Daily Comment (November 23, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! Equities are higher this morning as a third vaccine candidate shows promise. We begin our coverage with a recap of the G-20. Not much happened, so it will be short. We include foreign policy news. Brexit appears to be approaching the last minute; we discuss this below. Pandemic coverage follows along with a comment on China’s bond market. We close with economic odds and ends. As a reminder, for Thanksgiving, the Daily Comment will take a couple of days off, with no comment after Tuesday. We will return on Monday, November 30. There will also be no Asset Allocation Weekly (AAW) or Weekly Energy Update (WEU) next week. Here are the details:

G-20 and foreign policy: The meeting was held virtually over the weekend. There were promises of cooperation, including regarding vaccine distribution, but little in the way of concrete proposals. In part, world leaders are awaiting the final outcome of the U.S. election and the path of policy next year. Thus, it was a rather uneventful meeting.

- The U.S. has formally ended the Open Skies treaty, which allowed intelligence overflights between Russia and the U.S. The specialized equipment the U.S. used to conduct the flights is also being sold off, making resumption of the treaty more difficult.

- Israeli PM Netanyahu and SoS Pompeo flew to Neom, a city on Saudi Arabia’s Red Sea coast, for a visit with CP Salman. Although there was no official confirmation of the meeting, there was little done to conceal the visit. Saudi Arabia and Israel have had informal contacts for years, and the semi-open meeting should be seen as part of the reshuffling of positions as the U.S. reduces its influence in the region. The visit appears to be mostly about isolating Iran.

- The U.S. has been threatening to withdraw from the WTO’s government purchases agreement. This agreement sets ground rules for allowing nations to restrict imports of government goods. The fear is that if the U.S. abandons the rules, other nations will as well. It could lead to a reduction of trade and allow China access to foreign government procurement that the U.S. currently supplies.

Brexit: There are reports that the EU has quietly told the European Parliament to be prepared to vote on a Brexit deal around Christmas. As is normal for EU deals, nothing gets done until the very last minute. Although a vote at this time would ordinarily be a major hardship, it appears it will be held remotely, meaning MEPs won’t have to travel to Brussels.

- The U.K. and Canada have rolled over a trade deal that will extend current terms after New Year’s Day. This agreement is similar to one the U.K. inked with Japan. Currently, the U.K. is bound by EU trade agreements, but next year, when it is formally out of the EU, it will need to negotiate its own. The terms with Canada and Japan anticipate the exit.

COVID-19: The number of reported cases is 59,004,131 with 1,363,736 fatalities. In the U.S., there are 12,349,443 confirmed cases with 257,274 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

Virology:

- Some additional positive vaccine news—AstraZeneca (AZN, USD, 55.30) reports its vaccine, which is being jointly created with Oxford University, has a maximum 90% effectiveness rate, with an average of 70%. This vaccine differs from most recent efforts. It uses traditional development methods instead of mRNA. This means doesn’t need to be kept cool, and thus, would likely have wider international distribution. Research has found that with this vaccine, a half dose followed a few weeks later with a full does was most effective. This gives the world a third Western vaccine.

- Recent research raises concerns that COVID-19 can mutate in such a manner that allows reinfections.

- Mink culling has been reported in France; there is a strain of COVID-19 that has moved from humans to minks and back, raising worries that this mutation will thwart vaccine efforts. Therefore, there has been culling of minks in Denmark, and this has apparently moved to France.

- There is evidence that the recent wave of infections in Europe is starting to wane. Officials are beginning to ease lockdowns for the holidays. But, in its wake, hospitals in Europe are reaching capacity constraints. Most of the fatalities are seen with people over 60 years old.

- In the U.S., public health officials are bracing for higher infections due to holiday travel.

China: A recent wave of SOE bond defaults has led financial regulators to promise a crackdown. Given China’s debt fueled growth model, it remains to be seen what that crackdown will look like.

Economic news: Here’s an update of what we are following:

- Los Angeles port officials are reporting a massive backlog of container ships that are waiting to dock to unload their cargo. An influx of imports is colliding with capacity issues as the virus has reduced the workforce. As the imports arrive, they will tend to raise the trade deficit and weigh on GDP.

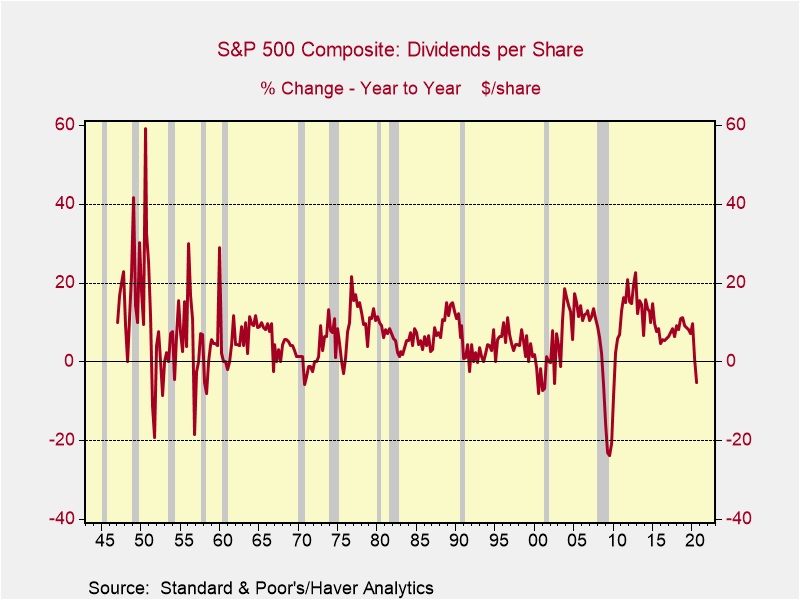

- As the pandemic hit, firms began to hoard cash; as part of the effort to alleviate this, dividends were restricted.

There are reports that firms are resuming dividend payments in anticipation of a vaccine.

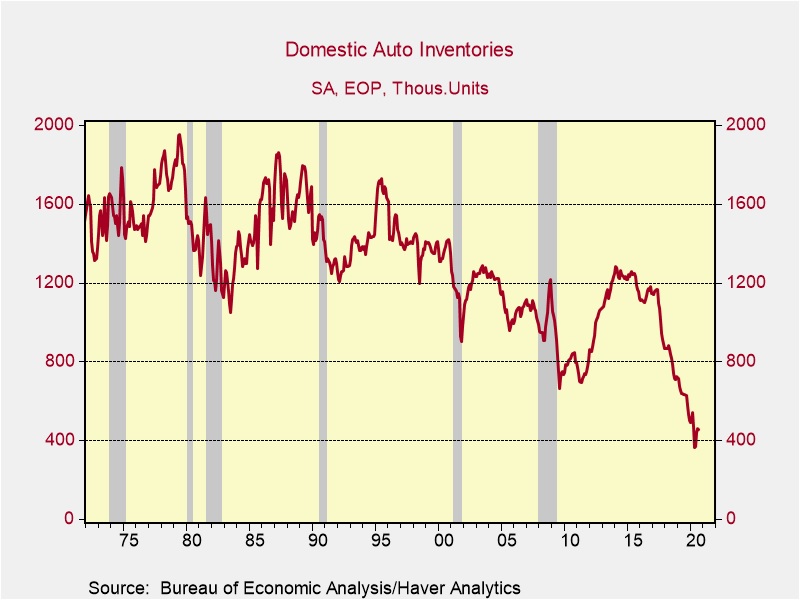

- For years, American car dealers have had large car lots with auto inventories. Car companies would maintain steady production, and during periods of slack demand, inventory levels would rise. Although there has been a clear downtrend in retail car inventories, the pandemic has led to historically low inventory levels.

The pandemic may accelerate a change in how Americans buy cars. Instead of getting the “how can I get you to drive off the lot with a new car today” from dealers, it may become a case where a buyer orders a car and waits a few weeks for delivery. This change would reduce inventory costs to dealers, although it probably leads to higher prices (the pressure to sell a car off the lot is lower if there isn’t a car on the lot). It probably reduces labor costs, too. If a salesperson is merely an order taker, that can be done online. However, this also means more variation of production schedules. Some of this issue could be mitigated by simply creating an order backlog. Europeans have been buying cars like this for years; Americans may be next.

- There is growing concern that forthcoming Q4 and Q1 economic growth will be weak. The second pandemic wave and the lack of fiscal stimulus are leading economists to reduce their expectations for growth. We already see Europe’s economic data show signs of stalling. President-elect Biden is apparently concerned enough that he is calling for a return to talks, and there are reports he is pressing Democratic leaders in Congress to accept a smaller spending package to bring aid to the economy.

- The Fed has agreed to return unused spending capacity to Congress; it is possible that this funding could facilitate a fiscal bill before year’s end. As to our comments last Friday, the Treasury did keep the MMK program in place, which is, in our opinion, the most critical of all the support programs. Although we think the corporate and muni backstops should be permanent, if markets believe they will be returned as needed, their official existence isn’t as necessary. The loss of the MMK backstop would be a problem. The fact that this program remains suggests a broader understanding of how the current financial system truly works among policymakers.

- The OFR’s measure of financial stress has fallen to late February levels, suggesting that the financial system is functioning well.