Daily Comment (November 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting Nvidia’s earnings report. In sports, Caitlin Clark has declined an offer to play in the Unrivaled three-on-three basketball league. Today’s Comment will cover Nvidia’s impact on the AI rally, the unintended consequences of trade restrictions, and updates on the Ukraine war. We’ll wrap up with a roundup of international and domestic data releases.

Nvidia’s Momentum: Spending on building AI-related infrastructure by Big Tech companies remains strong but is showing signs of waning.

- On Wednesday, Nvidia reported earnings that were nearly double the previous year’s, but still disappointed investors as it barely beat expectations. Fourth-quarter sales of $47.5 billion slightly exceeded estimates of $47.1 billion. While the modest beat suggests continued strong demand for the company’s products, concerns have emerged about the sustainability of its current growth trajectory. As investors assess the outlook for the AI-fueled rally that has propelled the S&P 500 to new highs, doubts have grown about its ability to carry over to next year.

- As a leading AI player, Nvidia has significantly benefited from the technology’s rapid adoption and is now a key industry barometer. Big Tech companies like Google, Amazon, Meta, and Microsoft rely on Nvidia’s high-performance chips to build and maintain their vast and complex data infrastructures. As a result, strong Nvidia earnings are often seen as a positive indicator of these tech giants’ continued investment in AI and cloud computing. According to Bloomberg Intelligence, capex spending by Big Tech firms is on pace for $165.2 billion this year, up from $120 billion last year.

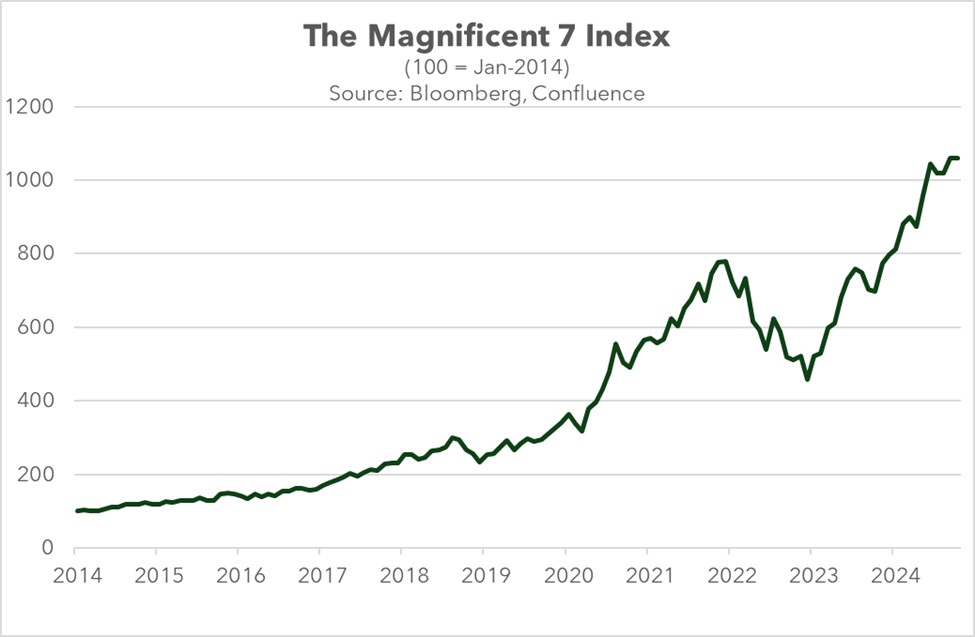

- While AI advancements have been a catalyst for the Magnificent 7’s growth, a significant portion of their recent momentum can be attributed to investor demand for higher returns. In an environment of elevated interest rates, investors have sought out large, established companies with strong growth potential. These tech giants, with their substantial financial resources and low risk of insolvency, are perceived as attractive investments capable of capturing market share through aggressive spending. As these stocks become more expensive, small and mid-cap stocks could become more appealing to investors.

Imports, Tariffs, and Yields: Firms have started to ramp up their purchases of imports as they look to get ahead of potential tariffs from the incoming administration.

- West Coast ports, such as Long Beach and Los Angeles, have experienced a significant increase in activity as investors and businesses seek to mitigate the potential impact of future trade restrictions. Last month, the Port of Long Beach handled nearly 1 million containers, surpassing records set two months ago. Together, the ports of Long Beach and Los Angeles account for approximately one-third of all US container imports and are expected to remain busy through the end of the year as companies build up inventory to safeguard against potential supply chain disruptions.

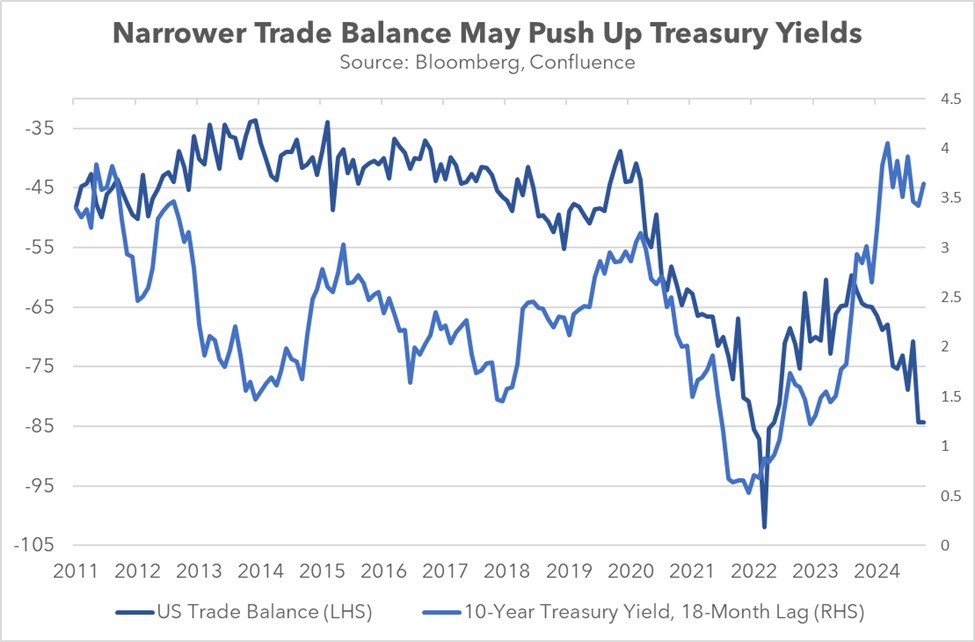

- Firms are increasing foreign purchases to preempt potential tariffs from the incoming administration. Deficit nations rely on foreign capital, while surplus nations provide it. Consequently, resolving a trade dispute involves altering the flow of capital. This could manifest in the US borrowing less from the rest of the world by issuing fewer Treasurys or global investors reducing their Treasury holdings. We observed the latter dynamic in October when markets began to anticipate a Trump victory, leading to increased Treasury yields as foreign investors, particularly in Japan and China, reduced their holdings.

- Although Treasury yields are influenced by various factors, including monetary policy, economic outlook, and inflationary expectations, we believe a potential trade war could significantly impact the bond market. Increased tariffs could strengthen the US dollar, making it more expensive for foreign countries to purchase US goods. To acquire the necessary dollars for these imports, these countries may be forced to liquidate their US Treasury bond holdings. The lack of demand for US Treasurys could exacerbate an existing supply-demand imbalance, potentially leading to higher Treasury yields in 2025.

Tensions on the Rise: As Ukraine’s defensive efforts against Russia intensify, the geopolitical implications of the conflict are broadening.

- A Danish naval encounter earlier this week revealed that the ships involved in severing two undersea communication cables in the Baltic Sea were of Chinese origin. Notably, the crews aboard those vessels were reportedly Russian. While China’s support for Russia’s war effort has been widely speculated, this incident provides concrete evidence of direct Chinese involvement, including the supply of critical equipment. The sabotage comes amongst threats from Russia that it views NATO’s assistance to Ukraine as proof of its involvement in the war.

- After Ukraine employed US-supplied weapons in attacks within Russian territory, Moscow intensified its rhetoric, including explicit nuclear threats. Last night, Russia escalated further by launching an intercontinental ballistic missile at Ukraine. While armed with conventional explosives, the missile’s nuclear capability underscores the growing risk of nuclear escalation. In response to this attack, Ukraine deployed specialized UK-supplied missiles to target military installations in the region.

- The escalating geopolitical tensions present a significant risk to global markets. As hostilities intensify, commodity markets, particularly crude oil, are experiencing heightened volatility. Brent crude oil prices have surged 3.1% over the past five days, driven by concerns of potential supply disruptions. Should the conflict escalate further, oil prices could climb toward $80 per barrel by December, exerting inflationary pressure on global economies and weighing on economic growth. Additionally, European equities may face downward pressure due to the region’s proximity to the conflict.

In Other News: The International Criminal Court has charged Israeli President Benjamin Netanyahu with war crimes, a move likely to spark conflict with the US, which has threatened sanctions in response. The Department of Justice has requested that Google sell its Chrome browser in what is shaping up to be one of the biggest anti-trust fights of this century. Bitcoin exceeded $98,000 after news that the Trump administration is considering the appointment of a cryptocurrency czar.