Daily Comment (November 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are eagerly awaiting Nvidia’s earnings report, due to be released later today. In sports, the Boston Celtics ended the Cleveland Cavaliers’ winning streak. Today’s Comment will cover potential candidates for US Treasury secretary, the role of high-income earners in driving US consumption, and our insights on the escalating conflict in Ukraine. As always, we’ll include a comprehensive roundup of international and domestic data releases.

The Battle for the Treasury: While Scott Bessent is viewed as the front-runner to take over the Treasury, the market is hoping that former Fed Governor Warsh will get the job.

- While Trump has been naming candidates for key roles in his administration, market attention has largely centered on who will lead the US Treasury. Howard Lutnick, previously a top contender, is out of the race after accepting the Commerce secretary role, narrowing the field to Kevin Warsh and Scott Bessent. Warsh, once considered for the Federal Reserve chair, is a key advisor to Trump’s economic transition team. Bessent, a major supporter of the president-elect, has faced criticism for his “business as usual” approach, particularly after describing tariffs as merely a bargaining tool.

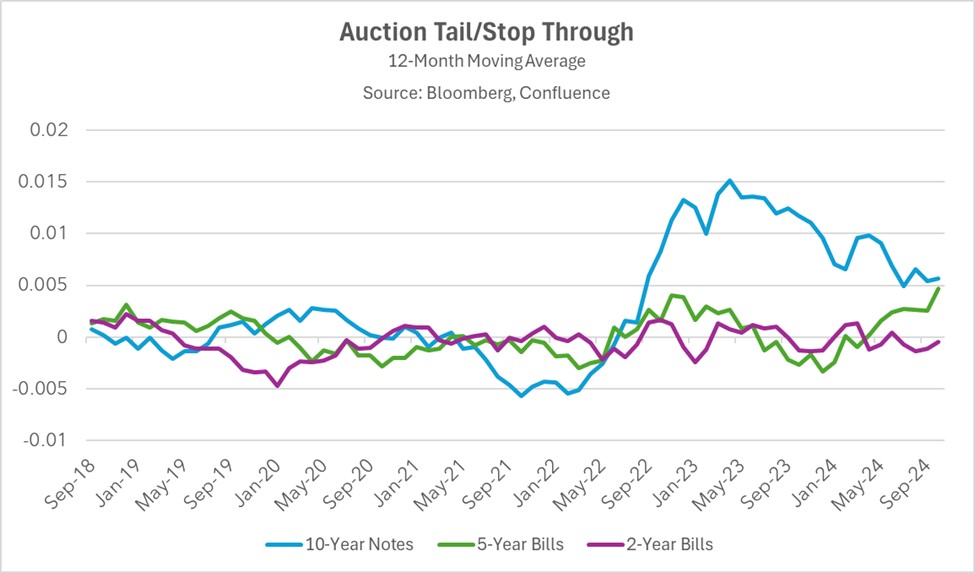

- The debate over the next Treasury secretary — tasked with managing the nation’s $28 trillion debt — carries significant market implications. Growing uncertainty surrounding future debt management strategies has raised concerns among fixed-income investors, especially given the persistent US deficit. This has dampened demand for US Treasurys, as seen in recent auctions where investor appetite for longer-term securities has waned. In recent years, Treasury auctions have increasingly resulted in “tails,” indicating that investors require higher yields to absorb the supply of government debt.

- The selection of the next Treasury secretary is likely to hinge on loyalty, which would potentially give Scott Bessent an advantage. However, the inclusion of Kevin Warsh in the discussion — widely considered a contender to succeed Fed Chair Jerome Powell when his term ends in May 2026 — could serve as a trial balloon to gauge market reactions to his potential leadership of the central bank. President-elect Donald Trump is rumored to be exploring naming a new Fed chair up to a year before Powell’s term ends. If true, this could spark market volatility as investors grapple with uncertainty over leadership.

High Earners Save the Day: The nation’s largest retailers reported mixed earnings, signaling that the economy remains strong but is gradually slowing.

- Target reported sluggish growth in the third quarter as the retailer failed to match the revenue gains of its peers Costco and Walmart. The slowdown in sales growth comes as more shoppers prioritize value, showing less willingness to absorb price increases. Its main competitor, Walmart, performed better, driven by strong performance from households earning over $100,000 annually. These consumers, seeking to offset rising prices, have been more willing to trade down to lower-cost options.

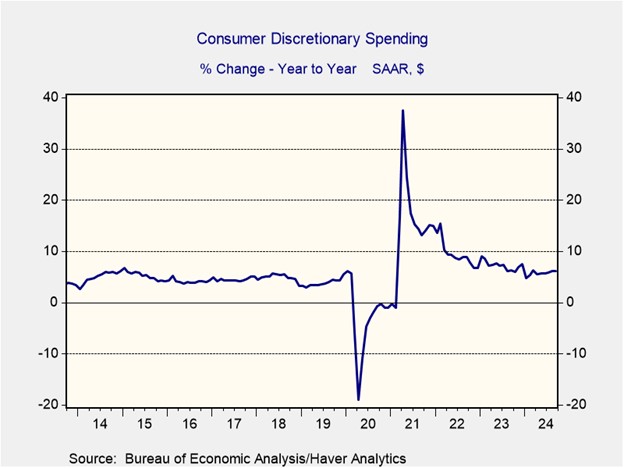

- While overall consumption has slowed in recent years, higher-income households have remained relatively unaffected. According to the Bureau of Labor Statistics, households in the top two income quintiles contributed to over 70% of the total spending increase in 2023. This represents a substantial rise from the previous two years, when their share was 62% in 2022 and 61% in 2021. Conversely, lower-income households have moderated their spending due to financial strain. Having depleted much of their pandemic savings, these households have been forced to curb their expenditures.

- The slowdown in spending is likely due to cumulative inflation and a cooling labor market. This dynamic could complicate the Fed’s efforts to communicate a clear monetary policy path, as it aims to balance price stability and its maximum employment mandate. Lowering interest rates could alleviate financial pressure, particularly for debt-dependent households, and potentially stimulate consumption. However, it could also exacerbate inflationary pressures. As a result, we expect the Fed may moderate its easing cycle, especially if the labor market shows signs of heating up.

Ukraine War Escalation: Investors turn to safe-haven assets as Ukraine escalates its efforts to defend against Russia by taking greater risks on the battlefield.

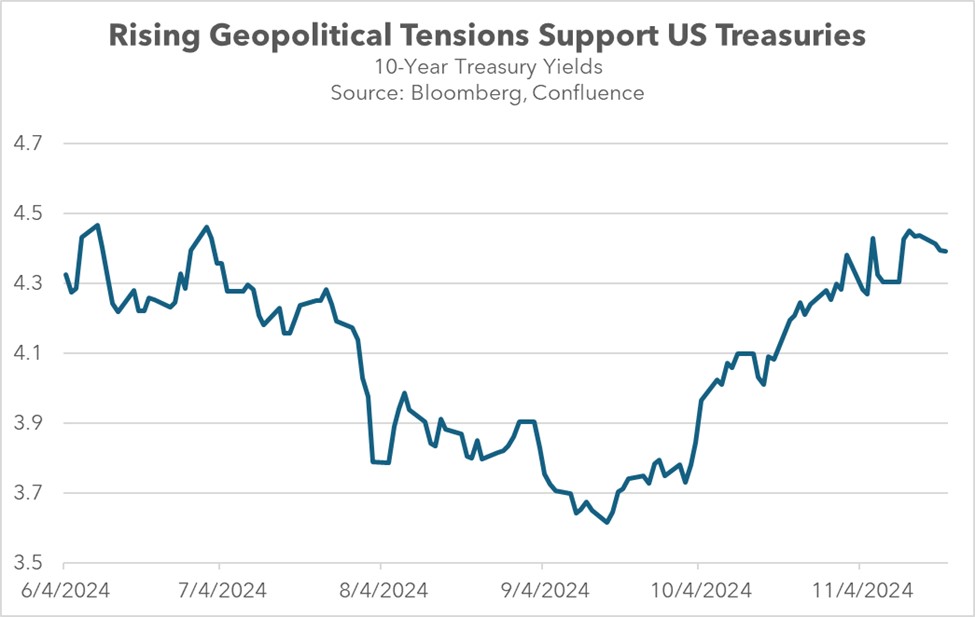

- Ukraine has utilized US-supplied weapons to target locations within Russia, following President Joe Biden’s decision to lift previous restrictions. This significant escalation marks a turning point in the war, as Russian President Vladimir Putin has previously warned that such actions would be interpreted as NATO involvement and suggested that this could lead to a broader conflict beyond Ukraine’s borders. In response to the attack, Putin lowered the threshold for using nuclear weapons to include critical threats to the territorial integrity of Russia or Belarus.

- The deployment of these weapons comes as Ukraine takes greater risks on the battlefield, while Western support for the war shows signs of waning. German Chancellor Olaf Scholz, who recently held his first talks with Putin in two years, is centering his reelection campaign on a more cautious approach to supporting Ukraine, firmly ruling out the supply of long-range missiles. Meanwhile, US President-elect Donald Trump has proposed a peace plan that could involve Ukraine ceding some of its territory. The escalation of the war is prompting investors to seek safety in US-denominated assets.

- As geopolitical tensions escalate in 2025, we anticipate that the US will be perceived as a relatively safer investment haven. The US economy, while facing significant fiscal challenges, appears more resilient compared to its global peers. In particular, the EU and China are grappling with their own systemic issues. While China’s debt concerns are well-documented, the EU is now facing increasing scrutiny due to its high debt levels and slow growth. The ECB recently warned that these factors could potentially trigger a eurozone crisis.

In Other News: The EU is expected to push Chinese EV makers to transfer intellectual property to access subsidies, in another sign that the bloc plans on getting tougher with China in regards to trade. The US is recognizing Edmundo González Urrutia as president-elect, a decision likely to reignite tensions with Venezuela. Iran has expressed a willingness to curb its nuclear program as it looks to avoid tough sanctions under the new US administration.