Daily Comment (November 7, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is refocusing its attention on the Fed’s rate decision later today. In sports news, the Golden State Warriors defeated the Boston Celtics. Today’s Comment will discuss why investors should not be overly focused on policy agenda. We will also take a deep dive into why small cap stocks have been outperforming the overall market and explore the possibility of snap elections in Germany. As usual, the report will conclude with a roundup of international and domestic data releases.

Red Wave: The S&P 500 had its best post-election rise in history as investors prepare for a Republican takeover of the executive and legislative branches of government.

- Republicans are projected to secure 53 Senate seats and possibly exceed the 218-seat threshold needed to control the House. This anticipated shift has caught investors’ attention, as control over both chambers of Congress means that lawmakers will face fewer obstacles in pushing through pro-growth measures such as tax cuts and the removal of regulations. Financials and Energy outperformed, as both sectors are expected to be big winners. Additionally, there is increasing optimism that AI will face less oversight, potentially boosting research and development in the tech space.

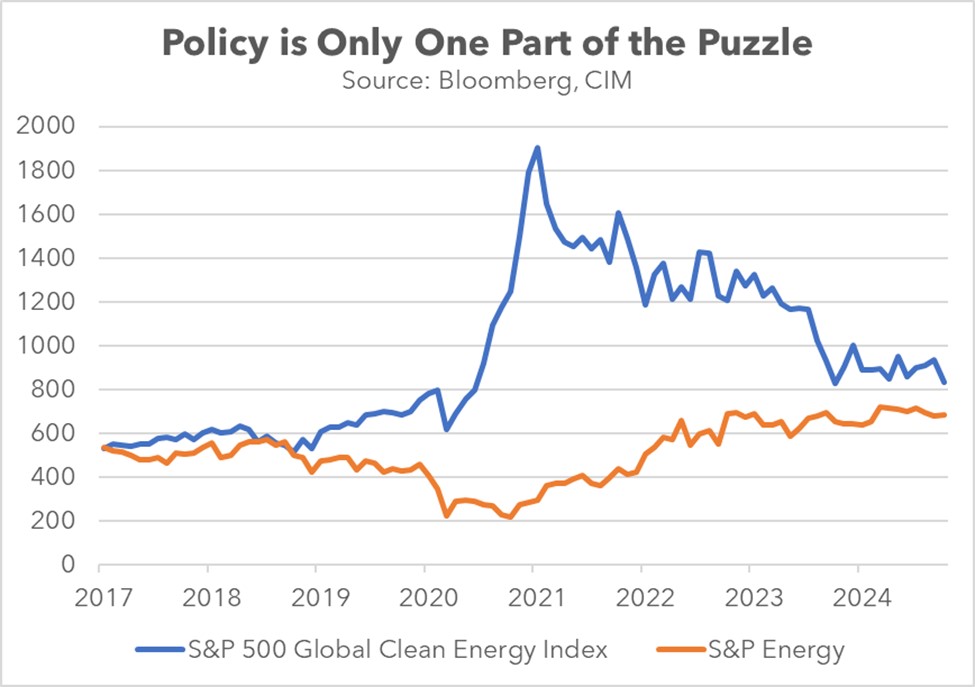

- While policy agendas can be influential, they don’t always drive market returns. As JP Morgan Global Market Strategist Meera Pandit highlights, during Trump’s first term, the S&P Global Clean Energy Index outperformed the S&P Energy Index, rising 275% compared to -40%, respectively. Conversely, under Biden, the overall energy index outperformed clean energy, returning 211% versus -54%, respectively. This happened despite Trump’s pro-fossil-fuel stance and Biden’s focus on clean energy. This contrast underscores the importance of looking beyond policy rhetoric to understand broader market forces.

- A key risk during this period of policy optimism is that unfavorable market conditions could undermine the effectiveness of certain policies. While tax cuts will help boost earnings and consumption, the effects of policy changes are less clear. In short, although Republican influence on policy decisions is noteworthy, external factors such as trade relations, economic trends, and geopolitical tensions are likely to have a greater impact on sector returns. Therefore, investors should exercise some caution before participating in the current rally.

The Small Cap Rise: The Russell 2000 surged ahead of its larger peers as markets anticipate pro-growth policies from Trump’s win.

- The day after Trump’s victory, the Russell 2000 index surged nearly 6%, marking its largest post-election gain since the index began in 1978. This strong performance was no anomaly; the second-largest gain followed Trump’s surprise win in 2016. The rally was fueled by expectations that Trump would push through tax cuts and remove restrictions that would help drive growth and boost corporate profits. Consequently, investors showed a heightened risk appetite, focusing on small cap Communication Services and Financials as the sectors are relatively cheap compared to its peers.

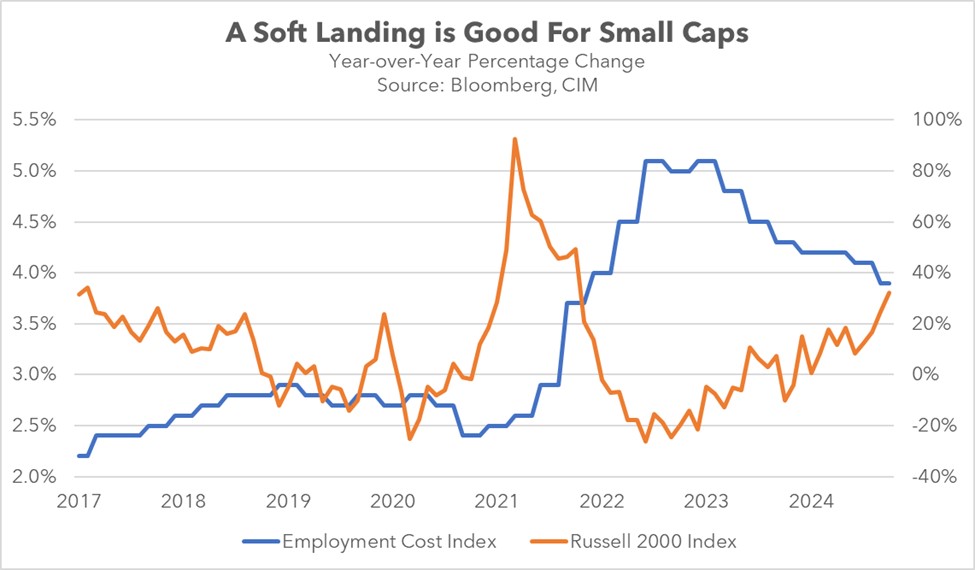

- A key difference between Trump’s initial term and now is the changing macroeconomic landscape. While recent indicators show improvement, small cap companies still face strong headwinds, including high labor and borrowing costs and persistent inflation — all of which have pressured earnings growth. Continued market confidence in small cap stocks will largely depend on the Fed’s ability to engineer a soft landing and achieve economic growth alongside declining inflation. This would likely boost revenues and reduce borrowing costs, thereby improving profitability.

- While some initial optimism may wane in the coming weeks as investors seek further clarity from the administration, the long-term outlook for small cap stocks appears to be improving. Assuming the administration avoids more extreme policy actions, such as challenging the Fed’s independence, the market is likely to view the election as a positive catalyst. This positive sentiment is expected to persist throughout much of 2025, as the Republican-led government is likely to hit the ground running by removing burdensome regulations and implementing tax cuts.

Germany on the Cusp: The German government teeters on the edge of collapse as the ruling coalition’s deep divisions are proving to be insurmountable.

- On Wednesday, German Chancellor Olaf Scholz dismissed Finance Minister Christian Lindner over disagreements on spending and economic reforms. This decision effectively removes the fiscally conservative Free Democrat Party from the coalition and paves the way for a no-confidence vote scheduled for mid-January. If Scholz loses, which is highly probable, then there would likely be snap elections in March. Polls show that the right-wing Christian Democrats (CDU) and the anti-immigration Alternative for Germany (AfD) are the two most popular parties, with the Social Democratic Party (SPD) in third.

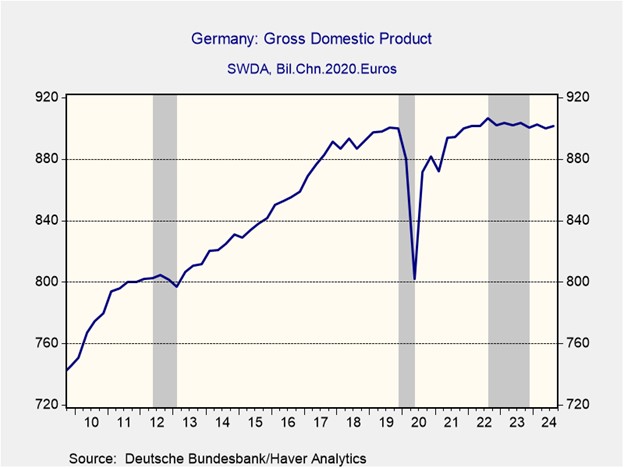

- The collapse of the coalition government coincides with a period of significant economic weakness. Industrial production has stagnated since 2017, and annual GDP growth is on track to fall for the second consecutive year. Factory activity has notably plummeted, with key sectors like automotive, chemical, and engineering experiencing sharp declines. These issues have been exacerbated by high energy costs, elevated labor expenses, and insufficient infrastructure investment. While consumer sentiment has improved due to easing inflationary pressures, it remains relatively low.

- New elections could boost right-wing parties, but their ability to form a government remains uncertain. The center-right CDU’s refusal to ally with the far-right AfD means it would need significant support and partnerships with smaller parties to secure a majority. Alternatively, a coalition could emerge between the Social Democratic Party and the rising left-wing alliance led by Sahra Wagenknecht. The composition of Germany’s next government will impact equities, with a CDU-led government generally viewed as the most market-friendly outcome.

In Other News: Mitch McConnell has expressed his belief that the filibuster will remain in place if the GOP takes control of both the House and the Senate. The Bank of England has cut its policy rate by 25 basis points but did not indicate any further rate changes for this year. In October, Chinese exports grew by 12.7% year-over-year, marking the fastest pace of growth since 2022.