Daily Comment (November 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently processing the election results. In sports news, Sporting Lisbon achieved a stunning upset by defeating Manchester, the defending champions, with a score of 4-1. Today’s Comment will discuss the election results, provide a preview of the upcoming FOMC meeting, and offer an update on the Iran-Israel conflict. As usual, the report will conclude with a roundup of both international and domestic data releases.

Election 2024: The Republican party appears to be on pace to sweep all three houses of government.

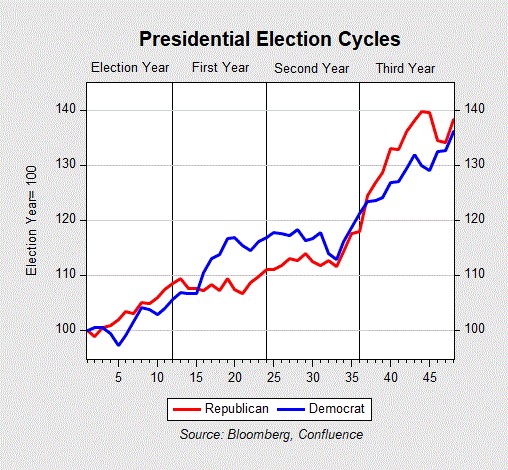

- Donald Trump secured another presidential term after successfully sweeping all of the swing states. He currently holds over 277 electoral votes and is expected to finish with around 312. His victory also lifted several down-ballot Republicans, including Bernie Moreno in Ohio, who unseated Democratic incumbent Sherrod Brown. The House remains closely contested, with Republicans gaining one seat and slightly increasing their majority, while swing seats are still in play for Democrats. Following Trump’s win, equities rallied, the dollar strengthened, and 10-year Treasury yields surged as investors doubled down on the so-called “Trump trade.”

- Trump’s return to power has sparked speculation about a possible growth shock. On the campaign trail, he proposed a series of stimulus measures that included lowering the capital gains tax, removing of the cap on SALT deductions, eliminating taxes on tips, and exempting firefighters, police officers, active-duty military, and veterans from paying taxes. Additionally, the decision to deregulate is also likely to help boost corporate profits. While campaign promises are likely to face some sort of adjustment to make them more palatable, it seems that the market is taking Trump at his word.

- Post-election optimism is expected to buoy equity markets in the coming weeks as investors speculate about the potential impact of the next presidency. A Republican president with a divided Congress often provides a balance that can temper more extreme policy shifts, potentially supporting equities and mitigating a rise in yields. Conversely, a Republican sweep could boost equities but also lead to increased bond yields. While Republicans currently hold a slight advantage, the final majority could be razor-thin, potentially as close as a single seat.

The Fed’s Next Move: The FOMC is set to start its two-day meeting on Wednesday as it looks to bring down policy rates and continue its easing cycle.

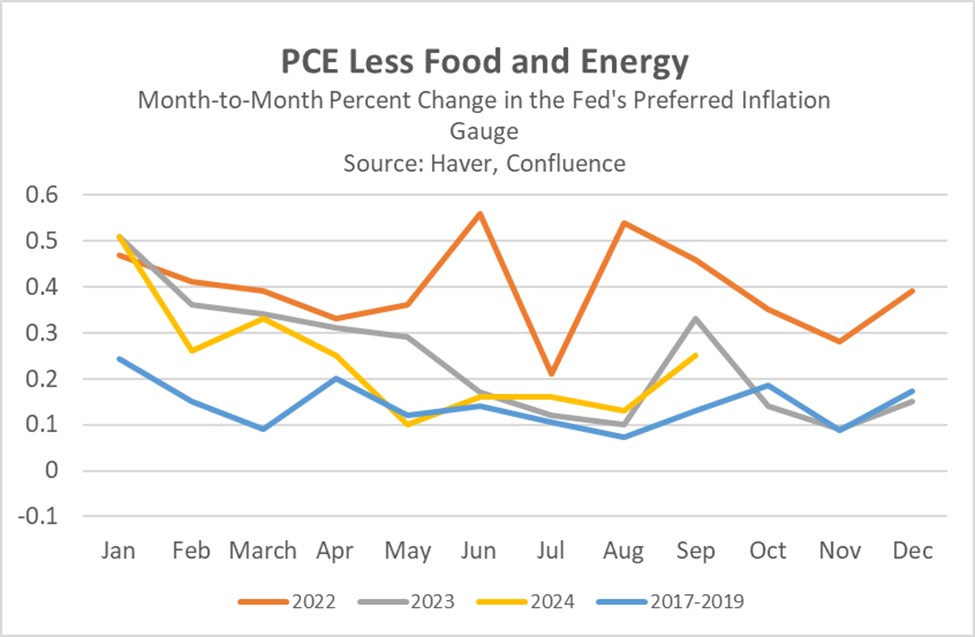

- Market sentiment strongly favors a 25 basis point interest rate cut by the Federal Reserve on Thursday, with the CME FedWatch Tool indicating a 97.5% probability. This expectation is fueled by recent economic data, which shows a cooling inflation and labor market. The Personal Consumption Expenditure (PCE) price index, the Fed’s preferred inflation gauge, declined to 2.1% in September, while core PCE remained steady at 2.7%. Additionally, the Bureau of Labor Statistics’ payroll report revealed a significant slowdown in job growth, with only 12,000 jobs added in October, which is well below the consensus estimate of 100,000.

- That said, investors will also seek clarification on the Fed’s future policy direction. While the previous dot plot indicated a median projection of a 50-basis-point cut for the federal funds rate, it was driven a single vote majority. This suggests that the November cut may be the last for the year. The Fed’s decision will likely hinge on whether it observes sufficient progress in reducing inflation over the next two months. For core PCE to decline below 2.7% in this timeframe, prices would need to remain essentially unchanged from October levels, which seems unlikely given current trends.

- The key focus of this week’s FOMC meeting will be the committee’s interpretation of recent economic data. If it dismisses the weak employment figures as an anomaly, it may become more cautious about further rate cuts. However, if it maintains its assessment of a cooling labor market, it could signal a more accommodative stance. Given the inconsistent nature of recent data, it’s difficult to draw definitive conclusions about the trajectory of inflation and the labor market. As such, we anticipate that the Fed will likely provide limited guidance, leading to relatively muted market reactions.

Israel Uncertainty: Prime Minister Benjamin Netanyahu has fired a member of his cabinet who was one of the strong proponents for a ceasefire in a sign that the conflict is not getting any closer to ending.

- Israeli Defense Minister Yoav Gallant was dismissed by Prime Minister Netanyahu amid ongoing disagreements over conflict strategy, with Netanyahu citing trust issues as the primary reason. Gallant, a strong advocate for a Gaza ceasefire to secure the release of hostages, is now absent from the cabinet, removing a prominent voice for negotiation. His removal has sparked nationwide protests, reflecting distrust with the handling of the war. This decision comes as Israel fights on two fronts against Iranian proxies Hezbollah in Lebanon and Hamas in Gaza, while bracing for possible retaliatory action from Iran.

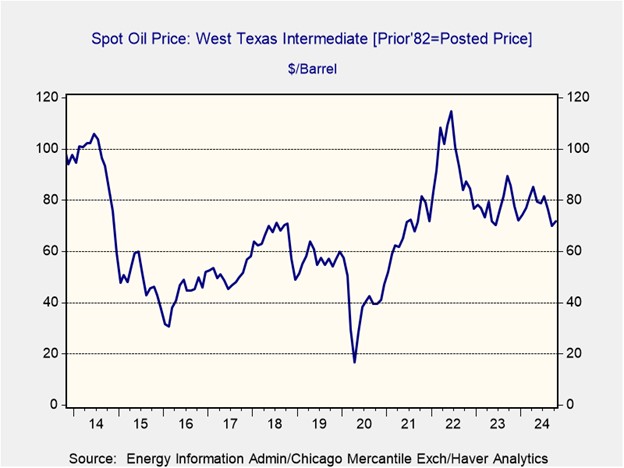

- Israel’s deepening internal divisions are making it increasingly difficult for the US to prevent a wider regional conflict. On Tuesday, the US issued a stark warning to Iraq, demanding that it prevent Iran from launching attacks on Israel from its territory. According to US intelligence, the Islamic Revolutionary Guard Corps recently transferred ballistic missiles to Shia militias in Iraq, signaling preparations for imminent attacks. These heightened tensions have already caused oil prices to surge nearly 6% since Iran threatened retaliation for Israeli airstrikes.

- Gallant’s dismissal signals that a ceasefire may not be imminent, though the potential for further escalation remains uncertain. While Iran has expressed intent to retaliate for recent strikes, it remains vulnerable to counterattacks on its energy and nuclear facilities after Israeli forces recently weakened its air defenses. Meanwhile, ongoing protests within Israel reflect growing public discontent, suggesting limited tolerance for prolonged conflict. In the coming weeks, Netanyahu may face increasing pressure to pursue a ceasefire, which could clarify the conflict’s trajectory.

In Other News: EU regulators have fined Apple under the Digital Markets Act, signaling that the European Union is preparing to adopt a stricter approach toward US tech companies. Meanwhile, German Chancellor Olaf Scholz is expected to convene a meeting with his three coalition partners as he seeks to avert a potential breakup. Brazil’s central bank is expected to raise its benchmark rate by 50 basis points later today to combat rising inflation.