Daily Comment (November 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly awaiting fresh consumer sentiment data to assess the strength of the US economy post-election. In sports, Shohei Ohtani of the Los Angeles Dodgers and Aaron Judge of the New York Yankees have been named MVPs of their respective leagues. Today’s Comment begins with an overview of Trump’s supply-side economics. We then provide an analysis of regulators’ increasing scrutiny of Big Tech and take a look at Mexico’s sudden policy shift. As always, the report concludes with a roundup of key international and domestic data releases.

Trumpian Supply Side: The Trump administration plans to reshape supply-side economics to align with a more populist agenda.

- The incoming administration intends to stimulate economic growth through a series of tax cuts and deregulation. Businesses anticipate a corporate tax rate reduction from 21% to 15%, while individual taxpayers also expect tax relief. As far as deregulation is concerned, the financial industry, in particular, has already seen some benefits. In preparation for the transition, federal regulators under President Biden announced on Thursday that they would not finalize any new bank capital rules. Additionally, SEC Chair Gary Gensler, a villain in cryptocurrency circles, has also agreed to resign from his position.

- A key distinction between the original supply-side economists and their contemporary counterparts lies in their approach to trade policy. The current group advocates for the imposition of trade barriers, arguing that this strategy will attract more foreign direct investment. By erecting barriers to trade, they believe that foreign firms will be compelled to establish operations within the US to avoid tariffs, thereby facilitating the transfer of goods into the country duty-free. Japanese automakers used this strategy to avoid tariffs (also called “tariff jumping”) in the 1980s by building factories across the southern US.

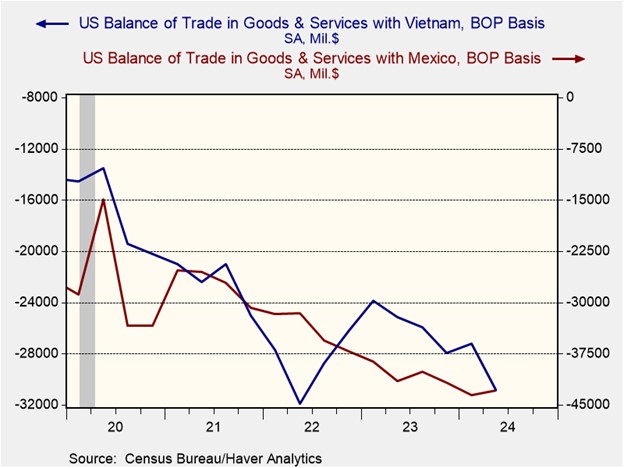

- While tariff jumping can stimulate domestic manufacturing, it often leads manufacturers to prioritize countries with US free trade agreements. Mexico and Vietnam are prime examples of this, and could benefit significantly from increased US-China trade tensions. This trend may explain the support for blanket tariffs to prevent any country from exploiting loopholes. However, given the administration’s other priorities — tax cuts for households and businesses and deregulation — a broad-based tariff policy may not take precedence.

Google Breakup: US regulators have requested that the court force Google to sell its Chrome web browser business.

- Following a court ruling that found the company guilty of monopolizing the search engine industry, the Department of Justice has requested that it sell its Chrome browser business. The DOJ had sued the tech giant, alleging that it used unfair trade practices to harm competitors. While the Android business was also considered for divestiture, regulators ultimately decided against it. They reasoned that the threat of future divestiture could be sufficient to deter the company from further anti-competitive behavior.

- If successful, this would mark the first time a major company has been forced to undergo an antitrust breakup since AT&T in 1982. Over the past three to four decades, the court system has adopted the so-called “Bork standard,” which allows companies to form monopolies as long as they can demonstrate consumer benefits. In essence, the government has permitted major companies, particularly in the tech industry, to consolidate, provided that it leads to increased efficiency. This shift played a role in the disinflationary trend we have seen in recent decades as it forced many firms to prioritize cost leadership.

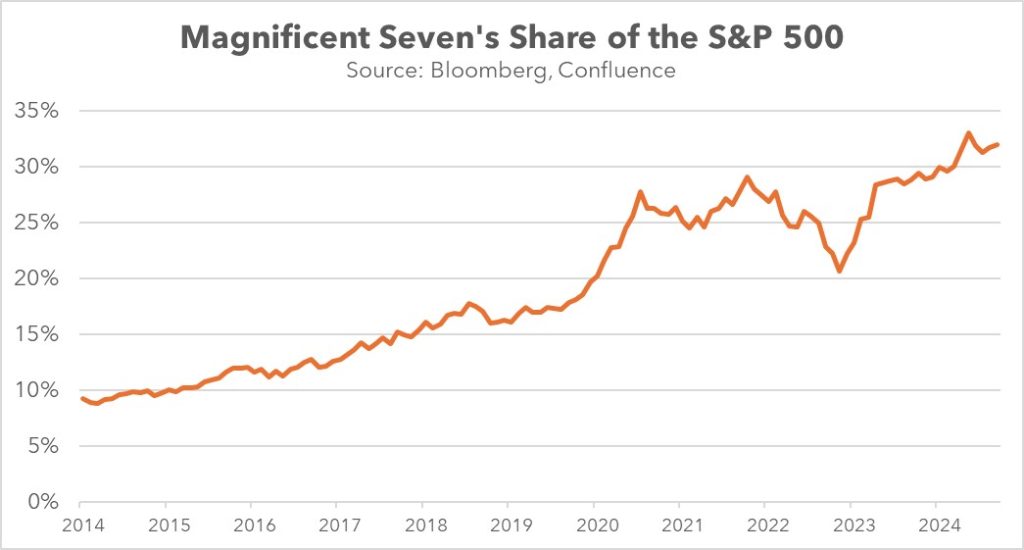

- The “Bork Standard,” a once-dominant antitrust framework, has increasingly become outdated. In today’s tech-driven economy, mature, inefficient firms are rare. Now, mergers and acquisitions often target innovative startups or smaller competitors. This trend can lead to heightened market concentration, stifling competition, and ultimately harming consumers. While we expect Google to appeal the recent antitrust ruling, both Google and other tech giants may face intensified regulatory scrutiny. As a result, the Magnificent 7 remain vulnerable to antitrust risks.

Mexico Backtracks: Mexico’s recent court system reforms may face implementation delays as the government seeks to temper potential backlash from both investors and the US.

- To ensure compliance with the USMCA agreement, the lower house of Congress has proposed modifying recent reforms. These changes that originally aimed to dismantle multiple regulatory bodies, including the transparency institute, the antitrust body, and the telecom overseer, have faced significant scrutiny. The elimination of the telecom overseer, in particular, has been identified as a potential violation of the agreement. To address this issue, lawmakers propose merging the antitrust and telecom regulators into a single entity, which has been viewed positively by investors.

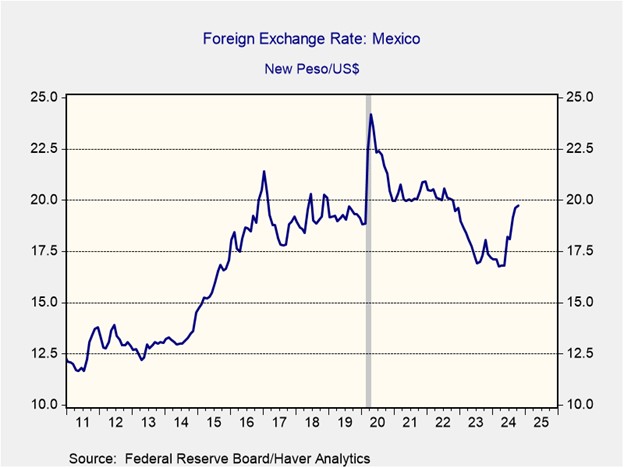

- The Mexican peso (MXN) has depreciated 7% against the dollar over the past three months. Investors are increasingly concerned about the country’s recent constitutional reforms, which would empower the ruling Morena party to appoint favorable judges. This has raised fears of unchecked power and potential policy overreach. Additionally, the incoming US administration’s increased scrutiny of Mexico’s policies, particularly its openness to Chinese investment, has added to investor worries. Last week, Moody’s downgraded Mexico’s outlook from stable to negative, citing these policy concerns.

- The market will be closely watching the relationship between the new US and Mexican presidents in the coming years. With the USMCA up for review in 2026, Trump is expected to push for changes to protect US interests from Mexico’s constitutional reforms and to close loopholes that allow other countries to bypass tariffs by operating in Mexico to export to the US. However, Mexican President Claudia Sheinbaum has yet to signal her stance on Trump’s concerns. This uncertainty surrounding potential revisions to the agreement is likely to introduce volatility to the Mexican peso and equity markets.

In Other News: NATO and Ukraine will convene emergency talks to discuss the use of Russian hypersonic missiles as concerns grow over escalating tensions. Meanwhile, President-elect Donald Trump’s nominee for Attorney General, Matt Gaetz, has withdrawn from consideration, highlighting resistance from Republican senators to some of the president’s appointees.