolidate power was all about moving the country forward and making sure he stays in office as long as he likes.

- Xi seems to be downplaying the role of GDP targets. If China is going to bring its debt growth under control, investments driven by debt will likely need to stop. The downside is that this action will lead to slower economic growth. If the GDP targets are deemphasized, there is a better chance that economic restructuring can occur.

- There also seems to be a return to the earlier position on Taiwan, which is that unification can happen naturally in the future. Xi did warn that any action to declare independence would trigger a military response.

- Although recent actions suggest China may be trying to walk back recent belligerence, the U.S. is moving in a direction that assumes a hostile relationship with China.

- The U.S. is looking to bolster trade relations in Asia, although not joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) undercuts the effort.

- A Congressional commission recommends the U.S. scale back commercial relations with China.

- We are seeing financial firms getting increased access to China, but it is unclear how long this opening will last. It is possible the U.S. may be the bigger obstacle. Meanwhile, it is abundantly clear that Beijing sees the U.S. business community as an ally and pressure point against China hawks.

- We see one area of cooperation; Washington has asked Beijing to release oil from their SPR in a bid to lower prices.

- At the same time, this potential “thaw” should be treated with caution. China is still trying to expand its reach across the globe, especially in data control. This data control is also affecting global shipping.

- The EU is delaying its trade upgrade legislation regarding Taiwan.

- The World Tennis Association continues to express concern over Peng Shuai, the Grand Slam doubles champion linked to a sex scandal with a high-ranking CPC official. There has been a new release purporting to be from Peng, but there is little confidence she actually issued the press release.

- Tsinghua Unigroup (600100.ss, CNY, 5.68) is seeking a deep-pocketed buyer. The company is an important element in China’s goal of tech independence.

- The U.S. has named a director for AUKUS.

- Australia has named 63 areas of technology that won’t be shared with China.

- Longer-term, China is facing a nearly insurmountable demographic problem.

Economics and policy: Inflation dominates the newsflow.

- The White House is growing increasingly worried about inflation. Unfortunately, the executive branch has limited tools to affect price levels.

- Oil prices have become a sensitive issue for the administration. Not only has Washington asked Beijing to release SPR oil, but other Asian nations have received similar requests.

- An increasing number of FOMC members are pushing for tighter policy. It remains to be seen if Chair Powell can overcome growing opposition to accommodation.

- We are starting to see mainstream center-left economists calling for rate hikes. Jason Furman is a potential candidate for a Fed governor role, but a recent op-ed may eliminate him as a nominee. Or not. If President Biden is serious about controlling inflation, he should be looking for a hawk to replace Chair Powell. Presidents supporting hawkish monetary policy are quite rare; President Carter was arguably the only one since Fed independence since 1951 (even President Truman, who approved the deal for independence, was uncomfortable with the arrangement). The political cost Carter paid should be a cautionary tale for any president.

- As prices rise, households are adapting. Retail traffic is rising at discount stores as shoppers try to stretch their incomes. The nascent goods exchange network reports increased activity as well.

- Saule Omarova, the nominee for comptroller of the currency, is scheduled to appear before the Senate Banking Committee. She is a controversial selection, supporting ideas like government saving accounts for the unbanked. Given that she won’t get any GOP support needed to be approved by the committee, she will need all the Democrats to sign off on her nomination. That may not be possible.

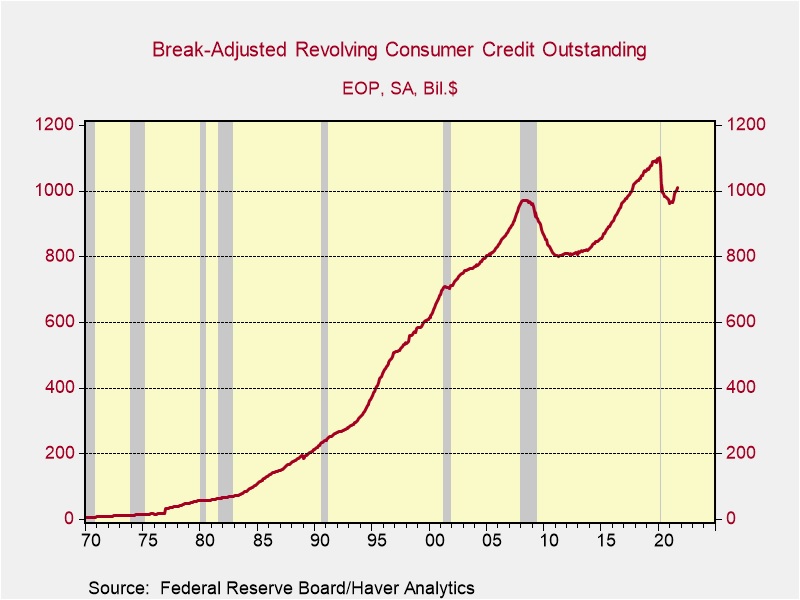

- Banks are boosting credit card offers, hoping to encourage households to carry balances. Balances fell sharply during the pandemic, as households used their support payments to pay down balances.

- Despite calls for 24/7 port activities, in practice, it isn’t happening. Truckers who handle container shipments to warehouses have not been coming to take cargos at night. Part of the issue is due to truckers wanting to avoid night work. Another factor is that warehouses are not structured for 24/7 activities. In some cases, local community rules prevent night work.

- John Deere (DE, USD, 353.52) workers have ended their strike after the company boosted its base productivity pay offer.

- National defense legislation appears poised to move through Congress.

- The population center of the U.S., from the most recent census, is Wright County, MO.

International roundup: The Turkish lira plunges, the “three amigos” meet today in Washington, and Belarus is starting to ponder a plan for all these refugees.

- Turkey’s central bank cut its main policy rate by 100 bps to 15%, sending the TRY to new lows against the dollar. President Erdogan holds the position that high-interest rates contribute to inflation and has undercut the central bank’s independence to force unorthodox rate reductions.

- The dollar has been stronger recently across the board, mostly on ideas that the Fed will need to raise rates sooner than other central banks.

- As we have been discussing recently, Belarus has been using Middle East refugees as a weapon against EU sanctions. However, one problem with this policy is that if it fails and the refugees can’t enter the EU, what does Minsk do with all these people? We doubt he can send them back, and the country doesn’t really have the resources to house them.

- Leaders of the USMCA meet today in Washington in what could be an acrimonious summit. Canada and Mexico are deeply intertwined in the U.S. auto industry supply chain, and recent legislation that would give higher tax credits to U.S. UAW EVs is a sore point for both nations. It’s not popular with non-UAW auto firms either.

- The EU’s top court says Poland’s rules on appointing judges violate EU law, setting the stage for a confrontation between Warsaw and Brussels.

- The U.S. and U.K. say Iran is behind recent cyberattacks.

COVID-19: The number of reported cases is 255,174,017, with 5,127,127 fatalities. In the U.S., there are 47,421,879 confirmed cases with 767,439 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 558,460,315 doses of the vaccine have been distributed, with 444,789,186 doses injected. The number receiving at least one dose is 228,175,638, while the number receiving second doses, which would grant the highest level of immunity, is 195,612,365. For the population older than 18, 70.7% of the population has been fully vaccinated, with 58.9% of the entire population fully vaccinated. The FT has a page on global vaccine distribution. The Axios map shows rising cases as colder weather increases indoor gatherings.

- One downside of lockdowns is that they increased the incidence of mental health problems. In the 12-month period ending in April 2021, drug overdose fatalities topped 100,000, a new record. This map shows the distribution of drug overdose deaths.

- Pfizer (PFE, USD, 50.87) announced it will allow developing nations to acquire its antiviral drug at a low cost. The U.S. is also pressing vaccine makers to expand global supplies.

- The FT has an in-depth investigation of “gain-of-function” gene experiments. Not only is the lax security and safety precautions worrisome, but the reason for doing such work is hard to justify.

- Europe is facing a new surge in cases, especially in central and eastern areas of the continent. Already, nations are imposing various levels of lockdowns and other restrictions.

- Reports indicate that schools inadvertently purchased air quality systems that either failed to work or were dangerous.