Daily Comment (November 30, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning on this last day of November. Risk markets are trending higher this morning, and a key component to the rally in commodities and equities (especially the former) is a weakening dollar. For most of the year, the dollar has been on a tear, despite the fact that on most valuation measures, it was already richly valued. Divergences in monetary policy due to the Fed conducting tighter policy than the rest of the world, was behind the strength. However, as the markets anticipate at least a slowing of tightening in the U.S., the dollar has begun to roll over. We still suspect that the expectations of easing are overly optimistic, which could mean that the dollar will at least make a recovery in the coming weeks. However, over next year, our expectation is that the dollar will decline, which will be supportive for commodities and equities. On the topic of the Fed, we get the Beige Book today and Chair Powell will speak on the economy. The markets are watching for any hints of a slowing of tightening.

In today’s Comment, our coverage begins with China news. Economics and policy are up next. An update on the Ukraine War follows, and we close with international news.

China news: The government’s Zero-COVID policy is evolving, and former General Secretary Jiang has died.

- In the past, when China’s leaders implemented unpopular policies, a common response to popular opposition to the policies is to blame local officials for “misunderstanding” the policy. By doing this, leaders in Beijing can soften the policy without losing face. It appears President Xi is deploying this well-worn playbook again, but that doesn’t necessarily mean that the CPC is easing the policy. Instead, the policy appears to be evolving.

- Elements of the policy include deepening surveillance, arresting leaders, and stifling less committed protesters. Security officials are systematically looking for participants to the protests, likely to either arrest or intimidate them, and “flooding the zone” with police to discourage gatherings. The response does appear to be working, as protests seem to have declined.

- At the same time, the leadership does seem to realize that the lockdown policies are probably no longer workable. The harm they bring to the economy is significant and public support is waning. So, how does China open without triggering a mass infection event? The plan emerging looks like it will focus on mass vaccinations, especially of the elderly. China continues to use its own vaccines, which are less efficient than Western-developed ones, which will slow the process. However, to avoid an expansion of infections, vaccination looks like the primary tool.

- Analysts are still sorting out the long-term ramifications of what increasingly looks like a massive policy failure. One element of the failure is the damage it has brought to President Xi as a leader. Is Xi in trouble? What we watch for are divisions at the top such as does dissention among the party leaders increase? So far, we have seen no signs of such divisions, but we also note that (a) the CPC is good at hiding such divisions and (b) Xi has mostly sidelined the powerful who opposed him.

- The other major issue is that tensions are not just due to Zero-COVID policy. Youth unemployment in China is terrible, with reports of 20% unemployment rates. As China’s economic growth slows, the promise of a future to young Chinese appears to be falling away, leading to rising tensions. The Zero-COVID policies have been a catalyst, but broader worries are notable as well.

- Jiang Zemin, the former General Secretary, has died at the age of 96. He came from the coastal regions of China and was seen as an economic liberalizer. There has been some speculation that protesters might use his demise to expand protests, perhaps at his state funeral. If his burial turns out to be a “private” affair, it might be a sign of the level of concern the current regime has over the protests.

- China, facing increasingly tight restrictions on semiconductor imports, is attempting to build out its own semiconductor industry. A key of this development is to convince European lithography firms to defy U.S. restrictions and export chip-building equipment to China. Although these firms would like to continue to export their wares to China, the U.S. can inflict harsh punishments on those who defy American policy. This is an area we monitor closely, but we don’t expect the Europeans, in the end, to continue exporting banned products to China.

- NATO is holding its first talks focused on China’s threat to Taiwan. The Pentagon warns that China has designs on more than just Taiwan in its neighborhood.

- As the world evolves into blocs, there will be nations that straddle the divide. Switzerland was such a nation during the Cold War. Chinese companies are increasingly betting on Singapore to play a similar role as the U.S. and China steadily separate.

- Although we do note that the Commerce Secretary doesn’t believe that the U.S. wants to decouple from China. That will be “music to the ears” of multinational firms, but in our reading of U.S. politics, it is widely out of step with political trends.

- The Vatican says Beijing violated its deal with the papacy. Who would have guessed?

Markets, Economics and Policy: Congress moves to prevent a rail strike and the “lame duck” session heats up.

- As a senator, Joe Biden built a narrative of his support for union workers. Holding stances as a senator rarely has ramifications, though, as a senator is simply part of a larger body and holding dissent positions doesn’t really matter all that much.[1] With the potential for a paralyzing rail strike looming, the president called on Congress to prevent a strike by taking away the union’s most powerful tool to extract revenue from capital. Although the decision is understandable, it will likely have political costs.

- With the seating of the next Congress, the U.S. will have a divided government. This prospect is triggering rather frenetic legislative activity to pass as much as possible before early January because once the government is divided, the likelihood of passing anything will become quite difficult. The biggest surprise is that the existing House and Senate leadership appear to be moving quickly to pass an omnibus spending bill. The Pentagon is worried that in the absence of a new spending bill, the government will fund itself with a continuing resolution which would mean that defense spending would not grow in a period where spending demands are elevated. In fact, the GOP is insisting that defense spending grow faster than other spending, and if the Republicans get their way, it may be supportive for the Defense sector.

- As we noted above, Chair Powell speaks today, and the regional banks will report on their local economies. We have seen a parade of Fed officials speaking recently and there is evidence of a growing hawk/dove divide. Such divisions shouldn’t be a complete surprise; in fact, these sorts of divides are common. Policy was so easy that for most of this year, there was near unity that tightening was needed. With divergences emerging, however, Powell’s position becomes increasingly important. Simply put, we need to know which side he favors, and his speech today may offer some clues.

- European inflation, although still elevated, did fall last month, triggering hope that inflation has peaked. European markets celebrated. Europe has had a run of good luck recently. Ukrainian forces have been doing well, the weather has been very mild, easing fears of energy shortages, and with inflation perhaps rolling over, sentiment is improving.

- The idea that inflation has peaked in the U.S. has triggered a rally in high-yield bonds. Widening credit spreads is usually a feature of recessions. However, we are still early in this expansion and credit practices have not had enough time to become lax. Thus, the chances of a spike in yields are less likely as defaults should be manageable.

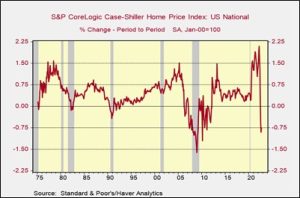

- Yesterday, it was reported that home prices fell. We are now seeing a rapid decline in home prices, which is usually consistent with recession.

- On the housing market, the government will now offer mortgage guarantees on mortgages of more than $1.0 million, a reflection of recent price escalation.

- One of the ways that companies deal with higher costs is through “shrinkflation” which is the practice of holding the price steady but packaging a smaller quantity. Edgar Dworsky is the go-to guy on this issue.

War in Ukraine: Is Crimea going to revert to Ukraine? And Germany recounts its errors.

- Although it looks to us a bit farfetched that Ukraine could retake Crimea, in the peninsula there is increasing evidence that the locals are expecting a direct conflict. If Crimea were threatened, an unconventional response from Russia would become more likely.

- German Justice Minister Marco Buschmann admitted that Germany’s policy of cozying up to Moscow contributed to Russia’s invasion of Ukraine. We note that Buschmann is a member of the Free Democrats, whereas the Social Democrats have been the most supportive of Russian/Soviet engagement going back to the 1970s. The Free Democrats are part of the ruling coalition along with the Greens. One of the tensions within the German government is that the dominant SDP continues to support engagement to some extent, but that is not at all in sync with the Greens or the Free Democrats.

- The U.S. is considering labeling the Wagner Group as a terrorist organization.

- Russia is asking India for specific products that have become scarce due to sanctions. This action would require India to break sanctions. So far, the U.S. has tended to give India a pass on its relations with Russia, wanting to keep India “on side” in containing China. So, India’s reaction to the request bears watching.

International News: Orbán is isolated, and “corn wars” are developing.

- Hungarian President Orbán has been on the outs with the EU for some time. His anti-immigration and social policies are seen as out of step with the EU. For the most part, Orbán has avoided severe penalties because Poland has similar policies and has supported Hungary. The EU has tended to avoid making both nations upset, so it has mostly not enforced strict constraints on Hungary. However, that situation does appear to be unwinding. Poland, a stanch opponent of Putin, opposes Hungary’s support of Russia and therefore isn’t coming to Hungary’s aid. This is allowing the EU to threaten a material funding reduction.

- Mexico is one of the world’s largest corn importers. It uses the grain for both cattle feed and for subsidized tortillas. The AMLO regime wants to ban GMO corn which is mostly grown in the U.S. Washington is threatening to enforce the USMCA to prevent Mexico from banning the GMO sales.

- Pakistan’s former head of its spy agency has been appointed to the head of the army. The military is very powerful in Pakistan, so General Asim Munir is essentially the head of state as well.

- It’s India’s turn to head the G-20, and it plans to make the most of it.

[1] This is why, in our analysis of politics, we usually have less regard for senators who become presidents. Senator’s positions often don’t matter; instead, we prefer people who have actually had to make decisions for which they are responsible. In this regard, we believe that governors tend to be better candidates.