Daily Comment (November 7, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning. It’s a risk-off day in the markets. As we noted above, global equities are mostly lower. Commodities are weaker as well on fears of weaker economic growth. We are seeing a rally in Treasuries in light of broader market weakness. It’s election day in the U.S. Although today’s elections are local, political analysts will be looking hard at the results for any insights into next year’s presidential race.

In today’s Comment, we start our coverage with an update on the situation in Gaza. China is up next, economic and finance news follows, and we close with our international overview.

Gaza: Netanyahu claims Israel will take “indefinite” control over the Gaza Strip, and the death toll is mounting.

- The Israeli PM indicated overnight that Israel would take control over Gaza to prevent Hamas from retaking power. For Israel, this is a “back to the future” moment, as Israel held control over the area until 2005, when PM Sharon concluded it would make more sense to leave Gaza to the Palestinians and create a hard border around the area. Returning to Gaza means re-occupation, which is difficult. However, it is now clear that a Hamas-controlled Gaza is a major threat to Israeli security, thus leaving Netanyahu with little choice.

- According to the health ministry in Gaza, 10k Palestinians have died in Gaza and 25k have been injured.

- U.S. continues to press Israel for a pause. So far, the Israeli government has refused any significant ceasefires without the release of hostages, although it has allowed for some relief supplies to enter the area from Egypt.

- The Israeli military has surrounded Gaza City, essentially cutting the area into two parts.

China Update: Australia is improving relations with Beijing, the U.S. and China are setting up meetings, as are EU officials, and China’s exports remain weak.

- Relations between Australia and China deteriorated during the pandemic when Canberra called for an international inquiry into the origins of COVID-19. This week, Australian PM Albanese concluded trade meetings with Beijing which apparently have eased Chinese restrictions on Australian products. General Secretary Xi spoke glowingly of the improving relations between the two nations, suggesting ties are now on the “right path.” What Albanese is trying to do is what many nations in the region are also attempting, which is to have economic ties to China while also building security relations to contain Beijing. We note the Australian PM remains cautious about China.

- Interestingly enough, as trade relations between Australia and China improve, Australia’s talks with the EU have “collapsed.” It may be difficult to maintain security relations when economic activity is stunted.

- Australia isn’t alone in trying to improve relations with Beijing. The Biden administration has been actively arranging talks all year. There are expectations that Xi and Biden will meet in San Francisco at the APEC summit later this month. Meanwhile, Treasury Secretary Yellen and Vice-Premier He are scheduled to meet November 9 and 10.

- Invitations were sent to U.S. business leaders to meet with Xi and Biden during the APEC summit.

- There are reports the U.S. and China will discuss nuclear weapons in the near future. China has been rapidly expanding its nuclear weapons arsenal recently.

- The EU is also planning talks with China in December. EC President von der Leyen is planning on traveling to Beijing for meetings, although the initial tone appears rather hawkish.

- China is increasingly harassing Western surveillance flights that are looking to see if nations are breaking sanctions on North Korea.

- On the economic and finance front, there were several interesting developments:

- Gallup is leaving China because the government views its surveys as a “tool” to discredit the regime.

- The CPC has banned party members from owning private equity. Concerns about corruption led to the decision.

- Chinese tech mogul Chen Shaojie has been arrested. It is unclear with what he has been charged.

- China’s exports fell again in October.

- Slumping pork prices could lead to a negative print on China’s CPI.

- China’s #2 property developer, Vanke (000002, CNY, 11.93), appears to be in trouble, prompting local governments to step up their support. There is evidence that Beijing is responding to the property crisis by moving to support other industries and through the expansion of central government spending.

- China has created a network of ports as part of its maritime Belt and Road Initiative. This network could become a major military asset. The Belt and Road projects have become notorious for pushing nations into debt; China has become a major source of aid that may be designed to support its collection efforts as well.

Economic Roundup: The Senior Loan Officers Survey was released yesterday; we offer details.

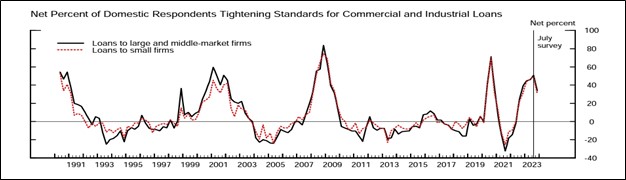

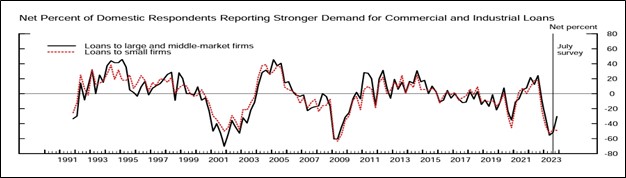

- The Senior Loan Officer Survey was released yesterday afternoon. For the most part, credit standards remain tight but have loosened somewhat.

Demand also showed signs of improvement.

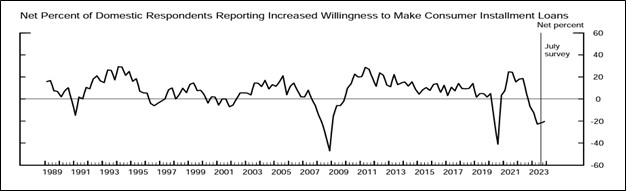

The willingness to make consumer loans was mostly steady.

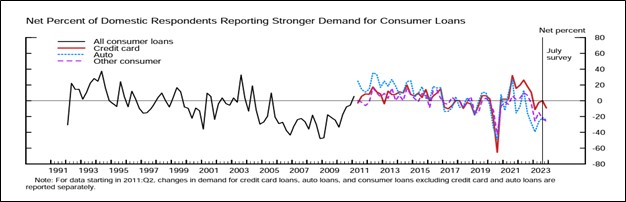

However, demand from consumers remains soft.

Overall, the survey suggests financing conditions are not getting much worse, but overall, lending standards remain tight.

- Higher interest rates and dollar strength are taking their toll on emerging markets.

- As commercial banks face increasing capital restrictions, they are developing novel ways to distribute lending risks. Banks are increasingly using synthetic risk transfer products, which allow banks to reduce their capital charges on loans. In return, buyers of these instruments receive high returns.

- In general, funding for any asset can come from either debt or equity. The attractiveness of either method depends on the cost of the funding. As mortgage rates hit 8%, homebuyers are being offered instruments which are essentially equity participation in the home-buying process. The firms providing the equity are then creating bonds to sell to investors.

International Roundup: Germany is struggling to deal with the Alternative for Germany party (AfD), and the incumbent in El Salvador can run again.

- A close advisor to the head of Ukraine’s armed forces was killed yesterday by a bomb hidden in a birthday gift. Major Gennadiy Chastyakov, an aide to General Zaluzhny, died when the package exploded.

- In democracies, there are situations where, if power is closely balanced, individuals can have an outsized impact on policy. In the U.S., such situations are uncommon because a two-party system tends to overwhelm its dissidents.[1] Multiparty systems, such as those seen in continental Europe, are much more prone to minority parties having significant power. Major parties rarely win a majority outright, and thus, must court minor parties to form governments. This means that if the lesser parties become unhappy, they can bring down governments. We are seeing something like this in Germany. The AfD has seen its power rise in recent local elections. The major parties are trying to avoid a situation where they need the AfD to form a government. What’s driving the AfD’s success is German’s anger over immigration and energy policy. Sometimes, minor parties in government can force the larger parties into policies that are unpopular. If that occurs, as we are seeing in Germany now, it can lead to political tensions.

- In El Salvador, an election tribunal decided to allow Nayib Bukele to run for a third term, in contradiction of the nation’s constitution. Bukele is very popular but was being prevented from running again due to legal restrictions. Now that those are out of the way, he will likely win; elections will be held in February 2024.

[1] Although uncommon, it isn’t unprecedented. The power of Sen. Manchin and Sen. Sinema was in evidence from 2020-22. And, the power of the Freedom Caucus has had an impact on the House of Representatives.